[ad_1]

Germany has seized management of three oil refineries run by Russian agency Rosneft in its newest effort to shore up vitality provides.

The nation’s vitality regulator will take management of stakes in oil refineries in Schwedt, Karlsruhe and Vohburg, equal to round 12pc of Germany’s oil processing capability.

The transfer mirrors Berlin’s determination to grab management of Gazprom Germania earlier this 12 months.

Chancellor Olaf Scholz’s Authorities can be weighing up nationalisation of vitality big Uniper, which already requires extra funding after burning by way of a €19bn help bundle it acquired in July. Ministers are additionally eyeing a stake in vitality agency VNG.

The transfer is an escalation within the stand-off between Europe and the Kremlin, and highlights efforts by international locations to safe their vitality provides.

Shell, which holds a 37.5pc stake within the PCK Schwedt oil refinery, stated it was unaffected by Germany’s determination.

Table of Contents

02:54 PM

EDF contractors loosen up radiation publicity limits to hurry up repairs

Some contractors serving to EDF to examine and restore its corrosion-hit nuclear reactors are planning to loosen up their guidelines on radiation publicity limits in order that their staff can spend extra time on the job.

The French vitality big, which is speeding to get its fleet of nuclear energy stations prepared for the winter, stated the brand new threshold was in step with its personal requirements and remained nicely under French authorized limits.

The corporate informed Reuters: “We have now been knowledgeable by a few of our companions that they count on to extend the radiation publicity restrict for a few of their employees.

“The actions at present underway at our vegetation result in a better variety of hours labored within the nuclear a part of our websites. This extra exercise had not been foreseen by our companions once they set their radiation limits.”

In keeping with the report, a minimum of one EDF contractor –French firm Monteiro – had already elevated the utmost publicity its staff may very well be topic to, including this posed no well being threat.

02:36 PM

Wall Road sinks as FedEx sparks slowdown fears

Wall Road’s fundamental indices have opened sharply decrease after a revenue warning from FedEx spooked buyers already fearful about aggressive fee hikes from the Federal Reserve tipping the financial system right into a recession.

FedEx plunged 23pc on the opening bell after the corporate stated a worldwide demand slowdown accelerated on the finish of August and predicted that it could worsen within the November quarter.

The benchmark S&P 500, Dow Jones and Nasdaq all slumped 1.3pc.

01:50 PM

Nationwide Specific shares rise on takeover rumours

Shares in Nationwide Specific have jumped 7pc amid rumours of a attainable takeover strategy.

The coach operator was talked about in a so-called ‘raw’ Betaville report, which stated it had attracted curiosity from a monetary purchaser resembling a personal fairness agency or infrastructure fund.

‘Raw’ stories on the Betaville weblog are inclined to check with market gossip.

01:23 PM

Scholz: Rosneft swoop brings independence

Chancellor Olaf Scholz has stated the transfer to take over Rosneft’s oil refineries ffrees Germany from dependence on Moscow.

He informed reporters: “We’re making ourselves impartial of Russia, and any choices which might be taken there.”

The German authorities has earmarked about €1bn (£880m) for Schwedt, together with help for the area. It’s a broad bundle to be disbursed over a number of years.

Mr Scholz added that stated the nation was ready in case Russia retaliates to the transfer by chopping oil deliveries to Germany.

One refiner has already warned it’s making ready for such a response from Moscow.

12:22 PM

EU’s €140bn vitality plan is not sufficient, warns business

Business teams have warned the EU’s bundle of emergency measures to convey down vitality prices doesn’t go far sufficient as they urged Brussels to do extra to tame fuel costs.

The European Fee this week proposed cuts in electrical energy use and making use of windfall taxes on vitality corporations, which it stated would elevate €140bn (£122bn) for governments to rechannel into serving to companies and residents with hovering vitality payments.

Business group European Aluminium stated: “These measures are usually not sufficient and won’t save the energy-intensive aluminium business from additional manufacturing cuts, job losses, and presumably a whole breakdown.”

The vitality intensive sector urged EU vitality ministers to take “further measures” once they meet later this month to barter the plans – particularly, to sort out excessive fuel costs, that are the principle driver of rocketing electrical energy prices.

Jacob Hansen, director common of Fertilizers Europe, stated: “We want a bodily provide of competitively priced fuel for the European fertiliser producers to restart manufacturing.”

12:11 PM

US futures slide as greenback retains climbing

US futures prolonged their declines this morning because the greenback stored climbing on expectations of additional Federal Reserve rate of interest rises.

Futures monitoring the S&P 500 fell 0.8pc, whereas the Dow Jones was down 0.7pc. The tech-heavy Nasdaq slumped 1.1pc.

12:08 PM

Russia makes smallest rate of interest lower this 12 months

Russia’s central financial institution has introduced its smallest rate of interest lower because it began easing financial coverage within the wake of the Ukraine invasion amid contemporary inflation dangers.

Coverage makers led by governor Elvira Nabiullina lowered charges to 7.5pc from 8pc. In an announcement with the choice, the central financial institution left it unclear what path it would take with future charges.

Russia’s urgency to revive the financial system following the shock of western sanctions is giving solution to issues that inflation may very well be tougher to comprise within the months forward.

11:56 AM

LNER suspends ticket gross sales because of strikes

David Horne, boss of LNER, says the operator has suspended ticket gross sales for October 1 and 5 because of the newest strike motion.

LNER serves the East Coast Most important Line, with trains from London serving stations together with Leeds, York, Newcastle and Edinburgh.

11:40 AM

Prepare drivers plot contemporary strike motion

Prepare drivers at 12 rail corporations are planning two extra days of strike motion in a long-running dispute over pay.

The economic motion will happen on October 1 and October 5, PA stories.

11:07 AM

Value stability is precedence earlier than progress, says ECB’s Lagarde

The ECB’s actions could weigh on progress however value stability is the principle precedence, President Christine Lagarde has stated.

Talking to highschool college students on the French central financial institution, Ms Lagarde stated that in setting its financial coverage the ECB needed to have in mind all parts affecting inflation, in addition to the dangers weighing on progress.

She stated: “Will that weigh on progress? It is attainable, however it’s a threat we’ve to take… as a result of value stability is a basic and principal dimension.”

10:58 AM

London Metallic Trade faces lawsuit from hedge funds

The London Metallic Trade faces a possible lawsuit by a bunch of hedge funds over its dealing with of the nickel disaster earlier this 12 months.

AQR Capital Administration, DRW Commodities, Circulate Merchants, Capstone Funding Advisors and Winton Capital Administration filed a industrial courtroom declare in London towards the LME, in response to courtroom data.

To this point the declare relates solely to pre-action disclosure.

The transfer ramps up the stress on the LME, which has been broadly criticised for its dealing with of the nickel disaster, when it suspended the market and controversially cancelled $3.9bn (£3.4bn) of merchants following an enormous brief squeeze.

It’s also going through lawsuits from Jane Road and Paul Singer’s Elliott Funding Administration, collectively claiming almost $500m in damages arising from its dealing with of the incident.

10:36 AM

Chinese language financial system exhibits indicators of restoration

China’s financial system confirmed indicators of restoration in August as Beijing rolled out stimulus measures.

Industrial manufacturing, retail gross sales and glued asset funding all grew sooner than anticipated final month. The city jobless fee fell to five.3pc, whereas youth unemployment eased again from a document excessive.

Regardless of indicators of enchancment, China’s restoration stays fragile amid extra outbreaks of Covid throughout the nation and continued stringent lockdowns.

A property market hunch additionally exhibits no signal of easing, with information exhibiting home costs have now declined each month within the final 12 months.

10:22 AM

John Lewis hopes for Christmas advert miracle

As the price of dwelling disaster sends the excessive avenue plunging in the direction of a harrowing winter, spending hundreds of thousands of kilos on a Christmas advert may seem to be an extravagance, write Matt Oliver and Laura Onita.

However for John Lewis, this 12 months’s annual TV spot is greater than only a means of exhibiting off its standing.

After plunging to a near-£100m loss, the corporate wants a festive miracle to stave off catastrophe – a lot in order that one govt warned chopping the advert funds can be a “horrible concept”.

“Nobody may have predicted the dimensions of the cost-of-living disaster that has materialised, with vitality costs and inflation rising forward of anybody’s expectations,” the mutual’s chairman Dame Sharon White stated on Thursday.

“As a enterprise, we’ve confronted unprecedented price inflation throughout grocery and common merchandise.

“A profitable Christmas is vital for the enterprise, given the primary half.”

10:06 AM

Teesside Airport staff to vote on strike motion

Employees at Teesside Airport have begun voting in a poll on strike motion as we speak, elevating the specter of extra disruption for passengers.

Workers together with air visitors controllers and fireplace fighters on the Darlington journey hub turned down a pay provide from bosses, in response to the GMB union.

The poll closes on September 28, with any industrial motion more likely to happen subsequent month.

09:54 AM

Bare Wines brings again founder as adviser

Bare Wines has referred to as again founder and former boss Rowan Gormley has an adviser amid issues concerning the firm’s funds.

The place is unpaid and is predicted to final for a interval of two to 3 months. Mr Gormley holds a 2.9pc stake in Bare Wines.

It comes a day after the web wine service provider misplaced a 3rd of its worth following the abrupt departure of a non-executive director after simply three weeks.

Bare has stated it is reviewing its funds for the following 18 months and has introduced talks with lenders over its credit score facility.

Learn extra on this story: Fears ‘something awry’ at Naked Wines as director leaves after just three weeks

09:37 AM

The misheard phrase that directed public to mourn late Queen in Yosemite

Snaking by way of London, the queue to see Queen Elizabeth II mendacity in state ran for 4.4 miles on Thursday, stretching from Westminster to Tower Bridge and past.

Nonetheless, these seeking to be part of the again of the road might need been forgiven for considering it started 5,300 miles away in Fresno, California.

The rationale for the confusion was a alternative by the Division for Digital, Tradition, Media and Sport to make use of a British app to assist mourners discover the tip of the queue.

The app, referred to as What3words, makes use of a mix of three phrases to pinpoint a grid deal with anyplace on the earth. Its map is damaged up into 57 trillion three metre squares, every with a singular identifier made up of three phrases.

Matthew Area and Gareth Corfield report. Read their full story here.

09:16 AM

Liz Truss to foyer SoftBank to checklist Arm in London

Prime Minister Liz Truss and Chancellor Kwasi Kwarteng are stated to be making ready a last-ditch effort to steer SoftBank to checklist British tech agency Arm in London.

The Authorities will push for high-level talks with SoftBank bosses as soon as the official mourning interval ends subsequent week, the Monetary Instances stories.

SoftBank had beforehand indicated it needed to checklist Arm in New York, however there have been talks over a possible twin itemizing.

Such a deal can be a major present of confidence within the London Inventory Trade at a time when it is struggling to draw preliminary public choices.

08:47 AM

Pound drops to $1.1400 for first time since 1985

Sterling has prolonged its losses this morning following dire retail gross sales figures for August.

The pound dropped nearly 1pc to fall under $1.1400 for the primary time since 1985, when Ronald Reagan’s tax cuts sparked an enormous rally for the greenback.

08:44 AM

Royal Mail shares hunch after FedEx warning

Royal Mail is the largest FTSE faller this morning because it felt the influence of a wire revenue warning from US rival FedEx.

The bundle supply big pointed to weak point in Asia and challenges in Europe because it withdrew its earlier forecasts and reported quarterly outcomes that fell nicely in need of expectations.

It additionally warned buying and selling may deteriorate within the present quarter, including it could take speedy steps to chop prices.

The glum replace sparked jitters throughout the sector. Royal Mail slumped as a lot as 11pc.

08:37 AM

FTSE risers and fallers

The FTSE 100 seems to be set to finish the week in adverse territory after retail gross sales fell greater than anticipated in August.

The blue-chip index was down 0.4pc, with merchants responding to the most recent gloomy outlook for the financial system.

Retailers had been within the pink on contemporary indicators of bother for the excessive avenue after Asos, Primark proprietor Related British Meals and Ocado all warned on income this month.

InterContinental Resorts Group was the largest faller, sliding 4pc after analysts at Citi downgraded the inventory amid warnings of “muted” demand.

AstraZeneca bucked the development, rising 1.6pc after its Evusheld Covid drug acquired the inexperienced mild from EU regulators.

The domestically-focused FTSE 250 slumped 0.7pc. Royal Mail dropped 11pc after US rival FedEx issued a revenue warning.

08:28 AM

Vitality corporations hauled in for value cap conferences

The Authorities has referred to as in a few of the nation’s largest vitality corporations for a gathering subsequent week to debate a measure that may cap wholesale electrical energy costs.

Enterprise Secretary Jacob Rees-Mogg is pushing for a deal that may see low-carbon vitality producers promote energy at fastened costs on long-term contracts.

Ministers reportedly need to get the measure arrange as quickly as attainable, to make sure costs are fastened for winter.

08:20 AM

Germany takes management of Putin’s oil refineries

Germany has taken one other daring step to shore up its vitality provides by seizing management of three oil refineries run by Russian agency Rosneft.

The nation’s vitality regulator will take management of stakes in oil refineries in Schwedt, Karlsruhe and Vohburg, equal to round 12pc of Germany’s oil processing capability.

The transfer mirrors Berlin’s determination to grab management of Gazprom Germania earlier this 12 months.

Chancellor Olaf Scholz’s Authorities can be weighing up nationalisation of vitality big Uniper, which already requires extra funding after burning by way of a €19bn help bundle it acquired in July.

Ministers are additionally eyeing a stake in vitality agency VNG.

The transfer is an escalation within the stand-off between Europe and the Kremlin, and highlights efforts by international locations to safe their vitality provides.

08:15 AM

1,000 flights cancelled in French air visitors management strike

Greater than 1,000 flights have been cancelled forward of a walkout by French air visitors controllers as we speak.

France’s aviation authority DGAC has warned of “extreme” disruption and requested airways to halve their flight schedules.

The strikes, that are because of run from 6am as we speak till 6am tomorrow, may additionally disrupt flights passing over French airspace.

It is the most recent blow for passengers, who’ve suffered from widespread delays and cancellations all through the summer season.

08:01 AM

FTSE 100 opens decrease

The FTSE 100 has misplaced floor on the open after retail gross sales figures added to bleak indicators concerning the state of the financial system.

The blue-chip index fell 0.4pc to 7,250 factors.

07:56 AM

Pound sinks additional as retail gross sales hunch

Sterling has prolonged its losses after retail gross sales dropped greater than anticipating, highlighting the grim financial outlook forward of the Financial institution of England assembly subsequent week.

The pound fell 0.6pc towards the greenback to $1.1414, testing its current 37-year lows.

The foreign money has dropped 15pc towards the greenback to date this 12 months and is close to its lowest since 1985. By the way, as we speak is the anniversary of Black Wednesday, when the UK crashed out of the Trade Price Mechanism.

07:48 AM

Brits spending extra to purchase much less

Shoppers are spending extra to purchase much less, writes my colleague Eir Nolsoe.

The price-of-living disaster meant Britons spent 5.4pc extra on retail in August than a 12 months earlier, however purchased 5.4pc much less by way of amount.

The very best enhance in spending was on gasoline, with households spending 21pc greater than in August final 12 months whereas shopping for 9pc much less. Spending on groceries additionally rose by 6pc, regardless of volumes being 4.5pc decrease.

On a month-to-month foundation, gross sales volumes fell by 1.6pc in August, whereas worth fell 1.7pc. Shoppers have been shopping for fewer retail items since final summer season when Covid restrictions on hospitality ended, with many swapping cooking at house for consuming out extra typically. Meals retailer gross sales are 1.4pc under their pre-pandemic ranges.

On-line purchasing stays far more outstanding than earlier than Covid, nevertheless. Households purchased round 1 / 4 of retail on-line in August, in contrast with a fifth in February 2020.

07:46 AM

Response: Financial institution of England must elevate charges additional

Olivia Cross, assistant economist at Capital Economics, predicts that the Financial institution of England must elevate rates of interest even additional.

The 1.6pc drop in retail gross sales volumes in August helps our view that the financial system is already in recession.

Retail gross sales will in all probability proceed to battle as the price of dwelling disaster hits tougher within the coming months. However nonetheless the Financial institution of England will nonetheless have to boost rates of interest aggressively.

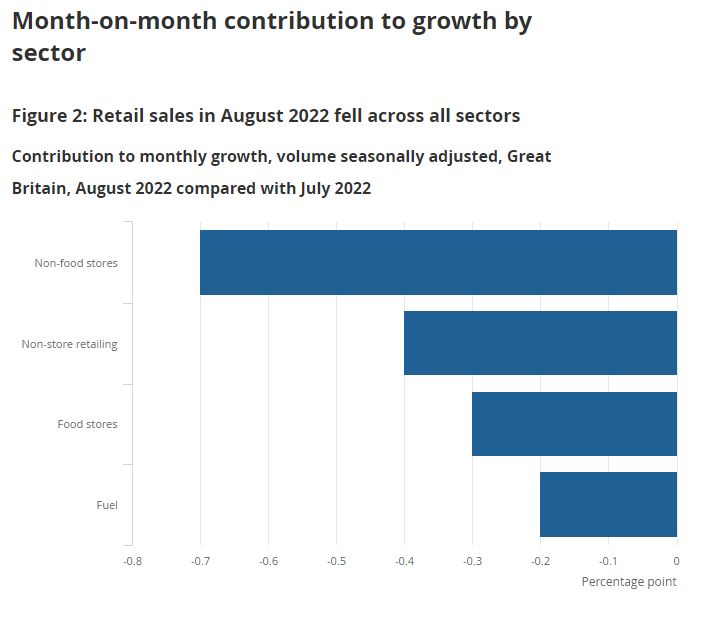

The autumn in retail gross sales in August greater than reverses the upwardly revised 0.4pc rise in July. Gross sales volumes fell in each main class and the ONS reported that prime costs had been prompting households to reign of their spending.

And this sits comfortably with the autumn in client confidence to its lowest degree on document in August. For instance, gasoline gross sales fell 1.7pc regardless of a pointy 6.2pc decline in gasoline costs in August.

With CPI inflation but to peak, it would proceed to squeeze actual incomes and weigh on client spending within the coming months. That stated, the possibly large fiscal growth from the federal government’s Vitality Value Assure will provide substantial help to households and client spending additional forward.

We now count on that the recession shall be smaller and shorter than we did earlier than, which is one motive why we count on that the Financial institution of England might want to elevate rates of interest additional than we had been anticipating to a peak of 4pc.

07:39 AM

Response: Retailers face winter of discontent

Lynda Petherick, retail lead at Accenture, says the most recent gross sales figures shall be worrying for retailers.

With a tough winter to come back, it would come as a fear to retailers that customers have already reigned of their spending regardless of the recent summer season.

The sombre ambiance within the UK this week and information of sluggish financial progress shall be including to the sense of concern amongst retailers because the climate will get colder.

Rising prices stay entrance of thoughts, and types shall be doing all they’ll to minimise outgoings and defend their margins for the months forward.

To keep away from a winter of discontent and past, expertise shall be essential to serving to retailers discover a cautious steadiness between product, value and expertise to maintain clients coming again for extra.

07:36 AM

Gross sales hunch throughout all sectors

There have been declines throughout the board in August, with retail gross sales tumbling in all classes.

It is the primary time that is occurred since July 2021, when all Covid restrictions on hospitality had been lifted.

07:31 AM

Retail gross sales hunch

Good morning.

There’s extra dire financial information this morning, as retail gross sales dropped on the quickest tempo in eight months in August.

The amount of products bought in-store and on-line fell 1.6pc from July, in response to the ONS. That fall was 3 times larger than forecast.

Gross sales declined throughout all classes – the primary time this has occurred since July 2021, when the reopening of hospitality venues following Covid restrictions drove punters to eating places and bars.

The figures are the most recent signal of how hovering inflation and an enormous squeeze on dwelling requirements is hitting customers. It additionally highlights the problem going through retailers heading into the important thing Christmas buying and selling interval.

5 issues to start out your day

1) Why Waitrose’s claim to have held down prices doesn’t add up Costs for on a regular basis staples have gone up by greater than 30pc in some circumstances

2) British Airways cancels one in seven flights during Queen Elizabeth II’s funeral 100 flights axed to maintain skies clear as Heathrow restricts arrivals and departures on Monday

3) We don’t know how much Liz Truss’s energy bills freeze will cost, admits Treasury PM’s fiscal assertion, due subsequent week, is about to reverse tax rises however costings for insurance policies to ease payments will solely cowl first few months

4) Louis Vuitton owner tells staff to take the stairs and turns down store thermostats Even French luxurious retailer is chopping again within the face of skyrocketing vitality prices

5) Billionaire founder of Patagonia gives the outdoors brand away Firm will cut up between two organisations and pay dividends to ‘defend the planet’

What occurred in a single day

Asian markets had been weaker this morning as buyers braced for a US fee hike subsequent week amid rising issues of a worldwide recession following warnings from the World Financial institution and the Worldwide Financial Fund.

MSCI’s broadest index of Asia-Pacific shares outdoors Japan was down 0.3pc on Friday, after US shares ended the earlier session with gentle losses. The index is down 4.1pc to date this month.

Australian shares had been down 0.9pc on Friday, whereas Japan’s Nikkei inventory index slipped 1.2pc.

Hong Kong’s Dangle Seng Index was down 1.1pc whereas China’s CSI300 Index was 0.9pc decrease.

Arising as we speak

-

Economics: Inflation (EU), retail gross sales (UK, US, China), industrial manufacturing (China), Michigan client sentiment index (US)

-

Company: No main scheduled updates

Source link