[ad_1]

A rising variety of merchants, teachers, and bond-market gurus are apprehensive that the $24 trillion marketplace for U.S. Treasury debt may very well be headed for a disaster because the Federal Reserve kicks its “quantitative tightening” into excessive gear this month.

With the Fed doubling the tempo at which its bond holdings will “roll off” its stability sheet in September, some bankers and institutional merchants are apprehensive that already-thinning liquidity within the Treasury market may set the stage for an financial disaster — or, falling in need of that, contain a bunch of different drawbacks.

In corners of Wall Road, some have been mentioning these dangers. One significantly stark warning landed earlier this month, when Financial institution of America

BAC,

interest-rate strategist Ralph Axel warned the financial institution’s purchasers that “declining liquidity and resiliency of the Treasury market arguably poses one of many best threats to international monetary stability in the present day, doubtlessly worse than the housing bubble of 2004-2007.”

How may the usually staid Treasury market change into floor zero for one more monetary disaster? Properly, Treasurys play a crucial function within the worldwide monetary system, with their yields forming a benchmark for trillions of {dollars} of loans, together with most mortgages.

Around the globe, the 10-year Treasury yield

TMUBMUSD10Y,

is taken into account the “risk-free charge” that units the baseline by which many different belongings — together with shares — are valued in opposition to.

However outsize and erratic strikes in Treasury yields aren’t the one difficulty: because the bonds themselves are used as collateral for banks searching for short-term financing within the “repo market” (usually described because the “beating coronary heart” of the U.S. monetary system) it’s attainable that if the Treasury market seizes up once more — because it has practically completed within the latest previous — varied credit score channels together with company, family and authorities borrowing “would stop,” Axle wrote.

See: Stock-market wild card: What investors need to know as Fed shrinks balance sheet at faster pace

In need of an all-out blowup, thinning liquidity comes with a bunch of different drawbacks for buyers, market individuals, and the federal authorities, together with larger borrowing prices, elevated cross-asset volatility and — in a single significantly excessive instance — the likelihood that the Federal authorities may default on its debt if auctions of newly issued Treasury bonds stop to perform correctly.

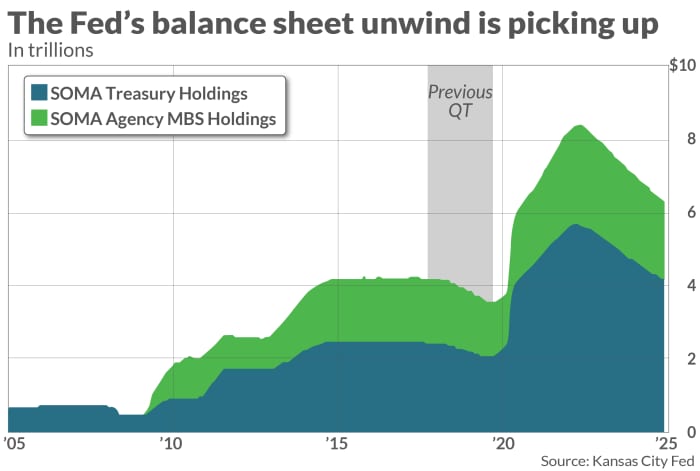

Waning liquidity has been a problem since earlier than the Fed began permitting its large practically $9 trillion stability sheet to shrink in June. However this month, the tempo of this unwind will speed up to $95 billion a month — an unprecedented tempo, in response to a pair of Kansas Metropolis Fed economists who printed a paper about these dangers earlier this 12 months.

Uncredited

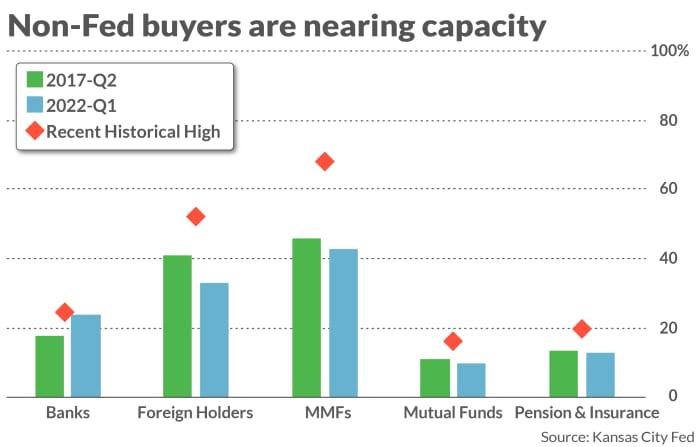

In response to Kansas Metropolis Fed economists Rajdeep Sengupta and Lee Smith, different market individuals who in any other case would possibly assist to compensate for a less-active Fed are already at, or close to, capability by way of their Treasury holdings.

Uncredited

This might additional exacerbate thinning liquidity, until one other class of patrons arrives — making the current interval of Fed tightening doubtlessly way more chaotic than the earlier episode, which came about between 2017 and 2019.

“This QT [quantitative tightening] episode may play out fairly in a different way, and perhaps it gained’t be as tranquil and calm as that earlier episode began out,” Smith stated throughout a telephone interview with MarketWatch.

“Since banks’ stability sheet house is decrease than it was in 2017, it’s extra doubtless that different market individuals should step in,” Sengupta stated in the course of the name.

In some unspecified time in the future, larger yields ought to entice new patrons, Sengupta and Smith stated. Nevertheless it’s tough to say how excessive yields might want to go earlier than that occurs — though because the Fed pulls again, it appears the market is about to search out out.

‘Liquidity is fairly dangerous proper now’

To make certain, Treasury market liquidity has been thinning for a while now, with a bunch of things taking part in a task, even whereas the Fed was nonetheless scooping up billions of {dollars} of presidency debt per 30 days, one thing it solely stopped doing in March.

Since then, bond merchants have observed unusually wild swings in what is often a extra staid market.

In July, a group of interest-rate strategists at Barclays

BARC,

mentioned signs of thinning Treasury market in a report ready for the financial institution’s purchasers.

These embody wider bid-ask spreads. The unfold is the quantity that brokers and sellers cost for facilitating a commerce. In response to economists and teachers, smaller spreads are sometimes related to more-liquid markets, and vice-versa.

However wider spreads aren’t the one symptom: Buying and selling quantity has declined considerably because the center of final 12 months, the Barclays group stated, as speculators and merchants more and more flip to the Treasury futures markets to take short-term positions. In response to Barclays’ information, common mixture nominal Treasury buying and selling quantity has declined from practically $3.5 trillion each 4 weeks in the beginning of 2022 to simply above $2 trillion.

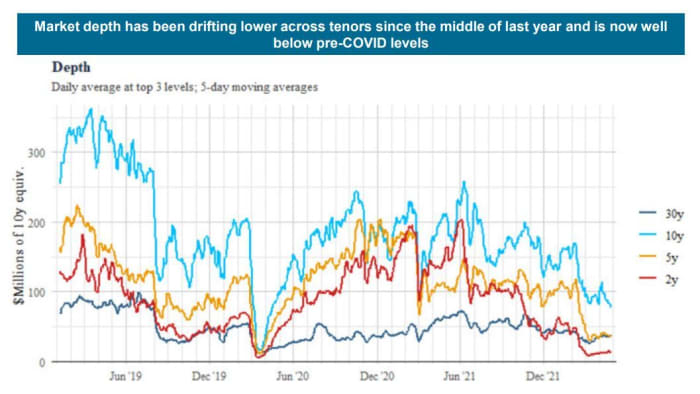

On the similar time, market depth — that’s, the greenback quantity of bonds on provide through sellers and brokers — has deteriorated considerably because the center of final 12 months. The Barclays group illustrated this pattern with a chart, which is included under.

Supply: Barclays

Different measures of bond-market liquidity verify the pattern. For instance, the ICE Financial institution of America Merrill Lynch MOVE Index, a well-liked gauge of implied bond-market volatility, was above 120 on Wednesday, a stage signifying that choices merchants are bracing for extra ructions forward within the Treasury market. The gauge is just like the CBOE Volatility Index, or “VIX”, the Wall Road “worry gauge” that measures anticipated volatility in fairness markets.

The MOVE index practically reached 160 again in June, which isn’t removed from 160.3 peak from 2020 seen on March 9 of that 12 months, which was the best stage because the monetary disaster.

Bloomberg additionally maintains an index of liquidity in U.S. authorities securities with a maturity better than one 12 months. The index is larger when Treasurys are buying and selling additional away from “honest worth”, which usually occurs when liquidity circumstances deteriorate.

It stood at roughly 2.7 on Wednesday, proper round its highest stage in additional than a decade, if one excludes the spring of 2020.

Thinning liquidity has had the largest impression alongside the quick finish of the Treasury curve — since short-dated Treasurys are sometimes extra prone to Fed interest-rate hikes, in addition to modifications within the outlook for inflation.

Additionally, “off the run” Treasurys, a time period used to explain all however the newest problems with Treasury bonds for every tenor, have been affected greater than their “on the run” counterparts.

Due to this thinning liquidity, merchants and portfolio managers instructed MarketWatch that they have to be extra cautious concerning the sizing and timing of their trades as market circumstances develop more and more risky.

“Liquidity is fairly dangerous proper now,” stated John Luke Tyner, a portfolio supervisor at Aptus Capital Advisors.

“We now have had 4 or 5 days in latest months the place the two-year Treasury has moved greater than 20 [basis points] in a day. It’s definitely eye opening.”

Tyner beforehand labored on the institutional mounted revenue desk at Duncan-Williams Inc. and has been analyzing and buying and selling fixed-income merchandise since shortly after graduating from the College of Memphis.

The significance of being liquid

Treasury debt is taken into account a world reserve asset — identical to the U.S. greenback is taken into account a reserve foreign money. This implies it’s broadly held by international central banks that want entry to {dollars} to assist facilitate worldwide commerce.

To make sure that Treasurys retain this standing, market individuals should be capable of commerce them shortly, simply and cheaply, wrote Fed economist Michael Fleming in a 2001 paper entitled “Measuring Treasury Market Liquidity”.

Fleming, who nonetheless works on the Fed, didn’t reply to a request for remark. However interest-rate strategists at JP Morgan Chase & Co.

JPM,

Credit score Suisse

CS,

and TD Securities instructed MarketWatch that sustaining ample liquidity is simply as essential in the present day — if no more so.

The reserve standing of Treasurys confers myriad advantages to the U.S. authorities, together with the flexibility to finance massive deficits comparatively cheaply.

What could be completed?

When chaos upended international markets within the spring of 2020, the Treasury market wasn’t spared from the fallout.

Because the Group of 30’s Working Group on Treasury Market Liquidity recounted in a report recommending ways for bettering the functioning of the Treasury market, the fallout got here surprisingly near inflicting international credit score markets to grab up.

As brokers pulled liquidity for worry of being saddled with losses, the Treasury market noticed outsize strikes that made seemingly little sense. Yields on Treasury bonds with comparable maturities turned totally unhinged.

Between March 9 and March 18, bid-ask spreads exploded and the variety of commerce “failures” — which happen when a booked commerce fails to settle as a result of one of many two counterparties doesn’t have the cash, or the belongings — soared to roughly 3 times the conventional charge.

The Federal Reserve finally rode to the rescue, however market individuals had been placed on discover, and the Group of 30 determined to discover how a repeat of those market ructions may very well be prevented.

The panel, which was led by former Treasury Secretary and New York Fed President Timothy Geithner, printed its report final 12 months, which included a bunch of suggestions for making the Treasury market extra resilient throughout instances of stress. A Group of 30 consultant was unable to make any of the authors out there for remark when contacted by MarketWatch.

Suggestions included the institution of common clearing of all Treasury trades and repos, establishing regulatory carve-outs to regulatory leverage ratios to permit sellers to warehouse extra bonds on their books, and the institution of standing repo operations on the Federal Reserve.

Whereas a lot of the suggestions from the report have but to be carried out, the Fed did set up standing repo services for home and international sellers in July 2021. And the Securities and Trade Fee is taking steps towards mandating extra centralized clearing.

Nonetheless, in a standing replace launched earlier this 12 months, the working group stated the Fed services didn’t go far sufficient.

On Wednesday, the Securities and Trade Fee is making ready to announce that it could suggest guidelines to assist reform how Treasurys are traded and cleared, together with ensuring extra Treasury trades are centrally cleared, because the Group of 30 beneficial, as MarketWatch reported.

See: SEC set to advance reforms to head off next crisis in $24 trillion market for U.S. government debt

Because the Group of 30 famous, SEC Chairman Gary Gensler has expressed assist for increasing centralized clearing of Treasurys, which might assist enhance liquidity throughout instances of stress by serving to to make sure that all trades choose time with none hiccups.

Nonetheless, if regulators appear complacent in terms of addressing these dangers, it’s in all probability as a result of they anticipate that if one thing does go fallacious, the Fed can merely journey to the rescue, because it has prior to now.

However Financial institution of America’s Axel believes this assumption is misguided.

“It isn’t structurally sound for the U.S. public debt to change into more and more reliant on Fed QE. The Fed is a lender of final resort to the banking system, to not the federal authorities,” Axel wrote.

—Vivien Lou Chen contributed reporting

Source link