[ad_1]

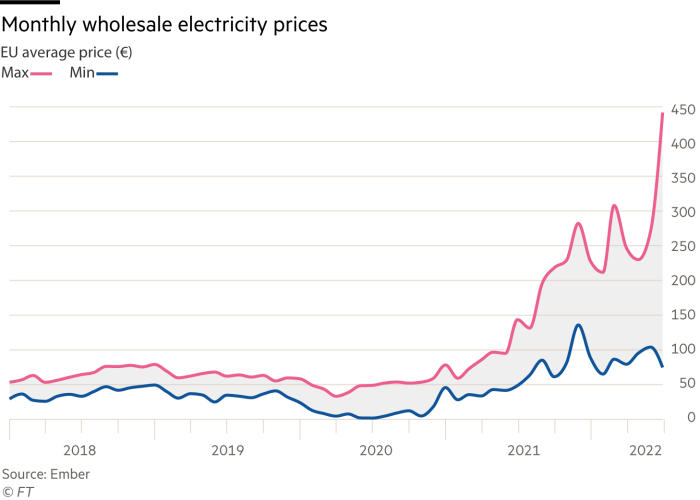

European Fee president Ursula von der Leyen used her first post- summer season break speech to vow measures to curb hovering wholesale electrical energy costs in Europe which are shredding the funds of households and firms throughout the bloc.

She vowed a short-term intervention — one thing that might be “triggered in a short time, in weeks maybe” — and announced a longer-term “structural reform of the power market”.

Table of Contents

How does the EU’s power market work and why are costs so excessive?

European energy costs are set by way of a so-called marginal pricing system through which the costliest energy plant known as on to satisfy demand on any given day units the wholesale electrical energy value for all suppliers. This implies gas-fired energy stations, that are nonetheless wanted to maintain the lights on in lots of international locations, are likely to dictate the wholesale electrical energy value for the remainder of the market although renewable energy will be produced extra cheaply.

Traditionally, there was little want to overtake the system, even because the proportion of fresh energy within the power combine elevated. It was hoped that larger wholesale electrical energy costs would incentivise the event of inexperienced power by growing the revenue margin for lower-cost renewables tasks.

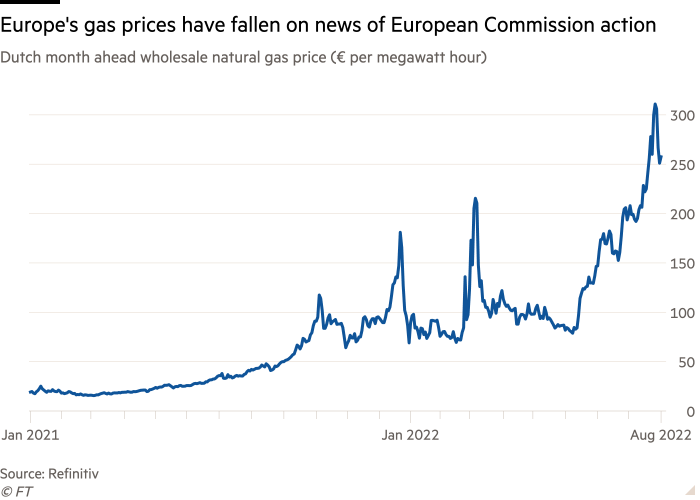

However as gasoline costs have soared to document ranges this 12 months — largely as a consequence of Moscow’s determination to cut back provides to Europe — the price of electrical energy has been dragged up too. Extra policymakers are due to this fact calling for a brand new method that might enable cheaper renewable power to be bought at a lower cost. Polish prime minister Mateusz Morawiecki stated on Tuesday that proposals to alter the market construction “are falling on more and more fertile floor”.

The UK authorities in July launched a session on decoupling the costs of gasoline and renewable energy. Strain is now mounting in Brussels.

What can the EU do to chop prices for customers and business?

Commission officers say that choices below dialogue embody a value cap on gasoline, detailed steerage pushing EU capitals to impose windfall taxes on power firms that might be used to help weak customers, and a short lived separation of gasoline and electrical energy costs forward of extra long-term uncoupling.

Another choice is to require cuts to electrical energy demand according to what’s at the moment a voluntary 15 per cent reduce to gasoline consumption agreed by EU power ministers in July.

These measures would come along with efforts to search out different provides — the bloc has changed round a fifth of its pure gasoline provide from Russia with gasoline from different international locations — and turbocharge funding in renewables.

What are the dangers?

The EU’s power company, Acer, has warned in opposition to tearing up the market construction. In a report in April, it stated that the EU’s wholesale electrical energy markets work effectively below regular situations, guaranteeing safe electrical energy provide.

As an alternative of ripping up the current preparations, it instructed there might be a “momentary reduction valve”. This might restrict electrical energy costs mechanically if there are sudden spikes, below predefined situations — for instance, unusually excessive value rises in a brief time frame.

William Peck, energy market analyst at ICIS, a commodity analytics agency, additionally cautioned in opposition to overhauling a mechanism that had functioned effectively for many years and nonetheless served as an incentive for much-needed funding in clear energy.

Politicians have been specializing in energy market reform as a result of that they had been unable to discover a fast and enough different to Russian gasoline, he stated. “If it was me, I’d actually be focusing my power on the gasoline provide a part of this equation and never ripping up a 20- to 30-year-old market.”

What can we study from Spain and Portugal’s value cap experiment?

Portugal and Spain reached a political settlement with the European Fee in April permitting them to cap the value of pure gasoline utilized in energy crops, thus decoupling electrical energy and gasoline costs. The measure got here into impact in Could and can run for a 12 months with the cap averaging €48.80 per megawatt hour.

The €8.4bn subsidy the Iberian international locations can pay to gasoline firms will likely be largely recouped by prices on the electrical energy distributors that the value cap advantages.

The European Fee granted what has grow to be often known as “the Iberian exception” from state support guidelines as a result of their electrical energy payments are strongly linked to wholesale power costs. They’ve restricted power connections with the remainder of the EU, making the Iberian peninsula “an power island”. Brussels has additionally argued that the measure will enable the 2 international locations to develop inexperienced power manufacturing.

Spain claims that between June 15 and August 15 the value of electrical energy had been €49.85 per megawatt hour cheaper than it might have been had the value cap mechanism not been in place, saving customers round €1.4bn.

However the quantity of gasoline used for electrical energy had elevated 17 per cent between January and July 2021 to 23 per cent in the identical interval this 12 months. Madrid stated this was as a result of summer season drought, which has hit hydropower crops.

Peck at ICIS stated that increasing such a mechanism Europe-wide may equally enhance gasoline demand by making it artificially low cost. “That’s the precise reverse of what we wanted to be doing.”

What’s subsequent?

Whereas von der Leyen stated that the fee would give you options “in a matter of weeks”, officers say proposals are unlikely to be made in time for a gathering of EU power ministers on September 9 however could also be outlined in her State of the Union tackle to EU parliament on September 14.

Georg Zachmann on the Bruegel think-tank stated it was tough to envisage an answer to rapidly decrease wholesale costs with out inflicting chaos within the markets. “There are quite a lot of issues you possibly can undermine by tinkering with the market design,” he stated.

The taxation system was a greater mechanism to handle the short-term concern of excessive costs, he argued, comparable to a windfall tax on electrical energy producers that might be channelled to customers.

Extra reporting from Peter Sensible in Lisbon

Are you going through difficulties managing your funds as the price of residing rises? Our client editor Claer Barrett and finance educator Tiffany ‘The Budgetnista’ Aliche mentioned tips about the most effective methods to save lots of and funds as costs throughout the globe enhance in our newest IG Reside. Watch it here.

[ad_2]

Source link