[ad_1]

Byju’s, India’s most dear start-up, is coming beneath intense scrutiny from the federal government, traders and collectors over repeated failures to publish its accounts, as funding and revenues dry up for the once-booming instructional know-how sector.

The net tutoring firm had benefited from stay-at-home Covid restrictions and is valued at $22bn, after elevating practically $6bn from traders over a number of rounds, together with from main personal fairness companies Common Atlantic and Tiger International. It has additionally taken out $1.8bn in loans.

Nonetheless, the Bangalore-headquartered start-up has but to obtain at the least $250mn in funding from two traders, in keeping with folks with information of the matter.

It has additionally failed to satisfy its personal deadlines to file outcomes for its monetary 12 months ending in March 2021. India’s Ministry of Company Affairs final month requested the corporate to elucidate the practically 18-month delay. The ministry didn’t reply to a request for touch upon Byju’s non-compliance.

Byju’s has repeatedly mentioned its auditor, Deloitte, has not signed off on its accounts due to the complexity of reporting the greater than $1.1bn in acquisitions it made in the course of the 2021 monetary 12 months. Two traders contacted by the Monetary Instances have questioned its rapid international expansion and aggressive acquisition technique.

The edtech sector is being hit significantly onerous as India and different international locations emerge from the pandemic and college students return to bodily faculties. Byju’s has lower employees and budgets this 12 months in lots of areas, former and present staff mentioned, though the corporate mentioned it continued to be a “internet hirer”.

“It isn’t simply Byju’s, different [edtech] gamers comparable to Unacademy and Whitehat Jr have felt the influence as we open up and other people return to offline faculties,” mentioned Neha Singh, co-founder of Indian information supplier Tracxn. Whitehat Jr was acquired by Byju’s in July 2020.

As late as final December, Byju’s was reported to be in talks to go public within the US by combining with a clean cheque firm, or Spac, led by Michael Klein’s Churchill Capital, in a deal that will have valued the enterprise at greater than $40bn.

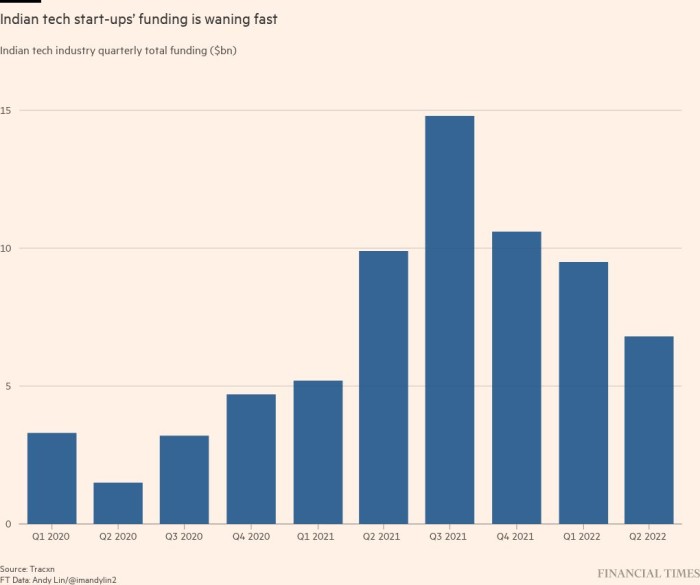

Sentiment on Spacs, and start-ups, has modified markedly since then. Tracxn information present funding for Indian start-ups hit a file excessive of $14.8bn within the third quarter of 2021. However three quarters of decline have adopted as financial circumstances have worsened, with the second quarter of 2022 seeing simply $6.8bn in funding — a 31 per cent fall in comparison with a 12 months earlier.

In an uncommon transfer, co-founder Byju Raveendran led financing of his firm’s most recent funding round with a private funding.

Like many start-ups, Byju’s father or mother firm, Assume & Be taught Personal Restricted, is failing to show a revenue. Its most up-to-date out there accounts, for the monetary 12 months which led to March 2020, put losses at Rs2.6bn ($32.5mn). Its primary income supply was “sale of instructional tablets and SD playing cards”, price Rs16.8bn.

Markets and collectors have gotten involved on the lack of an replace on its efficiency. A $1.2bn mortgage, raised by the corporate in November, was buying and selling at simply 69 cents on the greenback on Wednesday after a sell-off which began in April however quickened this week, in keeping with Bloomberg information.

Raveendran, a charismatic former trainer, turned one among India’s youngest billionaires because the valuation of the corporate he began in 2011 rocketed. Byju’s started out offering pre-recorded English lessons in India after which rapidly expanded throughout south-east Asia, the US and Latin America, whereas buying 20 Indian and overseas edtech start-ups, in keeping with Tracxn.

The pursuit of hypergrowth paid off when it comes to growing the corporate’s worth, with the newest funding spherical in March placing it at $22bn, in comparison with simply $5.5bn earlier than the pandemic in mid-2019.

Nonetheless, two traders have expressed issues over the variety of acquisitions, speculating that Byju’s was trying to “purchase revenues” to justify its excessive valuation because the pandemic wave eased and demand dropped.

“I’m not certain why they should make so many acquisitions. I believe the core enterprise can do nicely in India, I’m not certain if their mannequin works abroad,” mentioned one investor of a number of years who requested for anonymity to debate a portfolio firm.

“‘Construct or Purchase’ is a query that an organization of our scale should consider once we enter a brand new phase or geography,” Byju’s advised the Monetary Instances. It mentioned revenues at Osmo, an academic video games firm it acquired, had grown 5 instances for the reason that acquisition three years in the past.

However after Byju’s funding didn’t materialise in full this 12 months, a former operations government mentioned budgets had been slashed by greater than 50 per cent in some instances and the worldwide enlargement scaled again — with dozens of employees engaged on the initiative in India laid off with little warning.

Byju’s mentioned the claims of mass lay-offs had been “inaccurate”. “Whereas there have been some cutbacks in a couple of departments, there even have been large will increase in hiring in lots of others,” it mentioned, including that it had recruited 3,000 folks prior to now 12 months.

The beginning-up mentioned it anticipated to publish “annual monetary outcomes subsequent week” and first-quarter revenues for the present monetary 12 months had grown 50 per cent year-on-year. It argued it had insulated itself from the net downturn by diversifying into in-person courses and programs by way of its subsidiary Aakash.

“Whereas pure-play edtech gamers are seeing a correction after the pandemic increase, whole-spectrum training majors comparable to Byju’s are experiencing continued development,” it mentioned.

Extra reporting by Jyotsna Singh in New Delhi and Robert Smith in London.

Source link