[ad_1]

Are you aware what a pint of milk prices? It’s a query designed to catch out out-of-touch celebrities and politicians. In these instances of inflationary froth, central bankers — and due to this fact markets — may wish to listen, too.

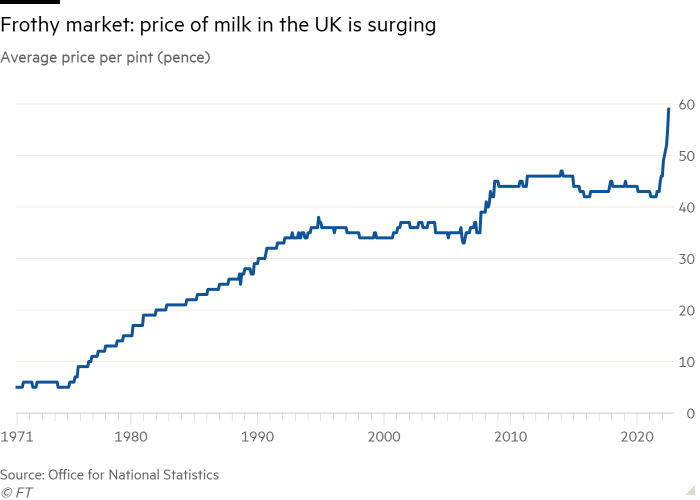

Costs for milk, one of the of primary of commodities, are surging. That issues not just for buyers, however for these of us after an indication of how sticky inflation will probably be.

Milk has historically proved stubbornly immune to inflation. Farmers and processors have to preserve margins at a minimal in the event that they wish to promote their wares to the grocery store behemoths, that are beneath strain from low cost retailers.

These market dynamics — and the truth that we’re now ingesting extra dairy-free options — meant that within the UK from 2008 till lately the typical worth of a pint had been as flat as a glass of the stuff at 42p. Over the previous yr, nonetheless, it’s leapt by 40 per cent to 59p. That may nonetheless sound like small change. However for a staple that the typical individual drinks three of per week, it’s fairly staggering for some.

It’s an analogous story elsewhere. In Germany, prices are up by virtually a 3rd over the previous yr, whereas the price of a gallon within the US has risen by 15 per cent since January.

So what does the hovering value of a pint of milk inform us in regards to the nature of inflation? And the way a lot of the current spurt has its origins within the supply-side shortages that emerged throughout the pandemic?

That we’re seeing it occur in such a aggressive market highlights how embedded worth rises have change into.

The price of two of the most important inputs for dairy farmers — feed and fertiliser — are up 83 per cent and 179 per cent respectively over the previous yr, in line with the UK Agriculture and Horticulture Improvement Board. “With farm enter prices rising so considerably, dairy processors have needed to pay extra to make sure farmers don’t scale back milk manufacturing an excessive amount of,” says Patty Clayton, the trade physique’s lead dairy analyst.

The battle in Ukraine has exacerbated supply-side inflation. The media highlight on Russia’s invasion has additionally meant the rise in prices has not solely been painful, however seen — an important issue that has helped processors cross them on to retailers.

Joanna Konings, a senior economist at Dutch financial institution ING, says the truth that this has occurred, after years of powerful negotiation with supermarkets, “reveals us simply how robust the present rises in enter costs are”.

Some enter costs are actually falling, nonetheless. Amongst them is the price of oil, which is important all through the availability chain. “The milk is collected from farms all over in tankers so they’re utilizing gas, then processing the milk takes vitality because it includes heating it. Then there may be the price of delivering lorry a great deal of milk and cheese and butter by street,” says Maggie Urry, who used to cowl the dairy trade for the Monetary Instances.

Droughts throughout the northern hemisphere might have lower brief the height milk-producing “spring flush”, weighing on output. However, with the price of commodities broadly down in current months, milk worth pressures might need peaked.

I believe, nonetheless, that it is going to be some time but earlier than the spillover results work their method by the availability chain.

When doing their weekly store, individuals discover inflation in two methods. The primary is that if the price of a staple they purchase typically goes up. You could or might not know what the worth of milk is, however I very a lot doubt you’d be capable of inform whether or not that bottle of Tabasco sauce you buy twice a yr prices extra now than it did throughout the winter.

The second is that if the worth of a basket of products rises. Andrew Porteous, a shopper and retail analyst at HSBC, says: “Everyone has a couple of gadgets that they know the worth of, however what most of us discover is what we pay on the checkout, after we go: ‘Oh my, I’ve spent 55 quid this week reasonably than 50.’”

Supermarkets — eager to not be outdone by the discounters which have robbed them of market share over the previous decade — “wish to guarantee that the worth of their baskets is aggressive”, provides Porteous. They try this by tending to lift prices solely of merchandise purchased often.

Milk is so ubiquitous that even Mark Carney, the previous Financial institution of England governor who was as close to to rock star standing as central bankers get, knew what the worth of half a gallon was. Couple that with a rise in the price of the typical store and what now we have is a really seen rise in inflation.

That visibility issues lots. It’s more likely to not solely affect the expectations of buyers and companies about the place costs will probably be this time subsequent yr, however make calls for for larger wages and will increase in the price of different merchandise all of the extra credible. How are you going to bemoan paying a farmer extra whenever you’ve felt the pinch your self?

The rise within the worth of a pint appears to be like to me like a portent of inflation’s stickiness. I’d warning in opposition to these market bets that financial policymakers will quickly pivot away from rising borrowing prices. As an alternative Carney’s successor, Andrew Bailey, and his central banking counterparts elsewhere must sit tight whereas worth pressures, from provide chain to grocery store shelf, play out.

Source link