[ad_1]

Australia’s first battery-grade lithium refinery, the biggest exterior China, has opened talks with electrical car makers because it seeks to fulfill surging demand from international automakers for the mineral.

Tianqi Lithium Power Australia, collectively owned by Chinese language group Tianqi and Australian firm IGO, mentioned it was aiming to provide quite a lot of international automakers with lithium hydroxide from its plant in Kwinana, close to Perth, Western Australia. Lithium hydroxide is the refined product utilized in electrical car batteries.

“I feel it’s a matter of time,” mentioned Raj Surendran, chief working officer of the three way partnership that owns the plant, about supplying lithium hydroxide on to electrical car corporations quite than exporting the uncooked mineral to be refined in China.

He didn’t give additional particulars of the talks. However he mentioned that the Kwinana plant’s manufacturing might quadruple within the coming years.

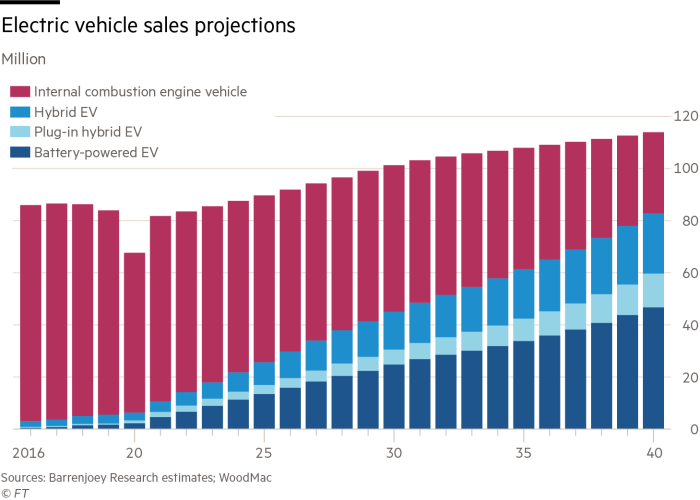

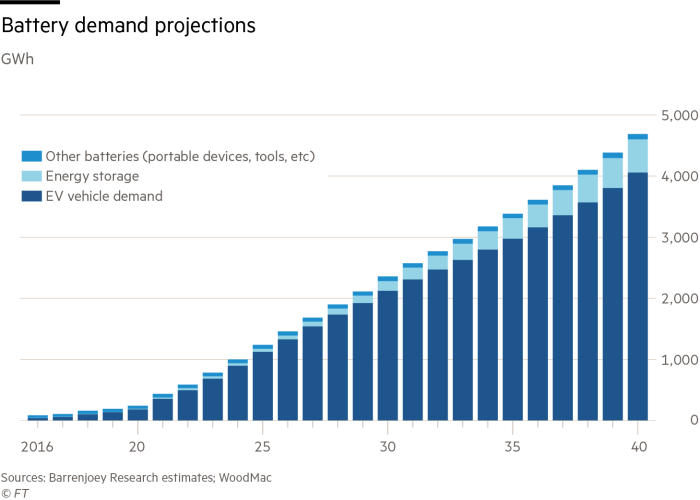

International lithium provide is anticipated to triple within the subsequent 9 years, based on funding financial institution Barrenjoey, however that also won’t be sufficient to match the wants of the electric vehicle market.

Though it’s majority owned by a Chinese language firm, TLEA is seen as necessary to realising a push to entry provides of refined minerals exterior China, which dominates the market. Automakers in Europe and Japan are anticipated to be necessary prospects of the refinery.

Carmakers, together with Ford, Tesla and their Japanese rivals, are already signing offers with different Western Australian miners together with BHP, Wesfarmers, Liontown and Lynas to safe uncooked supplies equivalent to nickel and lithium which might be crucial for electrical automobiles.

Hayden Bairstow, head of assets analysis at Macquarie, mentioned demand for lithium hydroxide was driving partnerships to remodel Western Australia into the centre of the business exterior China.

“Persons are determined to pay money for it however plenty of the information is in China, so joint ventures like Tianqi [and] IGO are taking place,” he mentioned. “That is the primary massive buildout of hydroxide capability wherever else on the planet. It’s nonetheless in its infancy however inside a decade, will probably be a considerable and necessary area for everybody’s provide chain.”

TLEA mentioned it has taken A$1bn (US$687mn) of funding to provide lithium that’s pure sufficient to be used in batteries. Erik Laurent, normal supervisor of the plant, described it as refining the equal of “a teaspoon of water from a yard swimming pool”.

Tianqi began constructing the refinery six years in the past when Sino-Australian tensions — which have grow to be elevated because the begin of the Covid-19 pandemic — had been a lot decrease.

The challenge was beset by issues and delays. Tianqi, which is listed in Shenzhen and likewise floated in Hong Kong this 12 months, as soon as absolutely owned the refinery and the mine.

However the indebted Chinese language firm discovered itself on the point of chapter two years in the past when the lithium worth collapsed. It additionally turned embroiled in a bitter dispute with its building contractor.

IGO bought into the refinery and Tianqi’s Australian hard-rock lithium mine in 2020 in a $1.4bn deal for a 49 per cent stake.

Peter Bradford, chief govt of IGO, instructed the Diggers and Sellers convention in Kalgoorlie, Western Australia, this month that the refinery was crucial to his firm’s push into the booming lithium market.

“I’m assured that now we’ve got the recipe proper, we are able to cease the deal with high quality and transfer the main target to amount,” he mentioned of the refinery’s output.

Gray-coloured spodumene, a lithium ore, is refined in Kwinana by heating it in rotary kilns at 1,100C and utilizing sulphuric acid to separate different elements — together with gypsum and sodium sulphate, which is used for detergent — from the core product. The white powder, the consistency of refined sugar, is then packed into 450kg luggage which, at present costs, are price A$28,000 every.

The refinery is fed by the Greenbushes mine 250km south of Kwinana, which exports spodumene to China. The mine, which is collectively owned by Tianqi, IGO and US firm Albemarle, is ready to virtually double its output to 2.2mn tonnes by 2027.

Albemarle is planning to construct a separate refinery alongside an area firm, Mineral Sources, that can even be equipped by Greenbushes.

Some fear in regards to the political danger of the TLEA refinery, given China-Australia tensions. The Chinese language affect continues to be obvious in Kwinana. Guests are greeted by two big marble Chinese language lion statues on the door, whereas the lobby is festooned with a big frieze of pandas at play. The Chinese language ambassador to Australia visited the plant in June

However Surendran mentioned the enterprise operates independently of its majority proprietor and has its personal board. He mentioned Tianqi has not been “heavy-handed” in its strategy to the Australia-based enterprise.

Susan Zou, senior metals analyst with Rystad Power, mentioned the funding in jobs and excessive value-added lithium merchandise was helpful to the Australian market.

“These components, in addition to the present three way partnership and collaboration with native companions, assist to mitigate any political dangers,” she mentioned of the refinery.

Source link