[ad_1]

The US central financial institution will carry its benchmark coverage charge above 4 per cent and maintain it there past 2023 in its bid to stamp out excessive inflation, in line with the vast majority of leading academic economists polled by the Monetary Instances.

The most recent survey, performed in partnership with the Initiative on International Markets on the College of Chicago’s Sales space Faculty of Enterprise, suggests the Federal Reserve is a great distance from ending its marketing campaign to tighten financial coverage. It has already raised rates of interest this yr on the most aggressive tempo since 1981.

Hovering close to zero as just lately as March, the federal funds charge now sits between 2.25 per cent and a couple of.50 per cent. The Federal Open Market Committee gathers once more on Tuesday for a two-day coverage assembly, at which officers are expected to implement a 3rd consecutive 0.75 proportion level charge rise. That transfer will hoist the speed to a brand new goal vary of three per cent to three.25 per cent.

Practically 70 per cent of the 44 economists surveyed between September 13 and 15 consider the fed funds charge of this tightening cycle will peak between 4 per cent and 5 per cent, with 20 per cent of the view that it might want to go that degree.

“The FOMC has nonetheless not come to phrases with how excessive they should increase charges,” stated Eric Swanson, a professor on the College of California, Irvine, who foresees the fed funds charge ultimately topping out between 5 and 6 per cent. “If the Fed desires to sluggish the financial system now, they should increase the funds charge above [core] inflation.”

Whereas the Fed sometimes targets a 2 per cent charge for the “core” private consumption expenditures (PCE) worth index — which strips out risky objects like meals and power — it carefully screens the buyer worth index as effectively. Inflation unexpectedly accelerated in August, with the core measure up 0.6 per cent for the month, or 6.3 per cent from the earlier yr.

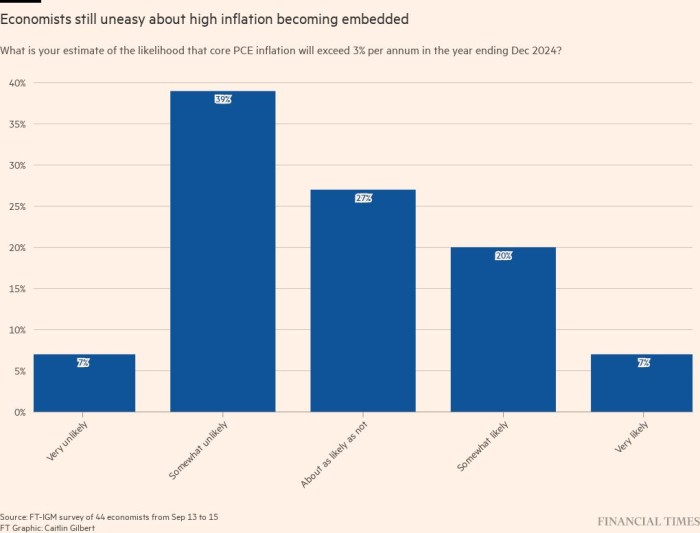

Many of the respondents undertaking core PCE will drop from its most up-to-date July degree of 4.6 per cent to three.5 per cent by the top of 2023. However almost a 3rd count on it to nonetheless exceed 3 per cent 12 months later. One other 27 per cent stated “it was about as possible as not” to stay above that threshold at the moment — indicating nice unease about excessive inflation changing into extra deeply embedded within the financial system.

“I worry that we’ve gotten to a degree the place the Fed faces the chance of its credibility severely eroding, and so it wants to begin being very cognisant of that,” stated Jón Steinsson on the College of California, Berkeley.

“We’ve all been hoping that inflation would begin to come down, and we’ve all been disillusioned over and over and over.” Greater than a 3rd of the surveyed economists warning the Fed will fail to adequately management inflation if it doesn’t increase rates of interest above 4 per cent by the top of this yr.

Past lifting charges to a degree that constrains financial exercise, the majority of the respondents reckon the Fed will preserve them there for a sustained interval.

Easing worth pressures, monetary market instability and a deteriorating labour market are the almost certainly causes the Fed would pause its tightening marketing campaign, however no reduce to the fed funds charge is anticipated till 2024 on the earliest, in line with 68 per cent of these polled. Of that, 1 / 4 don’t anticipate the Fed decreasing its benchmark coverage charge till the second half of 2024 or later.

Few consider, nevertheless, the Fed will increase its efforts by shrinking its steadiness sheet of almost $9tn through outright gross sales of its company mortgage-backed securities holdings.

Such aggressive motion to chill down the financial system and root out inflation would have prices, some extent Jay Powell, the chair, has made in recent appearances.

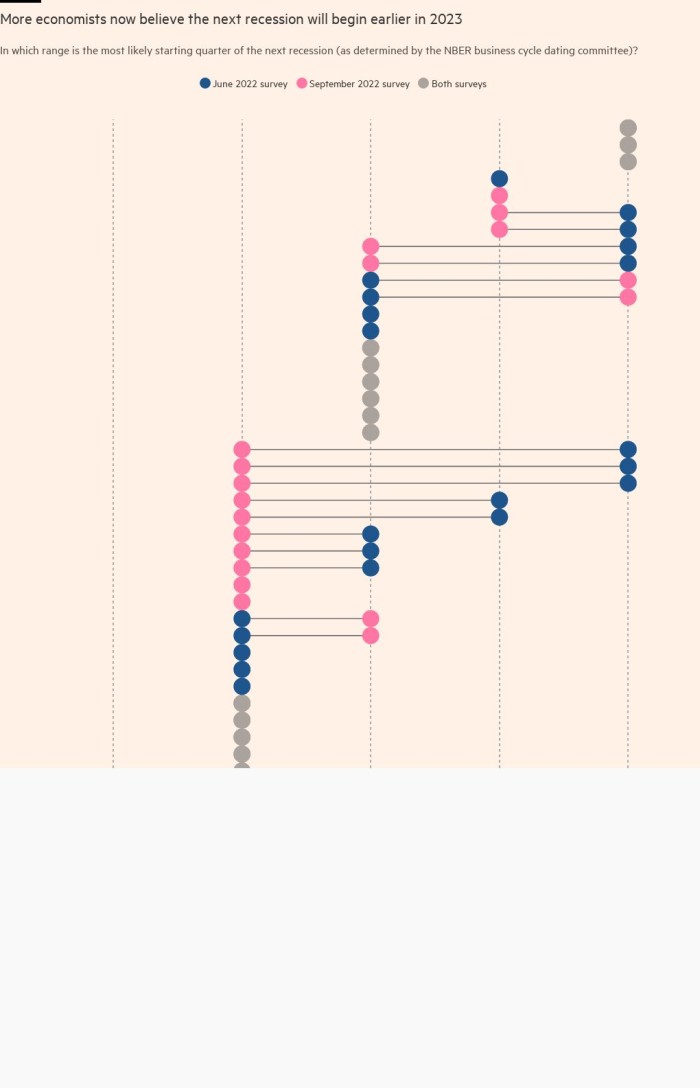

Practically 70 per cent of the respondents count on the Nationwide Bureau of Financial Analysis — the official arbiter of when US recessions start and finish — to declare one in 2023, with the majority holding the view it should happen within the first or second quarter. That compares to the roughly 50 per cent who see Europe tipping right into a recession by the fourth quarter of this yr or earlier.

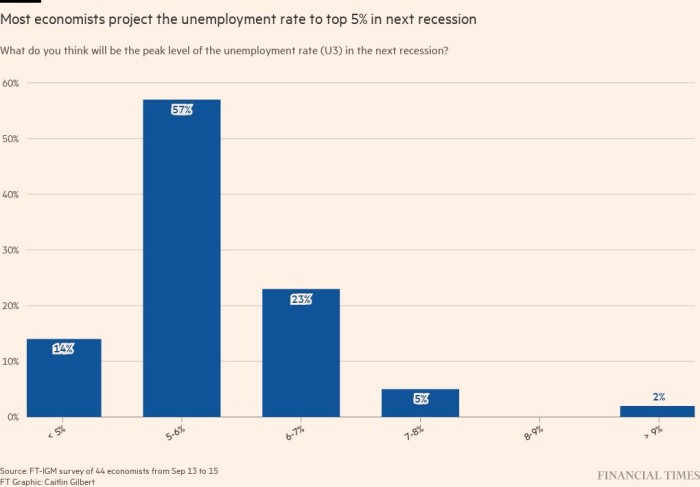

A US recession is more likely to stretch throughout two or three quarters, a lot of the economists reckon, with greater than 20 per cent anticipating it to final 4 quarters or extra. At its peak, the unemployment charge might settle between 5 per cent and 6 per cent, in line with 57 per cent of the respondents, effectively in extra of its current 3.7 per cent degree. A 3rd see it eclipsing 6 per cent.

“That is going to fall on the employees who can least afford it when we’ve rises in unemployment because of these charge will increase in some unspecified time in the future,” warned Julie Smith at Lafayette Faculty. “Even when it’s small quantities — a proportion level or two of improve in unemployment — that’s actual ache on actual households that aren’t ready to climate these kinds of shocks.”

An easing of supply-related constraints associated to the conflict in Ukraine and Covid-19 lockdowns in China might assist minimise simply how a lot the Fed must damp demand, that means a much less extreme financial contraction ultimately,” stated Şebnem Kalemli-Özcan on the College of Maryland. However she warned the outlook is very unsure.

“Clearly that is one shock after one other, so I’m not assured that is going to occur straight away,” stated Kalemli-Özcan. “I can’t let you know a timeframe, however it’s entering into the appropriate path.”

Source link