U.S. inventory futures slip from 3-month highs as merchants await Fed minutes and retail gross sales knowledge

[ad_1]

U.S. inventory futures fell again from current highs as bulls held their fireplace forward of the discharge of Fed minutes afterward Wednesday

How are stock-index futures buying and selling

-

S&P 500 futures ES00

ES00,

-0.44%

dipped 15 factors, or 0.4% to 4293 -

Dow Jones Industrial Common futures

YM00,

-0.30%

fell 83 factors, or 0.2% to 34034 -

Nasdaq 100 futures

NQ00,

-0.54%

eased 67 factors, or 0.5% to 13591

On Tuesday, the Dow Jones Industrial Common

DJIA,

rose 240 factors, or 0.71%, to 34152, the S&P 500

SPX,

elevated 8 factors, or 0.19%, to 4305, and the Nasdaq Composite

COMP,

dropped 26 factors, or 0.19%, to 13103. The Nasdaq Composite is up 23.1% from its mid-June low however stays down 16.3% for the year-to-date.

What’s driving markets?

The urge for food for extra dangerous bets was waning as buyers took day out to evaluate the sturdy summer time surge that powered the inventory market to three-month highs, and awaited the newest financial coverage replace through the minutes of the newest Fed assembly.

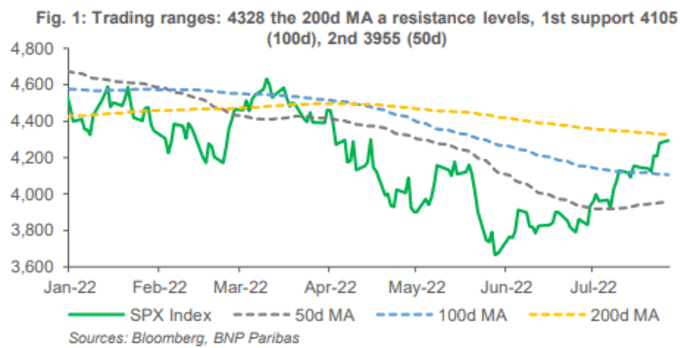

Hopes that inflation might have peaked and that the Federal Reserve thus could possibly keep away from delivering a tough financial touchdown has pushed the S&P 500 up 17.4% from its mid-June low, and left the benchmark difficult its 200-day transferring common for the primary time since April.

“The index traded above its 200-DMA twice this 12 months, as soon as in early February, then late March, however couldn’t maintain on to the good points and quickly offered off,” famous Ipek Ozkardeskaya, senior analyst at Swissquote Financial institution.

“We are going to see if the third time is a allure; earnings and the FOMC minutes might be decisive for the short-term course,” she added.

Supply: BNP Paribas

The Federal Reserve is because of launch the textual content from its late July rate-setting assembly at 2 p.m. Jap and merchants might be eager to see whether or not the dialogue matches present market expectations for the tempo of charge hikes.

Earlier than that, buyers will get extra clues as to the well being of the U.S shopper. Following better-than-expected outcomes on Tuesday from Walmart

WMT,

and Residence Depot

HD,

it’s the flip of retailing friends Goal

TGT,

and Lowe’s

LOW,

to ship earnings.

As well as, retail gross sales knowledge for July are due for launch at 8.30 a.m. Jap. Retail gross sales are anticipated to develop simply 0.1% versus 1% development in June, in line with economists polled by Dow Jones Newswires and The Wall Road Journal.

Probably contributing to the market’s warning on Wednesday are issues that the rally could also be wanting overstretched on a short-term foundation.

The S&P 500 future’s 14-day relative energy index, a closely-watched momentum gauge, was 78 in early morning motion, in line with CMC Markets. Technical analysts take into account a determine above 70 to be in ‘overbought’ territory.

“With [the] market wanting overbought and having rallied greater than 15% from June lows, the current transfer is, in our view, beginning to look over performed. The expansion outlook goes to stay difficult to navigate,” stated Greg Boutle, U.S. head of fairness and derivatives technique at BNP Paribas.

S&P 500 (SPX) valuations are additionally not compelling, Boutle famous. “SPX 2023 worth/earnings a number of at 18x is correct on the prime finish of the 30-year vary for 1-year ahead earnings (ex. bubble durations, late 90s and the publish lockdown restoration). In the course of a downgrade cycle this might make it difficult for the current tempo of restoration to persist.”

Supply: BNP Paribas

How are different property faring

-

Oil futures have been decrease, with U.S. WTI crude

CL.1,

+0.25%

falling 0.4% to $86.23 a barrel, amid hopes an Iran nuclear deal might assist the nation improve exports. -

The ten-year Treasury yield

TMUBMUSD10Y,

2.866%

rose 5.9 foundation factors to 2.871% as merchants awaited the Fed minutes. -

The ICE Greenback index

DXY,

+0.05%

inched up 0.1% to 106.63, and this pressured gold, off 0.1% to $1787 an oz.. -

Bitcoin

BTCUSD,

-0.61%

fell 0.7% to $23780. -

Asia markets have been broadly firmer after Wall Road moved to a recent three-month excessive in a single day. Japan’s Nikkei 225

NIK,

+1.23%

added 1.3% and Hong Kong’s Cling Seng

HSI,

+0.46%

climbed 0.5%. In Europe the temper was extra combined, reflecting the dip in U.S. futures on Wednesday, and the Stoxx 600

SXXP,

-0.07%

was barely modified.

Source link