[ad_1]

Progress traders are, by nature, optimistic. They imagine we live via a once-in-a-generation wave of technology-led change and {that a} small group of outlier firms could make exponential features by shaping the long run. The position of the profitable investor is to establish these companies.

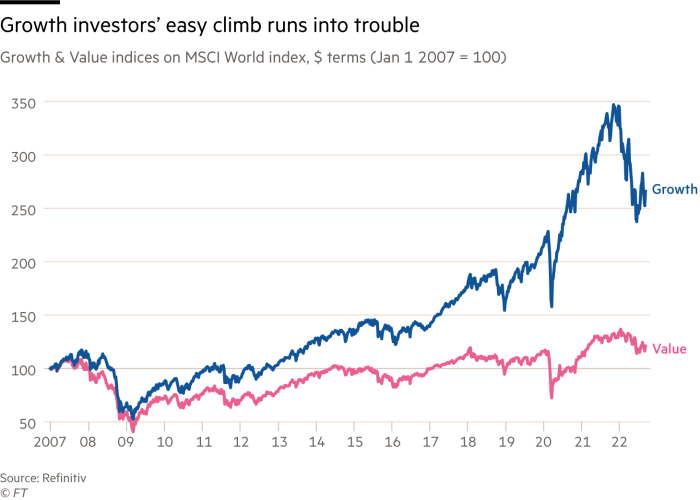

It’s an method that in some circumstances has delivered spectacular returns over the previous decade, as low-cost cash flooded economies and the costs of a string of tech firms soared.

However over the previous yr, the identical funding philosophy has run into the buzzsaw of rising rates of interest, inflation, warfare and the prospect of a looming recession. Many of those as soon as high-flying names have been left nursing heavy losses, as tech shares have been bought off and the easing of lockdowns led so-called Covid-19 winners resembling Zoom and Peloton to fall again to their pre-pandemic valuations. Buyers have purchased staid defensive names which have largely been ignored by Wall Avenue for years.

Within the US, T Rowe Worth’s International Know-how Fairness Fund is down 45 per cent within the yr so far, the flagship hedge fund run by Chase Coleman’s Tiger Administration misplaced 50 per cent via to the top of July, and Cathie Wooden’s flagship exchange-traded fund Ark Innovation has dropped about 55 per cent this yr so far. Ark Funding Administration has misplaced nearly half of its belongings below administration since December.

Amongst UK-based managers, Baillie Gifford’s FTSE 100-listed Scottish Mortgage Funding Belief is down 40 per cent this yr to the top of August, whereas the Polar Capital Know-how Belief has dropped 22 per cent via July. In Japan, plunging know-how valuations and a weak yen drove Masayoshi Son’s conglomerate SoftBank right into a file ¥3.1tn ($23bn) quarterly internet loss within the second quarter.

Confronted with such a humbling reversal, few distinguished development traders have deserted their method — and a few imagine the setbacks characterize a cautious shopping for alternative.

“Some nice development companies seem like on sale proper now,” says Kirsty Gibson, an funding supervisor in US equities on the Edinburgh-based Baillie Gifford. “That makes now a very thrilling time to be a long-term development investor. It doesn’t imply that it’s a snug time, but it surely’s an thrilling time.”

Ark’s losses don’t seem to have dimmed its founder’s relentless confidence. “Innovation solves issues, and the world is going through many extra issues at the moment than two years in the past,” Wooden tweeted on September 8. “Innovation is vital to actual development!”

However behind the outward bullishness about technological transformation, many development traders have launched important adjustments to their methods, putting a a lot better deal with short-term revenue potential and money technology, and trying to find new methods to help early-stage tech firms via a downturn.

“We’re not going again to the best way issues have been,” says David Older, head of equities on the €33.2bn asset supervisor Carmignac. “No matter how excessive you suppose rates of interest will go, this modification from mainly free cash to value of capital goes to have some ongoing adverse results for development firms.”

The place is the money?

Distinguished development traders say the macroeconomic atmosphere has made them short-term cautious, however they nonetheless have religion that the technological revolution is just starting.

Some funds make use of a so-called “crossover” technique of backing personal firms in addition to listed ones. A number of development traders emphasise their multiyear technique to backing firms, which helps them trip out short-term market volatility. Tech shares are seen as particularly prone to rises in rates of interest that diminish these potential future returns.

However somewhat than attempting to second-guess the place rates of interest would possibly go, they are saying they’re doubling down on attempting to know whether or not the aggressive panorama of their portfolio firms has altered. And so they largely reckon the change within the macro panorama has not broken the long-term potential of a lot of them.

Baltimore-based T Rowe Worth’s method is to think about the place a tech firm would possibly get to in three or 5 years’ time, and appears for these that may develop between 30 and 40 per cent a yr. 5 of the highest 10 holdings in its international know-how fairness fund are within the software program sector: Atlassian, MongoDB, HubSpot, ServiceNow and Snowflake Computing.

Julian Cook dinner, a US portfolio specialist on the $1.39tn US asset supervisor, stated that whereas rising rates of interest hit tech firm valuations, the extra necessary query is “what does the basic efficiency of that enterprise appear like when it comes to earnings development, income development and free money circulate development” over a five-year interval and inside a high-interest charge atmosphere.

However another traders are giving brief shrift to far-off guarantees of profitability. “We lowered the length of the investments in our portfolio,” says Ben Rogoff, co-head of the worldwide know-how workforce on the £19bn asset supervisor Polar Capital in London. Half of his know-how belief is invested in software program and semiconductor names, amongst them Nvidia, TSMC and ASML Holding.

“You might nicely have the know-how that’s going to deal with a really giant market, you could nicely change the world,” Rogoff says. “But it surely’s actually laborious to have conviction about that proper now.”

Buyers are putting better scrutiny on an organization’s path to profitability, agrees Carmignac’s Older, who says timelines for returns have plummeted from 10 years to 2. “It’s clear the market simply isn’t going to finance open-ended development tales anymore until they’ll actually show out the economics of the enterprise and generate money circulate rapidly,” he provides.

Potential development firms must survive the current pressures — amongst them supply-chain disruption, inflation and more durable fundraising circumstances — to make good on their long-term potential. Simply as company executives are revisiting their enterprise fashions, traders are attempting to determine how their portfolio firms would possibly cope in a downturn. In favour are cash-generative teams with market share, pricing energy and fewer publicity to a decline in client spending — particularly these they imagine are extra than simply pandemic winners.

“A deal with resilience and adaptableness of these companies is much more necessary than it’s ever been,” says Baillie Gifford’s Gibson. The fund supervisor’s general belongings below administration dropped to £231bn on June 30, a lower of greater than a 3rd from 12 months earlier.

“Some firms will emerge stronger,” she provides. “We welcome the companies who can minimize fats — however we’re cautious of companies chopping muscle as a result of we don’t need them to impair their long-term alternative.”

The macro-driven sell-off in tech shares has been indiscriminate, with the market not distinguishing between development shares with robust money circulate technology and people with out. That is throwing up alternatives for traders to each selectively improve current positions the place a sell-off within the inventory worth has overshot a lower in earnings, and so as to add new holdings.

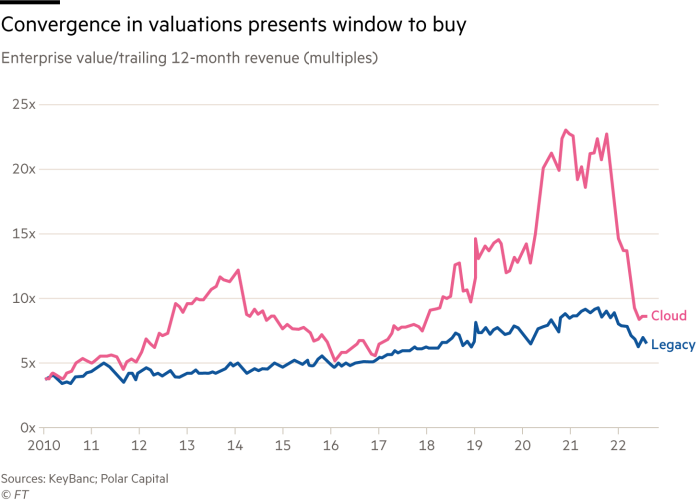

Polar’s Rogoff says that there was a convergence in valuations between subsequent technology “software program as a service” shares and legacy web firms, which offers a compelling probability for traders to snap up the previous due to their increased development potential.

A number of traders say that they’re bullish about defensive themes inside tech resembling high-quality semiconductor firms like ASML and Synopsys in addition to cloud computing and enterprise software program such because the database program MongoDB. When confronted with inflation, enterprise software program helps firms scale back prices, enhance productiveness and is usually a subscription mannequin which isn’t cyclical.

Lengthy-term structural traits are persevering with, they argue. “The digitalisation of the economic system and migration of labor processes to the cloud are nonetheless occurring,” says T Rowe’s Cook dinner, including that consumer-facing firms who over-earned throughout Covid have been due a “get actual” second.

Progress bulls additionally say that the technological revolution has barely scratched the floor of big swaths of the worldwide economic system, resembling vitality, gene sequencing and artificial biology.

Baillie Gifford’s US workforce has added to its positions in software program names like HashiCorp and Snowflake, in addition to the education-tech firm Duolingo and meals supply platform DoorDash.

‘The issue is the following yr’

But whereas some see the sell-off in development shares as a horny entry level, not everyone seems to be leaping in headfirst.

“It feels to me like there’s positively worth within the public markets over the following 5 years,” says Philippe Laffont, founding father of the New York-based Coatue Administration and one of the so-called Tiger cubs who skilled at Julian Robertson’s Tiger Administration. “The issue is the following yr.”

Laffont is among the many extra bearish voices among the many neighborhood of development traders. Following the market sell-off earlier this yr, Coatue liquidated positions in its hedge fund. In Might, the hedge fund was sitting on greater than 80 per cent money, in response to traders. This choice, and robust efficiency on the brief aspect, helped its flagship hedge fund include losses to down 17.6 per cent via August.

“The world is getting worse, not higher,” says Laffont, rattling off the record of macroeconomic headwinds he worries about: no finish in sight to the warfare in Ukraine; international vitality and meals crises; rising rates of interest to fight hovering inflation; geopolitical tensions between the US and China, and between China and Taiwan.

Baillie Gifford, one of many largest bulls on China lately, has warned of the mounting dangers to international traders in China, each from future US sanctions and the way the Chinese language administration might attempt to restrict the upside in inventory costs for the breakthrough winners.

Different traders say that whereas some particular person tech names appear like good worth, the market will not be as low-cost because it was in 2003, on the finish of the dot-com bust, and 2009 — and warning that attempting to name the underside is a idiot’s errand.

“I believe there are some actually good alternatives rising however when the ahead valuation of a software program inventory has gone from 25-times gross sales to 10-times gross sales, it’s actually troublesome to know if it’s going to cease at 10,” says Polar’s Rogoff. “If tomorrow warfare resulted in Ukraine, let’s imagine with some certainty that this may be the low, however the vary of outcomes stays extensive so we should always tread rigorously.”

One other dynamic giving would-be bulls pause is that whereas public markets have repriced, many traders have but to publish writedowns on their personal holdings. Baillie Gifford’s Scottish Mortgage gave one indication of what this would possibly appear like: the funding belief stated that through the first half of this yr, it carried out 351 revaluations on the personal firms in its portfolio and marked them down by 27.6 per cent on common.

A market pullback has made personal investments comparatively much less engaging than their public counterparts, and more and more choosy enterprise capitalists are sitting on a file money pile. Chase Coleman’s Tiger International has not made a brand new personal funding in additional than a yr, has dramatically minimize its general publicity to shares and elevated the prominence of its brief e-book in its hedge fund, in response to individuals near the fund. SoftBank’s Son — who personified the expansive type of the tech increase — is also in “defensive mode”, piling up and retaining money.

“Lots of our most fun alternatives are coming from the general public markets as a result of the sell-off has been so dramatic,” says Baillie Gifford’s Gibson. “The bar for inclusion for personal firms for us is increased than it has ever been as a result of the competitors for capital is bigger and also you’re competing towards a extra depressed public a part of the portfolio.”

A frothy marketplace for tech valuations adopted by a pointy sell-off inevitably prompts some market watchers to search for parallels with the dotcom increase and bust of the late Nineties. However traders stated that whereas each timeframes included intervals of irrational exuberance, the similarities have been outweighed by variations.

“The know-how sector itself is vastly extra mature than it was within the late Nineties, the earnings numbers really feel way more strong than they did on the time and there’s a profoundly completely different valuation place to begin,” says Polar’s Rogoff.

‘A brand new method of doing issues’

In July Klarna, a Swedish firm that pioneered the “purchase now, pay later” enterprise mannequin, had its price tag slashed from $46bn to $6.7bn when it introduced an $800mn fundraising spherical, sending ripples via the investor and start-up neighborhood. The drop in valuation at what was then Europe’s Most worthy personal tech firm was one of many starkest indicators of what many see as the difficulty nonetheless to return in personal markets.

With this in thoughts, some traders are attempting different approaches. Coatue is elevating $2bn for a structured fairness technique, the Tactical Options fund, which may lend cash to cash-strapped personal firms who don’t need to elevate dilutive fairness financing at depressed valuations. Structured fairness has debt and fairness traits, and customarily contains convertible debt, senior fairness or debt plus warrants.

“I felt that we would have liked to make use of the disaster to consider a brand new method of doing issues,” says Laffont. “Structured transactions are a method for us to play offence and to supply an answer to founders throughout a downturn. We wish them to proceed to have the ability to develop their enterprise, make engaging acquisitions and have the ability to develop their workforce. There are numerous new financing capabilities that can be utilized to help founders with out them having to take enormous markdowns.”

Atreides Administration, arrange by former Constancy Investments portfolio supervisor Gavin Baker, can also be elevating cash for an opportunistic enterprise fund. It should put money into structured fairness transactions to make the most of distressed conditions in enterprise and it’ll additionally take public firms personal, in response to a July investor letter.

“It’s simple to say, ‘Be fearful when others are grasping and grasping when others are fearful’, however a lot tougher to do in apply,” wrote Baker, referring to Warren Buffett’s well-known recommendation. “We imagine the following 9-12 months will likely be probably the greatest instances in historical past to be grasping and deploy capital inside enterprise.”

Source link