[ad_1]

The Financial institution of England selected to not play comply with the chief after the Federal Reserve’s 0.75 proportion level rate of interest rise on Wednesday, however the UK central financial institution signalled that its resolution was not its final phrase on preventing inflation.

Selecting a extra modest rise of 0.5 proportion factors on Thursday to place rates of interest at 2.25 per cent, the BoE Financial Coverage Committee as an alternative steadied itself for a sport of tug of conflict with the brand new ministerial group operating the Treasury this autumn.

The MPC made clear the speed rise was one thing of an interim resolution as a result of it couldn’t issue within the possible influence of Friday’s mini-Funds by new chancellor Kwasi Kwarteng, who is concentrated on a plan to kick-start financial development.

The MPC minutes of its September assembly mentioned: “All members . . . agreed that the forthcoming development plan would supply additional fiscal help and was prone to comprise information that was materials for the financial outlook.”

With huge selections on financial coverage postponed to November, the MPC needed to strike a fragile steadiness at its newest assembly.

Because the BoE final printed forecasts, in August, the financial system has weakened — the MPC now believes it has shrunk over two consecutive quarters. In the meantime the plans of recent prime minister Liz Truss to cap power costs for households and companies and push by huge tax cuts are prone to decrease inflation within the brief time period, whereas making it extra persistent in a while.

These tensions had been mirrored within the cut up vote on rates of interest on the 9 member MPC. 5 wished a 0.5 proportion level improve, whereas three voted for a extra aggressive rise of 0.75 proportion factors. One dissented, searching for a smaller improve of 0.25 proportion factors.

Most economists thought the BoE’s cautious method, and the guarded tone of the MPC minutes, was affordable given the troublesome timing of its assembly — coming only a day earlier than Kwarteng’s “fiscal occasion”.

The minutes confirmed that though Clare Lombardelli, chief economist on the Treasury, was current on the MPC assembly, she didn’t temporary the committee on the federal government’s fiscal plans.

“The MPC appeared cautious to not overtly criticise fiscal coverage,” mentioned Ellie Henderson, economist at Investec, whereas including the federal government’s deliberate fiscal growth would in the end “end in greater charges for longer”.

Allan Monks, economist at JPMorgan, mentioned the MPC vote had been “a really shut name” with current knowledge and a downgrade to the expansion outlook having performed “some position in steering the MPC away from a 0.75 proportion level hike”.

Julian Jessop, a fellow on the Institute of Financial Affairs, a think-tank, expressed disappointment at “one other missed alternative [for the BoE] to regain credibility” in preventing inflation.

However he additionally famous “mitigating elements”, given the BoE was urgent forward with promoting a few of the authorities bonds it had gathered in its quantitative easing programmes since 2009. This transfer was prone to elevate authorities borrowing prices in monetary markets.

Economists mentioned markets had been reassured by the BoE’s promise that it could give a full evaluation of the consequences of the federal government’s pump priming of the financial system on the MPC’s November assembly.

Sterling was secure after the newest MPC resolution, albeit near a 37-year low towards the greenback, and authorities borrowing prices had been little modified. Markets nonetheless count on the BoE to behave forcefully and roughly double rates of interest to effectively above 4 per cent by subsequent summer time.

A number of economists mentioned probably the most putting characteristic of the MPC’s resolution was the three-way cut up on the committee.

Andrew Goodwin, on the consultancy Oxford Economics, mentioned this steered the MPC was now extra prone to vote for a bigger, 0.75 proportion level price rise in November, including: “With solely two members needing to vary their thoughts to tilt the steadiness, the bar for sooner hikes is ready low.” However James Smith, at ING, drew the other conclusion, saying the growing division on the MPC was “an indication that market expectations are unlikely to be met”.

Ben Nabarro, UK economist at Citi, mentioned the MPC’s November assembly would now take particular prominence as a result of it could be the final likelihood for the committee to display it could not let authorities borrowing and tax cuts maintain inflation too excessive for too lengthy.

“The minutes make a number of references to prime minister Truss’s fiscal plans,” he added. “We see this as a warning that additional acceleration [in interest rate rises] might but be on the playing cards.”

There have hardly ever been direct clashes between the federal government and the BoE because it gained independence to set rates of interest in 1997.

Since turning into chancellor this month, Kwarteng has careworn the necessity for “co-ordination” between financial and financial coverage sooner or later however has not outlined what he means by this.

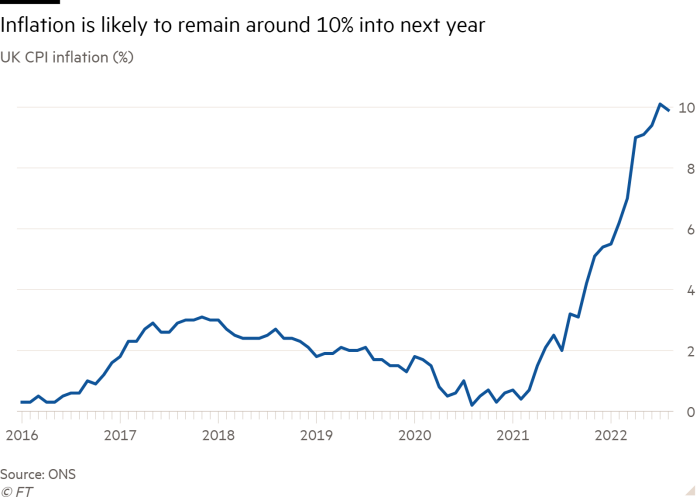

However now the BoE seems to be on a collision course with the federal government, decided to make sure inflation comes down from the 9.9 per cent price in August to the central financial institution’s 2 per cent goal and that corporations and employees imagine it’s critical.

Henry Prepare dinner, economist at MUFG financial institution, mentioned the times of alignment between Treasury and the BoE had been over and that was ushering in a brand new rigidity on the coronary heart of financial coverage.

“In contrast to within the years following the worldwide monetary disaster, it’s now the Treasury that’s supporting the financial system — whereas policymakers at Threadneedle Avenue are dashing to tighten coverage in an effort to rein in hovering inflation,” he added.

Source link