There is a new supercycle rising for the economic system, and these are the shares that might profit, strategist says

[ad_1]

It’s been an attention-grabbing summer time for monetary markets — kind of, a collection of largely downbeat financial knowledge led merchants to suppose the Fed will ease off the pedal, although during the last week they’re changing into much less satisfied of that view.

Taking an extended lens is Dario Perkins, managing director for international macro at analysis agency TS Lombard, who says a brand new macro supercycle is rising. “The supercycle in inflation and rates of interest is in the end about ‘energy,’ and the stability of energy appears to be shifting,” he writes. And that energy is swinging to labor, even when charge hikes from the Fed and different central banks tip the economic system right into a recession.

Table of Contents

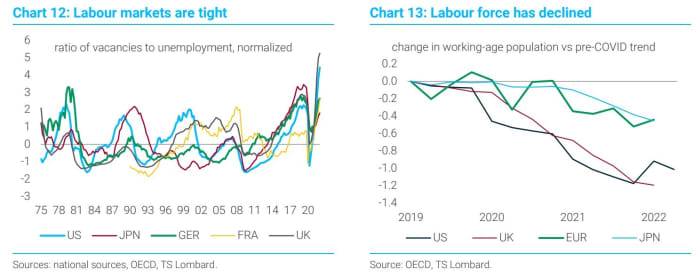

The ratio of vacancies to unemployed staff has surged within the developed world, whereas the working-age inhabitants has decreased.

“A gentle recession shouldn’t be going to eradicate present employee shortages or tilt the stability of energy again to capital. Central banks can’t stand in the way in which of structural shifts, similar to deglobalization, local weather change and ‘wartime economics,’” says Perkins, who beforehand labored on the U.Okay. Treasury and was an economist at ABN Amro.

What does that imply? Within the quick time period, there will likely be frustration for each bulls and bears, with additional gyrations in each bonds and shares because the inflation/deflation pendulum swings. In the end, although, long-term rates of interest are going to be greater, and central banks will likely be combating to maintain inflation beneath 3%, not beneath their 2% targets, Perkins says.

“With secularly greater rates of interest, traders will not have the option depend on the continual rerating of all different asset lessons, particularly long-duration equities similar to U.S. tech shares. The 2020s will demand a extra discerning method to asset allocation,” he says.

The beneficiaries will likely be corporations with tangible belongings — the true economic system, so to talk. In a high-pressure economic system, there’s a shortage premium on bodily belongings, uncertainty about future returns and fewer profit to monetary engineering, he says. In an period of deglobalization, intangible belongings will lose their attract.

“Buyers ought to search publicity to ‘tangibles’, similar to commodities, actual property and lots of conventional ‘worth’ components of the fairness market, that are prone to acquire from this transition,” Perkins says.

| Theme | Winners |

| Greater rates of interest | Banks, financials, healthcare |

| Infrastructure spending | Industrials, supplies, commodities |

| Structural power shortages | Power, commodities |

| Protection spending | Protection, aerospace, supplies |

| World housing revival | Banks, supplies, commodities |

| Deglobalization and reshoring | Industrials, capital items |

| Local weather change | Commodities, metals, power |

| Supply: TS Lombard | |

The markets

U.S. inventory futures

ES00,

NQ00,

meandered forward of the open. Crude-oil futures

CL.1,

superior, and the yield on the 10-year Treasury

TMUBMUSD10Y,

stayed above 3%.

The excitement

The economics calendar contains durable-goods orders, which had been flat in opposition to expectations of a wholesome advance. At 10 a.m. Japanese, the pending house gross sales report will likely be launched. The extra technical preliminary benchmark revision to the institution survey additionally will likely be launched, in what is going to present how effectively the Labor Division has achieved at measuring jobs development.

Nordstrom

JWN,

shares are set to skid after the retailer lowered its outlook for the year. City Outfitters

URBN,

additionally reported a tricky quarter, and residential builder Toll Brothers

TOL,

lowered its deliveries steering.

There are massive earnings releases after the shut, when tech corporations together with Salesforce.com

CRM,

and Nvidia

NVDA,

report outcomes. Cathie Wooden’s ARK funds sold shares in Nvidia forward of the outcomes.

Meme inventory Mattress Bathtub & Past

BBBY,

has discovered a financing supply on a mortgage deal, The Wall Street Journal reported, citing individuals conversant in the matter..

The White Home is anticipated to unveil a plan cutting $10,000 of student debt to those that make less than $125,000.

Minneapolis Fed President Neel Kashkari mentioned the Fed needs to keep tightening interest rates.

Better of the net

In a post-Fukushima shift, Japan is planning new nuclear power plants.

The warehouse property market is returning again to Earth.

This nonprofit is aiming to buy houses before investors do.

Prime tickers

Right here had been essentially the most lively stock-market ticker symbols on MarketWatch as of 6 a.m. Japanese.

| Ticker | Safety title |

|

BBBY, |

Mattress Bathtub & Past |

|

AMC, |

AMC Leisure |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

APE, |

AMC most popular fairness items |

|

AAPL, |

Apple |

|

NIO, |

Nio |

|

BBY, |

Greatest Purchase |

|

STBX, |

Starbox |

|

AMZN, |

Amazon.com |

The chart

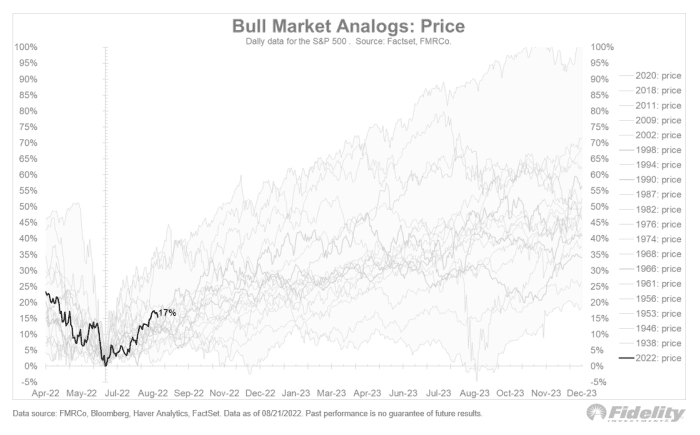

Proper now the large query in markets is whether or not this summer time has seen a bear-market rally or a brand new bull market emerge. Jurrien Timmer, director of world technique at Constancy Investments, says if this can be a new bull market, it’s wanting fairly middle-of-the-road when it comes to each length and magnitude to date.

Random reads

NASA has offered the “sound” of a black hole.

Australia, which popularized avocado toast, now has too many avocados.

Have to Know begins early and is up to date till the opening bell, however sign up here to get it delivered as soon as to your electronic mail field. The emailed model will likely be despatched out at about 7:30 a.m. Japanese.

Source link