[ad_1]

The U.S. Home of Representatives is poised to approve a $430 billion local weather, well being and tax measure that might make it less expensive to personal America’s hottest electrical vehicles, the Tesla Model 3 and Model Y, and can give incentives to consumers of used electrical vehicles for the primary time. However the Inflation Discount Act will even make enormous swathes of different EVs costlier.

The invoice retains the $7,500 most tax credit score however scraps the 200,000-unit production limit that GM and Tesla hit way back, and which was about to have an effect on different manufacturers like Toyota and Ford. However to qualify for the brand new credit, EVs should now be made in North America, and meaning tens of electrical vehicles that had been beforehand eligible, gained’t be eligible going ahead.

The brand new invoice additionally brings in car value caps of $55,000 for vehicles and $80,000 for vans, vans and SUVs, which means some Teslas, and each Rivian and Lucid won’t qualify for monetary help. And even EVs in-built America and beneath the value cap will solely be eligible for support if 40 % of their battery supplies are sourced within the U.S. or from a U.S. buying and selling accomplice, that share rising to 100% by 2029. There’s additionally an revenue tax cap of $150,000 ($300,000 for {couples}) to ensure assist solely goes to those that want it.

Associated: New $7,500 EV Tax Credit Passes Senate, Requires Carmakers To End Reliance On Chinese Batteries

The brand new system doesn’t utterly come into power till January 2023. Till then now we have a sort of, properly, hybrid state of affairs. Drivers who entered into written binding contract to buy a new EV (outlined as involving a minimal 5 % downpayment) earlier than August 16, 2022, however who don’t take supply till after that date, can declare tax credit score below the previous guidelines. And people who purchase a brand new automobile after August 16, however take supply by December 31, are additionally certain by the outgoing guidelines (together with the 200k manufacturing cap), plus the brand new one concerning the car’s meeting location.

Understandably, quite a few automakers negatively affected by the change are critically involved concerning the influence the brand new guidelines might have on their enterprise at a time when electrical vehicles are booming in recognition. The brand new rules will even have an effect on credit out there for hybrid vehicles, however we’ve targeted on BEVs to tug collectively a listing of 34 totally electrical vehicles out there now, or within the subsequent few months, that gained’t be eligible for tax credit below the brand new system.

Audi Q4 e-tron and Q4 e-tron Sportback (in-built Zwickau, Germany)

Audi e-tron and Sportback (in-built Brussels, Belgium)

Audi e-tron GT (in-built Heilbronn, Germany, and exceeds $55k)

BMW i4 (in-built Munich, Germany, and exceeds $55k)

BMW i7 (in-built Dingolfing, Germany, and exceeds $55k)

BMW iX (in-built Dingolfing, Germany, and exceeds $80k)

Fisker Ocean (in-built Graz, Austria)

Genesis GV60 (in-built Ulsan, South Korea)

Genesis G80 Electrified (in-built Ulsan, South Korea, and exceeds $55k)

Hyundai Kona Electric (in-built Ulsan, South Korea)

Hyundai Ioniq 5 (in-built Ulsan, South Korea)

Associated: Hyundai Motor Group To Build New EV And Battery Plant In Georgia Creating 8,100 Jobs

Hyundai Ioniq 6 (in-built Asan, South Korea)

Jaguar I-Pace (in-built Graz, Austria)

Associated: European Union Says America’s Proposed EV Tax Credit Might Violate World Trade Organization Rules

Kia EV6 (in-built Hwaseong, South Korea)

Kia Niro EV (in-built Hwaseong, South Korea)

Lexus RZ 450e (in-built Aichi, Japan)

Lucid Air (in-built U.S. however value exceeds $55k)

Mazda MX-30 (in-built Hiroshima, Japan)

Mercedes-Benz EQB (in-built Kecskemét, Hungary)

Mercedes-Benz EQE (in-built Bremen, Germany, and value exceeds $55k)

Mercedes-Benz EQS (in-built Sindelfingen, Germany, and exceeds $55k)

Mercedes-Benz EQS SUV (in-built U.S. however exceeds $80k)

Mini Cooper SE Electric (in-built Oxford, UK)

Nissan Ariya (in-built Kaminokawa, Japan)

Polestar 2 (in-built Luqiao, China)

Porsche Taycan (in-built Stuttgart, Germany, and exceeds $55k)

Rivian R1T (in-built U.S. however value exceeds $80,000)

Subaru Solterra (in-built Aichi, Japan)

Tesla Model S (in-built U.S. however value exceeds $55,000)

Tesla Model X (in-built U.S. however value exceeds $80,000)

Toyota bZ4X (in-built Aichi, Japan)

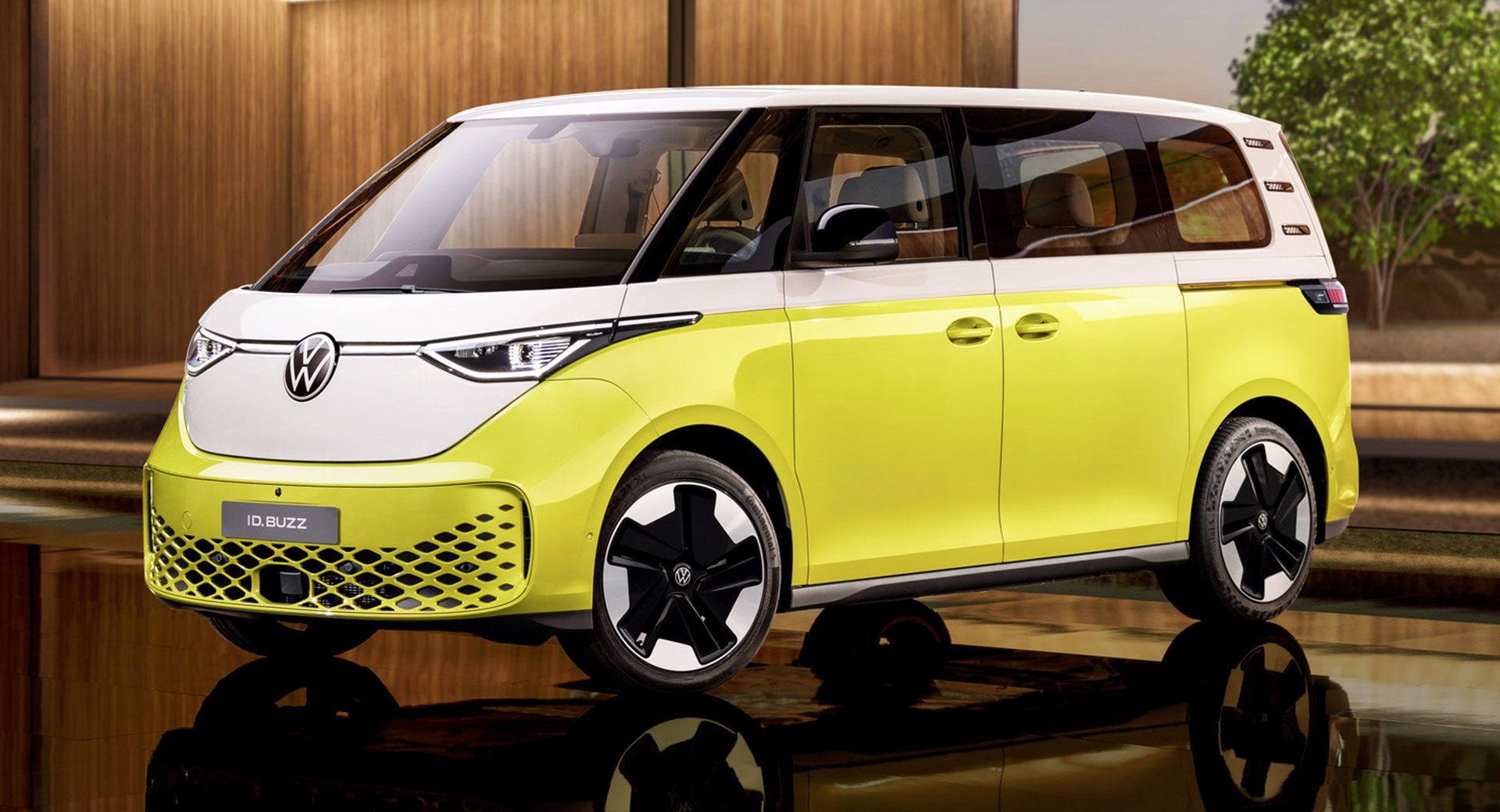

Volkswagen ID. Buzz (in-built Hanover, Germany)

Associated: VW Suggests The ID. Buzz Could Be Built In North America After All

Volvo C40 Recharge (in-built Ghent, Belgium)

Volvo XC40 Recharge (in-built Ghent, Belgium)

Will the implications of the Inflation Act on EV eligibility for tax credit make a distinction to your plans to purchase an electrical automobile? Are you extra possible to purchase a Tesla Mannequin 3 after January when the 200k manufacturing cap is lifted? And are you much less possible to purchase a Toyota bZ4X figuring out that it now not qualifies for federal support? Depart a remark and tell us.

Source link