[ad_1]

The S&P 500 broke beneath 4,000 this week, for the primary time because the finish of July. It has buyers questioning: Does this mark the low level of a curler coaster journey? Shares rose all final 12 months, fell from January to June, rallied from July to mid-August, and now are falling once more.

In response to Wells Fargo strategist Paul Christopher, it’s proof that the inventory rally is sputtering to a halt. Christopher writes that “Cracks in monetary market liquidity are showing,” and says of the S&P 500, “3,900 is the following key degree of assist. Under that brings the June intraday low of three,636 again into the dialog.”

The important thing issue right here, in Christopher’s view, is the Federal Reserve’s aggressive anti-inflation stance, and Fed chair Jerome Powell’s dedication, said in his Jackson Gap speech, to proceed elevating rates of interest till inflation is introduced underneath management.

With inflation working at 8.5%, Powell’s place implies additional price hikes, and market watchers anticipate the Fed to implement two extra 75-basis level hikes this 12 months. That can bump the Fed’s key price to vary of 4% to 4.25%, and enhance the danger that tighter cash will tip the economic system into recession.

This may naturally convey buyers to start out wanting into defensive shares, and significantly high-yielding dividend payers. These are the usual defensive performs when markets flip south – the dividend gives some surety of an earnings stream, and in right this moment’s setting, some safety towards inflation.

Bearing this in thoughts, we used the TipRanks’ database to zero-in on two shares which can be displaying excessive dividend yields – at the very least 8%. Every inventory additionally holds a Sturdy Purchase consensus score; let’s see what makes them so enticing to Wall Avenue’s analysts.

Saratoga Funding Company (SAR)

We’ll begin with Saratoga Funding, a enterprise improvement company. These firms put money into, and supply credit score and different monetary providers to mid-market enterprises – small- to mid-sized corporations that won’t qualify for conventional banking providers. Saratoga’s buyer base is made up of the kind of firm that has been the normal driver of the US economic system, the small companies that generate essentially the most job creation.

Saratoga lately reported its monetary outcomes for Q1 of fiscal 2023, the quarter ending on Could 31 of this 12 months. As of that date, the agency’s portfolio had a price of $894.5 million, and included investments in 45 firms. Of this complete, some 80% is first-lien time period loans, and 9.9% was frequent fairness. The rest was divided between second lien time period loans, unsecured loans, and subordinated notes.

This portfolio generated a complete funding earnings of $18.68 million within the fiscal 1Q23, up 11% year-over-year. Per share, internet funding earnings got here to 66 cents, a year-over-year achieve of 37%. With this degree of earnings, Saratoga was simply in a position to cowl the Q1 dividend of 53 cents per frequent share – and in reality, raised the dividend cost by 1 cent within the fiscal Q2 declaration, as much as 54 cent per frequent share. The raised dividend can be paid out on September 29.

On the new price, the dividend annualizes to $2.16 per frequent share, and provides a yield of 8.8%, simply above the present price of inflation – making the dividend excessive sufficient to make sure that SAR provides buyers a constructive price of actual return.

Compass Level’s 5-star analyst Casey Alexander is impressed with Saratoga’s execution in current months, writing: “Saratoga Funding Corp has carved out a observe file befitting a real development BDC. SAR’s NAV has reached new all-time highs regardless of the COVID credit score cycle… With its superior development efficiency, SAR is incomes a premium a number of of a ‘development’ BDC. We’re sustaining our goal P/NAV a number of at 1.00x. SAR is working by way of a interval of decrease common yields in addition to a few burdened credit of their portfolio. We nonetheless anticipate SAR to commerce at a premium to SAR’s peer-group P/NAV of 0.81x, however a reduction to these BDC’s acknowledged as ‘development’ BDCs.”

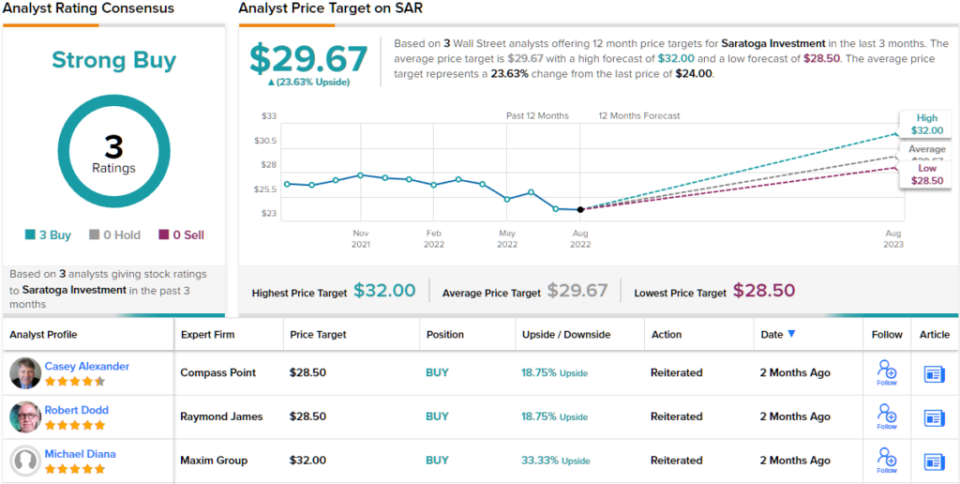

Alexander believes that this inventory will proceed to carry out for buyers, and charges it as a Purchase, with a worth goal of $28.50 indicating potential for ~19% share appreciation within the months forward. Primarily based on the present dividend yield and the anticipated worth appreciation, the inventory has ~28% potential complete return profile. (To observe Alexander’s observe file, click here)

There’s some proof that that Avenue is according to the bulls right here, for whereas SAR has solely picked up 3 current analyst evaluations, all of them agree that that may be a inventory to Purchase, making the Sturdy Purchase consensus score unanimous. The shares are at present buying and selling for $24 and their $29.67 common goal implies a one-year upside potential of ~24%. (See Saratoga stock forecast on TipRanks)

Crescent Capital (CCAP)

The second inventory we’ll have a look at is one other BDC, Crescent Capital. This agency directs its exercise towards personal mid-market enterprise clients, for whom it originates loans and invests in current debt and fairness. In its lifetime, Crescent, which payments itself in its place asset supervisor, has constructed a portfolio totaling $38 billion, made up of unique loans and current debt and fairness of the goal funding base.

The majority of Crescent’s portfolio, simply over 60%, is made up of unitranche first lien loans, whereas one other 26% consists of senior secured first liens. The rest of the portfolio consists of varied sorts of debt and fairness investments.

This portfolio supported a 2Q22 internet funding earnings of $15.5 million, 50 cents per share, with the adjusted internet funding earnings said at $12.7 million, or 41 cents per share. The corporate’s internet asset worth per share got here in at $20.69.

Traders ought to comply with these earnings numbers, as they permit Crescent to cowl its dividend cost. The subsequent dividend, set to be paid out on October 17, is for 41 cents per frequent share. This annualizes to $1.64, and yields a formidable 9.4%. Crescent can even pay out a beforehand introduced particular dividend of 5 cents per frequent share on September 15.

Oppenheimer analyst Mitchel Penn has been masking this inventory, and sees the dividend, and the corporate’s skill to prosper even when charges go up, as key factors for buyers. He states, “Our mannequin assumes rates of interest proceed to rise and that the central financial institution doesn’t reverse course. If that did happen, administration price waivers by way of end-2023 would probably enable Crescent to earn sufficient to cowl the $1.64 dividend, which means an 7.8% ROE…. If LIBOR rises 100 bps, administration estimates that NII would probably rise $7.4M, or $0.24/share. After an incentive price, we estimate $0.20. Now we have integrated a few of this price enhance in our mannequin as acceptable.”

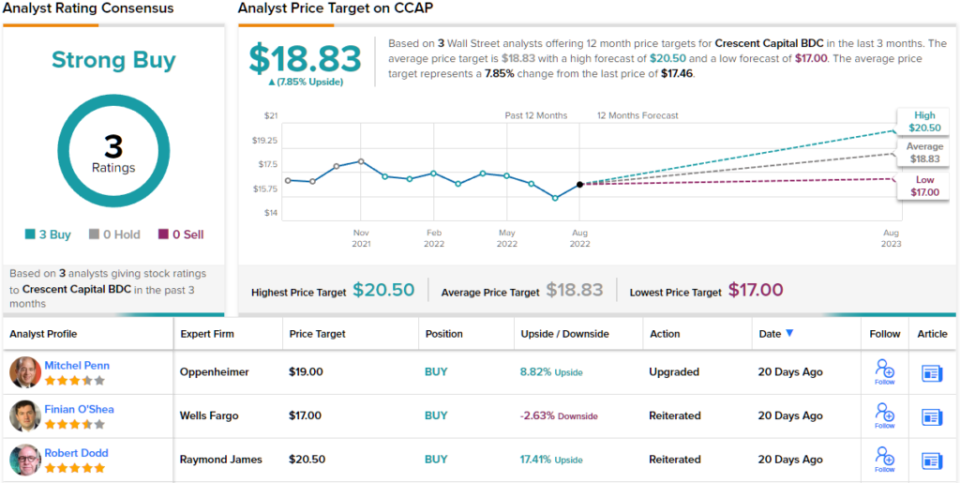

Advancing from these feedback, Penn units an Outperform (i.e. Purchase) score on the shares, together with a worth goal of $19, suggesting an upside of 9% by the tip of subsequent 12 months. (To observe Penn’s observe file, click here)

That is one other inventory with a unanimous Sturdy Purchase consensus score, based mostly on 3 constructive analyst evaluations set in current weeks. The inventory’s common worth goal of $18.83 implies ~8% upside potential from the present buying and selling worth of $17.25. (See Crescent stock forecast on TipRanks)

To search out good concepts for dividend shares buying and selling at enticing valuations, go to TipRanks’ Best Stocks to Buy, a newly launched device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally vital to do your personal evaluation earlier than making any funding.

Source link