[ad_1]

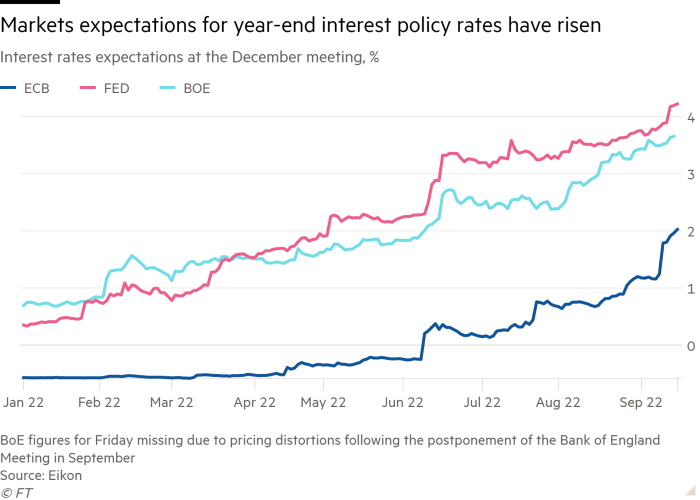

Traders are pricing in a sharper surge in rates of interest over the approaching months after the world’s main central banks strengthened their resolve to sort out hovering costs, signalling they might prioritise inflation over progress.

A Monetary Instances evaluation of rate of interest derivatives, monitoring expectations for borrowing prices within the US, UK and eurozone, confirmed markets anticipate a extra drastic tempo of tightening in the course of the ultimate quarter of 2022 than they did earlier this yr.

The shift in temper comes forward of essential coverage conferences by the US Federal Reserve, the Bank of England, the central banks of Norway and Sweden, and the Swiss Nationwide Financial institution this week. It follows a poor August inflation reading in the US and warnings from financial policymakers on either side of the Atlantic that they had been changing into more and more involved that, with out substantial price rises, excessive inflation would show exhausting to shift.

“Central banks are coming to phrases with how exhausting it will likely be to carry inflation again to focus on and they’re attempting to convey that message to the markets,” mentioned Ethan Harris, an economist at Financial institution of America.

The mounting expectations that central banks will enhance charges, even when their economies fall into recession, has prompted concern from the World Financial institution. The Washington-based organisation warned last week that policymakers risked sending the worldwide financial system into recession subsequent yr.

“Central banks will sacrifice their economies to recession to make sure inflation rapidly returns to their targets,” mentioned Mark Zandi, chief economist of Moody’s Analytics. “They perceive that in the event that they don’t, and inflation turns into extra entrenched, this can finally lead to a extra extreme downturn.”

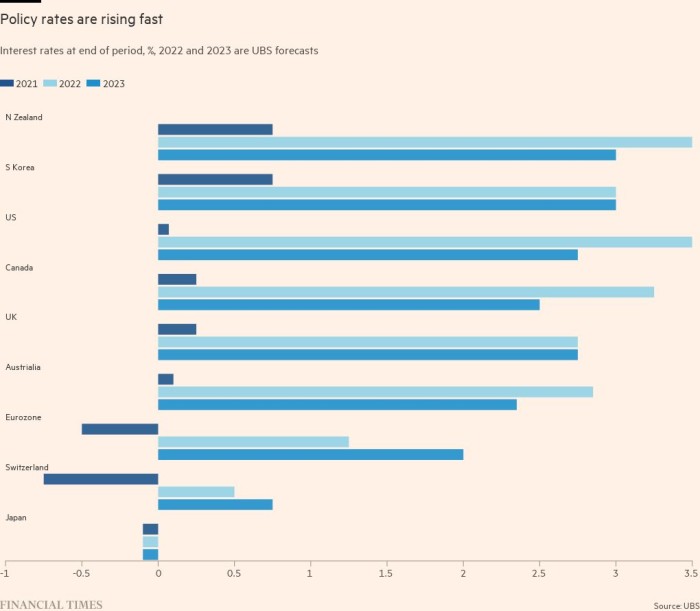

Since June, the world’s 20 main central banks have collectively raised rates of interest by 860 foundation factors, in response to FT analysis.

As of Friday, markets had been pricing in a 25 per cent probability that the US Federal Reserve would elevate charges by 100 foundation factors on Wednesday and anticipated the federal funds goal to be above 4 per cent by the flip of the yr — about one full share level increased than in early August.

Markets anticipate the European Central Financial institution’s deposit price to hit 2 per cent by the top of the yr, up from 0.75 per cent now. The most recent wager is a couple of share level increased than what traders had been forecasting in early August. Philip Lane, ECB chief economist, informed a convention on the weekend that he anticipated it to boost charges “a number of” extra instances this yr and early subsequent yr. He mentioned this was more likely to contain some “ache” of misplaced progress and jobs to carry down demand, reflecting the ECB’s rising concern that inflationary pressures are spreading from power and meals to different services.

12 months-end rate of interest expectations are additionally increased for the Financial institution of England, with economists largely cut up between an increase of fifty foundation factors and 75 foundation factors at Thursday’s vote.

Switzerland’s central financial institution is anticipated to boost its coverage price by 75-100 foundation factors subsequent Thursday, ending a seven-year experiment with destructive rates of interest.

Paul Hollingsworth, chief European economist at BNP Paribas, mentioned central banks had been “front-loading their tightening cycles” regardless of indicators that progress was weakening.

An enormous shift in market expectations got here after policymakers, equivalent to Federal Reserve chair Jay Powell and ECB govt board member Isabel Schnabel, delivered hawkish messages on the Kansas Metropolis Fed’s annual Jackson Gap convention in late August.

“That sucking sound you hear is the sound of policymakers pulling price hikes beforehand anticipated to happen in 2023 into 2022,” mentioned Krishna Guha, vice-chair on the funding banking advisory agency Evercore ISI, following the assembly. “We’re ending up globally with one thing that — wanting throughout 2022 as an entire — will resemble extra of a scrambled degree shift than a traditional tightening cycle.”

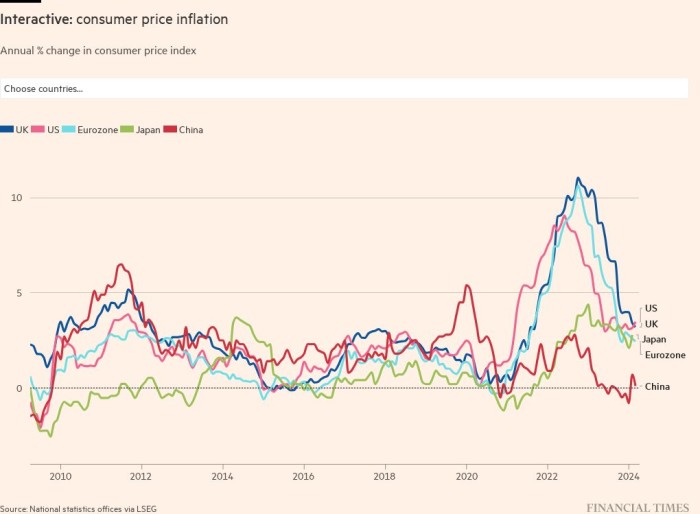

Since Jackson Gap, US inflation has proved to be stickier than anticipated, coming in at an annual price of 8.3 per cent in August. Within the eurozone, value pressures are anticipated to hit double digits within the coming months. The UK authorities’s £150bn energy support package will decrease inflation within the brief time period, however enhance value pressures within the medium time period by bolstering demand.

Central bankers equivalent to Schnabel have signalled that, with inflation set to stay near report highs for the foreseeable future, they’re now not ready to place their religion in financial fashions that present value pressures declining over the subsequent couple of years.

Whereas many of the inflation seen in Europe stays the results of the surge in power costs triggered by the warfare in Ukraine, there have been rising indicators in each the one foreign money space and the UK that value pressures have grow to be extra widespread and extra entrenched.

“Ordinarily, central banks would look by means of good points in these risky costs as short-term,” mentioned Jennifer McKeown, head of world economics at Capital Economics. “However in an surroundings the place core inflation is already excessive and inflation expectations and wage negotiations appear to be following power costs increased, financial policymakers simply can’t take that threat.”

Extra reporting by Martin Arnold

Source link