[ad_1]

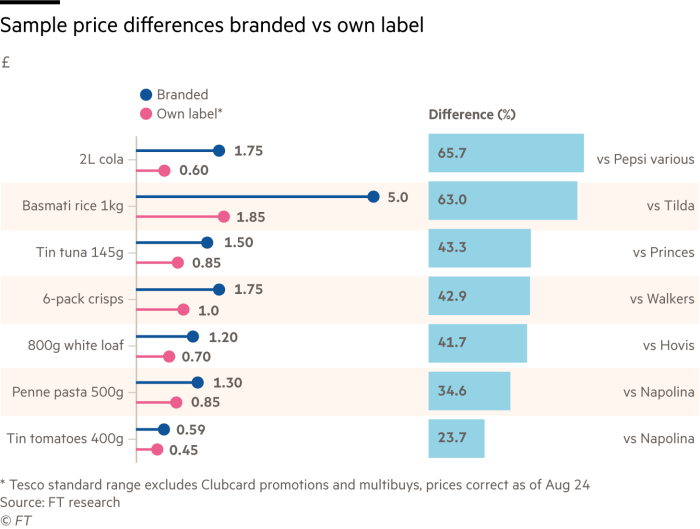

A loaf of branded, white sliced bread prices about £1.20 at Tesco. The retailer’s own-label equal prices 70p, or 42 per cent much less. It isn’t shocking that Tesco’s chief govt, Ken Murphy, just lately flagged bread as one of many classes the place prospects are beginning to commerce right down to cheaper alternate options.

That pattern is already being felt by the businesses that make own-label merchandise — they usually count on it to speed up. “We’re seeing a rise in our own-label volumes, particularly in bread the place the worth for cash hole could be very clear,” mentioned the managing director of 1 bakery merchandise group.

“The rise within the power worth cap is prone to focus minds much more,” he added, noting that the hovering value of power within the UK meant this downturn was “shifting at a far faster tempo” than earlier ones and that “lots of households should batten the hatches down”.

In the course of the pandemic and earlier than inflation took off, folks sought the reassurance of branded items. However Mike Watkins, head of retailer and enterprise perception at consultancy NielsenIQ, mentioned that habits had been shifting once more, with own-label gross sales outgrowing branded in latest months amid the biggest squeeze on UK wages in 20 years.

Final month Unilever, one of many world’s largest producers of branded items, warned that gross sales had been hit by consumers choosing cheaper versions as costs of its merchandise rose.

Fraser McKevitt, head of retail and client perception at one other consultancy, Kantar, mentioned own-label items now made up 51.6 per cent of grocery gross sales by worth, the best stage it had ever recorded.

Its figures present own-label gross sales rising 7 per cent within the 12 weeks to August 7, whereas a latest survey by consultancy Retail Economics urged that half of all consumers had been planning to purchase extra own-label merchandise.

A lot of the expansion in personal label over the previous decade has been pushed by the enlargement of discounters Aldi and Lidl, which between them have an 18 per cent market share, in contrast with 8 per cent in 2011. Each promote nearly completely own-label merchandise below names corresponding to Village Bakery for bread and Baresa pasta.

Some own-label merchandise are made by large corporations that additionally make branded items. Hovis and Kingsmill, for instance, each make own-label bread. However the sector is dominated by comparatively small and normally privately owned corporations. Some are important producers specifically classes, corresponding to Veetee in rice and Lovering Meals in canned fish.

The shift to personal label is broader than simply buying and selling down on staples.

The expansion of Tesco’s Best, J Sainsbury’s Style the Distinction and different ready-meal presents as a less expensive different to eating places and takeaways has been an enormous issue within the larger than common gross sales of own-label meals within the UK in contrast with Europe and the US.

“That is the place personal label comes into its personal,” mentioned Lydia Gerratt, a marketing consultant and former purchaser at an enormous grocery store chain. “These merchandise will not be developed to be the most affordable, however to supply your core prospects one thing they need that they don’t seem to be getting elsewhere.”

Nonetheless, larger demand for own-label merchandise is unlikely to translate into greater income for producers, as a result of they’re already engaged on skinny margins and face rampant inflation.

The bakery merchandise producer mentioned that rising gross sales had been “on no account offsetting the rises in costs of virtually every little thing we contact”.

“Wheat is up however the large factor is gasoline,” he added.

James Logan, UK industrial director at Refresco, which provides water, fruit juice and fizzy drinks to supermarkets throughout Europe, agreed the price will increase had been throughout the board. “Previously you may need obtained a spike in a single explicit commodity due to one thing like El Niño affecting harvests,” he mentioned.

“This time there isn’t any respite, prices are rising in all places within the provide chain.”

The query of how the additional prices are shared has led to high-profile stand-offs between retailers and suppliers of branded items, corresponding to a recent dispute between Tesco and Heinz that briefly took some merchandise off cabinets. Disagreements with own-label suppliers are much less seemingly on the entire.

“A superb own-label provider could have shut contact with the retailer and maintain them knowledgeable about any developments which may require a troublesome dialog,” mentioned Logan.

Clive Black, head of analysis at Shore Capital, mentioned asking suppliers to take the hit on worth was not a simple choice. Earlier stress from retailers had led to consolidation, he added, which means there have been fewer alternate options, whereas switching provider can also be not as simple because it was.

The bakery govt mentioned he was having “wise and constructive dialogue” with prospects whereas McBride, a listed provider of own-label family cleansing merchandise, just lately mentioned it had secured “important” worth will increase to assist offset the upper prices of chemical compounds and power.

Tesco and Sainsbury’s have indicated they may sacrifice some income this yr to soak up worth will increase from suppliers.

Logan mentioned media protection of the price of residing disaster had made worth discussions simpler to provoke. “No one can argue they had been unaware of what’s occurring.”

Source link