[ad_1]

Anybody who has labored in a job even tangentially related to the general public markets will not less than have heard of Bloomberg Terminal, an business commonplace platform utilized by professionals to achieve real-time information and insights into the monetary markets.

Certainly, Bloomberg Terminal is an extremely helpful — if costly — instrument for merchants, brokers, analysts and others involved with the general public markets. However these extra aligned with the personal sphere, akin to enterprise capitalists and personal fairness traders, maybe aren’t fairly as well-served in the case of funnelling into the info they should perform their due diligence forward of creating a giant funding, or monitoring and managing their portfolio by means of to an exit.

However that is one thing that French startup Edda is trying to repair, with a platform geared toward serving to traders, analysts, chief monetary officers (CFOs), and even firm founders get the insights they want, and the instruments that make working collaboratively on offers simply that little bit simpler.

Buyers make investments

Edda was based initially as Kushim VC back in 2017, however the firm has simply accomplished its official rebranded to Edda, whereas it has additionally introduced $5.8 million in funding from a slew of backers together with iPhone co-creator Tony Fadell’s Future Shape; Mucker Capital; Plug&Play; FJ Labs; and angel investor Arnaud Bonzom. Its new traders are additionally totally signed-up members of the Edda platform, as are some 100 different funding companies spanning 26 nations together with French public funding financial institution BPI France.

“Very like Bloomberg altered an business’s capability to function, Edda will remodel how traders visualise their fund and handle their dealflow and relationships,” FJ Labs’ founding accomplice Fabrice Grinda stated in a press release. “Enterprise capital and personal fairness generally has gone from strength-to-strength over the previous decade, spreading into new sectors and turning into the cornerstone of innovation funding.”

So what, precisely, does Edda give these working within the personal funding house?

“Edda permits safe transparency for everybody managing an funding portfolio, from deal-sourcing to due diligence and funding by means of to portfolio administration,” Edda cofounder and CEO Clément Aglietta defined to TechCrunch.

These unfamiliar with the interior workings of the personal funding realm could also be shocked to be taught that spreadsheets play an outsized position within the administration of the whole lot — it’s usually a really handbook endeavor in response to Aglietta, who beforehand plied his commerce as chief of employees at New York-based funding agency FJ Labs.

“The dearth of options for the personal markets was the first motive that I based Edda,” Aglietta stated. “Personal fairness traders at present handle greater than $6.5 trillion — nonetheless, the vast majority of these traders nonetheless depend on instruments akin to Excel spreadsheets to handle their portfolios.”

It’s possibly one thing of an over-simplification to recommend that traders simply use spreadsheets — in reality, they use an array of tools by means of the complete funding course of. This may occasionally embrace Airtable or Salesforce for workflow administration, or Affinity, Zaplow, and Sevanta for dealflow (the variety of potential funding alternatives). Elsewhere, portfolio administration software program from EFront and Ipreo have confirmed well-liked amongst traders, with both companies acquired in separate offers for a combined total of greater than $3 billion previously few years.

So Edda already has some competitors past dusty-old spreadsheets, however what it’s pitching is an all-singing, all-dancing instrument overlaying all bases.

“We consider that it’s time for funds to have a devoted instrument with a number of capabilities that helps companions to see the large image, that does the whole lot they want,” Aglietta stated.

When it comes to dealflow, Edda integrates with electronic mail inboxes and calendars to help workflow automation with duties and reminders. It additionally units out a transparent schedule and format for what stage every potential funding is at by means of a devoted watchlist.

Edda watchlist for dealflow

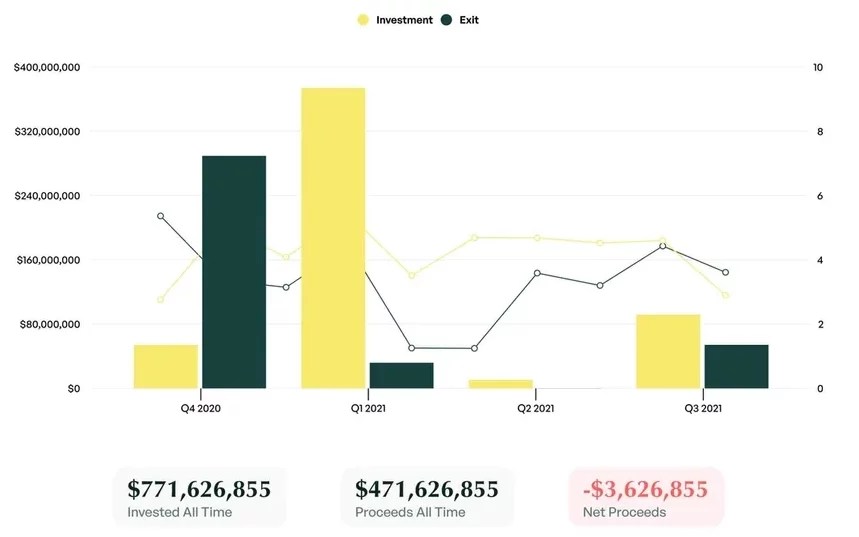

For the present portfolio, Edda permits traders to file historic valuations for all their firms, run valuation comparisons, and calculate IRR (inside fee of return) on a person firm foundation or for the complete fund. It additionally serves traders with analytics that present how properly their portfolio is aligning with their core funding focus.

Portfolio efficiency

Present me the info

Edda reels in information from publicly-available sources together with Crunchbase and Pitchbook, whereas it additionally packs a function that routinely pulls in further information from emails, paperwork, and recordsdata saved in cloud-based repositories akin to Dropbox. And on prime of that, Edda has additionally developed an API that tracks information referring to firms, funds, and the whole lot associated to the deal-making course of.

“All of this data, and information factors, are then used to generate a profile on the corporate,” Aglietta stated. “Funding selections are more and more pushed by a number of information factors, so that you

want as a lot data as attainable to make sure you make good selections — that is what Edda supplies.”

For instance how this would possibly all play out in a real-world situation, Aglietta highlighted an instance that concerned an funding fund accomplice who obtained an electronic mail a few potential funding alternative. Provided that this accomplice was utilizing an electronic mail plugin offered by Edda, the platform routinely captured the identify of the corporate, and checked if it was “already within the pipeline” on the fund, after which synchronized this with public data from Crunchbase and Pitchbook.

“The deal is routinely despatched to the pipeline for the remainder of the funding staff to begin engaged on it collaboratively, by including feedback, studying the paperwork and the emails already exchanged with this firm,” Aglietta stated.

Edda then generates a slide for every firm within the pipeline, which is reviewed weekly till the investor decides to take a position — at that time, Edda pushes the corporate into the portfolio administration part the place it generates a profile with key data akin to income and capitalization table. At this level, the corporate founders might be invited to collaborate by means of Edda, the place they will replace data themselves and talk with all the principle stakeholders.

And this highlights the core enterprise group administration aspect of the Edda platform. It displays the fact of at present’s funding panorama, the place financiers might put their cash into any variety of firms around the globe, which requires having to work with companions (together with different traders) and founders from all backgrounds and ranges of technical experience.

“The market is getting increasingly more complicated — traders make investments globally, and there are increasingly more deep applied sciences that traders must be educated about to make good selections about the place to deploy capital,” Aglietta stated. “Everyone knows that it’s not attainable to be an professional in the whole lot, that’s why traders are closely targeted on co-investment alternatives, speaking extra with firms founders, utilizing the experience of the LPs (restricted companions), and so forth.”

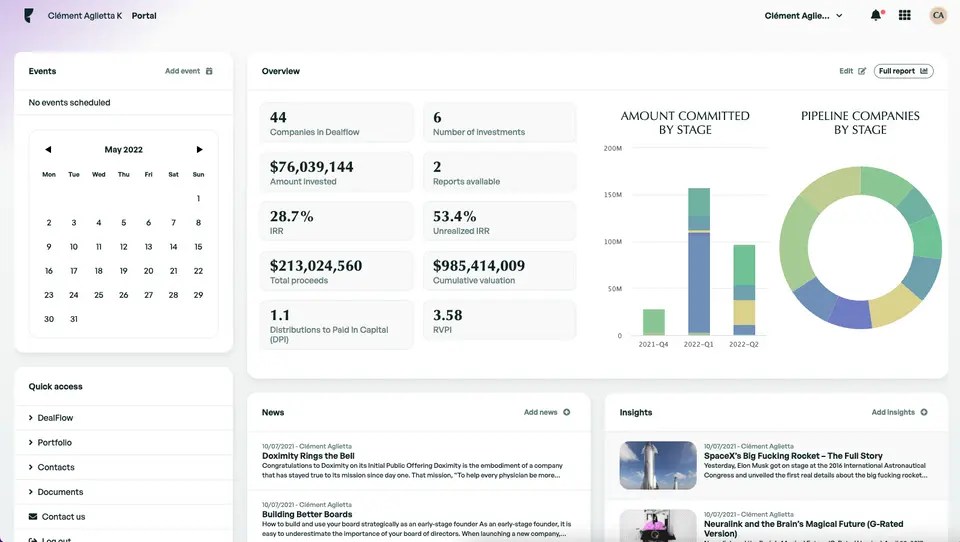

Edda helps this by serving as a centralized conduit for traders to add paperwork, maintain LPs up-to-date about offers, generate stories, share statistics, and extra. And portfolio firm founders can use Edda to ask questions and solicit recommendation, whereas traders can request particular updates and new metrics from the founders.

Edda: Sharing efficiency information with LPs

Market alternative

To offer some concept of the potential for Edda, Bloomberg reportedly generates round $10 billion in revenue annually, the overwhelming majority of which apparently emanates from its Bloomberg Terminal-driven Professional Services division.

The personal fairness markets are predicted to develop to $12.5 trillion by 2025, and for a lot of traders it’s a much more alluring proposition. Edda, for its half, at present works with traders with simply $22 billion in belongings underneath administration, which supplies some indication as to how a lot additional it may develop.

“This [private] market is large and is booming — it’s now greater than the general public market,” Aglietta stated. “There are extra firms, the whole valuation is greater, and the quantity invested can be greater.”

Source link