Charles Schwab Says Excessive-Yield Dividend Shares Are the Finest Play Proper Now; Right here Are 2 Names That Analysts Like

[ad_1]

As we shut in on the ultimate quarter of 2022, buyers are on the lookout for a solution to 1 query: was June’s low the underside for shares, or have they got extra room to fall? It’s a severe query, and there could also be no simple reply. Markets are going through a collection of headwinds, from the excessive inflation and rising rates of interest that we’ve grown accustomed to to an more and more sturdy greenback that may put strain on the upcoming Q3 earnings.

Weighing in on present circumstances from Charles Schwab, the $8 trillion brokerage agency, chief world funding strategist Jeffrey Kleintop notes these chief elements which might be on buyers’ minds, earlier than coming down firmly in favor of a bullish stance of high-yield dividend shares.

“We discuss traits of shares which might be outperforming throughout sectors and people are usually worth elements and prime quality elements. The one I have been targeted on most currently is excessive dividend payers… They’ve performed extremely effectively and normally a excessive dividend is an indication of fine money circulation and an excellent steadiness sheet, and buyers are searching for that out,” Kleintop famous.

So, let’s check out two of the market’s dividend champs, high-yield dividend payers which have the Road’s analysts like going ahead. In keeping with TipRanks’ database, each shares maintain Sturdy Purchase rankings from the analyst consensus – and each provide dividends of as much as 8%, excessive sufficient to supply buyers a level of safety from inflation.

Ares Capital Company (ARCC)

First up is Ares Capital, a enterprise growth firm (BDC) targeted on the small- and mid-market enterprise sector. Ares offers capital entry, credit score, and monetary devices and companies to corporations which may in any other case have problem accessing companies from main banking corporations. Ares’ goal consumer base are the small companies which have lengthy been the drivers for a lot of the US economic system.

At a macro degree, Ares has outperformed the general markets to this point this 12 months. The agency’s inventory is down – however solely by 3% year-to-date. This compares favorably to the 16% loss within the S&P 500 over the identical timeframe.

Ares has achieved this outperformance via the standard of its funding portfolio. The corporate’s portfolio, as of the top of calendar 2Q22, had a good worth of $21.2 billion, and was composed of mortgage and fairness investments in 452 corporations. The portfolio is various throughout asset lessons, industries, and geographic places, giving it a powerful defensive forged in at the moment’s unsure market surroundings.

The corporate reported a complete funding earnings of $479 million within the second quarter, up by $20 million, or 4.3%, from the year-ago quarter. This led to a internet GAAP earnings of $111 million, and a core EPS of 46 cents.

The latter two outcomes have been each down y/y – however have been greater than enough to fund the corporate’s dividend, which was declared in July at 43 cents per widespread share, for a September 30 payout. The dividend annualizes to $1.72 and provides a yield of 8.7%. Along with the widespread share dividend, the corporate may also pay out a beforehand licensed 3-cent particular dividend. Ares has a historical past of maintaining dependable quarterly dividends going again to 2004.

Protecting Ares for Truist, analyst Michael Ramirez describes the agency’s just lately quarterly earnings as ‘impacted by higher market volatility’ which resulted “in higher enticing phrases for brand spanking new originations coupled with larger yields- resulting in confidence to extend the common dividend.”

Trying ahead, in higher element, Ramirez added, “We proceed to anticipate NII enchancment to offer a cushion between earnings and the common and supplemental dividend via the second half of 2022. Moreover, we anticipate the whole portfolio yield will profit from larger brief time period charges with the present Fed Fund futures anticipating roughly 200bps of fee hikes within the second half of 2022.”

The analyst’s feedback level towards additional outperformance – and he backs them with a Purchase ranking on the inventory and a $22 worth goal that signifies confidence in a one-year upside of 12%. Primarily based on the present dividend yield and the anticipated worth appreciation, the inventory has ~21% potential complete return profile. (To observe Ramirez’ observe file, click here)

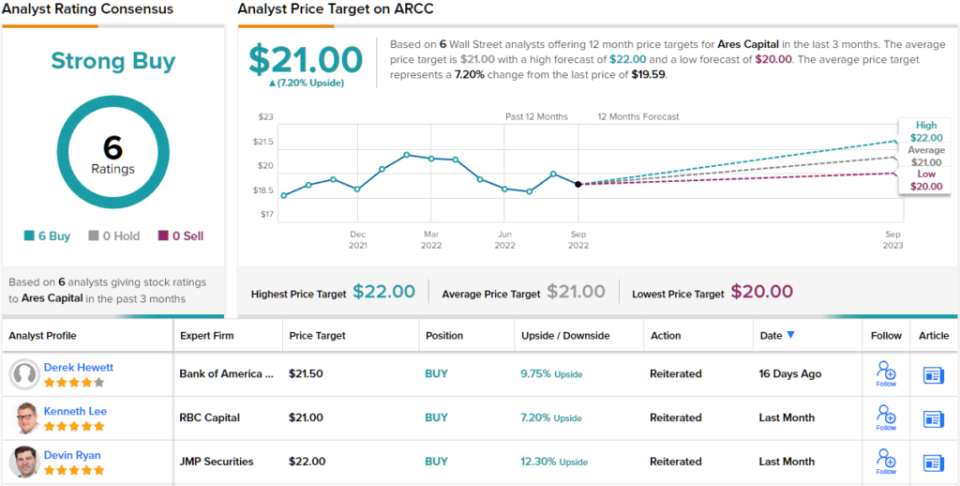

Total, the Sturdy Purchase consensus ranking on ARCC is unanimous, based mostly on 6 constructive analyst opinions set in current weeks. The shares are priced at $19.59 and their present $21 worth goal implies a modest 7% achieve from that degree. (See ARCC stock forecast on TipRanks)

The Williams Firms (WMB)

The following firm will have a look at, Williams Firms, is a significant participant within the pure fuel pipeline. Williams controls pipelines for pure fuel, pure fuel liquids, and oil gathering, in a community stretching from the Pacific Northwest, via the Rockies to the Gulf Coast, and throughout the South to the Mid-Atlantic. Williams’ core enterprise is the processing and transport of pure fuel, with crude oil and power era as secondary operations. The corporate’s footprint is large – it handles nearly one-third of all pure fuel use within the US, each residential and business.

The agency’s pure fuel enterprise has introduced sturdy leads to revenues and earnings. In the newest quarter, 2Q22, confirmed complete revenues of $2.49 billion, up 9% year-over-year from the $2.28 billion reported within the year-ago quarter. The adjusted internet earnings of $484 million led to an adjusted diluted EPS of 40 cents. This EPS was up 48% y/y, and got here in effectively above the 37 cent forecast.

The rising worth of pure fuel and the strong monetary outcomes have given the corporate’s inventory a lift – and whereas the broader markets are down year-to-date, WMB shares are up 26%.

The corporate has additionally been paying out an everyday dividend, and in the newest declaration, in July for a September 26 payout, administration set the fee at 42.5 cents. This marked the third quarter in a row at this degree. The dividend annualizes to $1.70 and yields 5.3%. Even higher, Williams has a historical past of holding dependable dividend funds – by no means lacking 1 / 4 – going again to 1989.

This inventory has attracted the eye of Justin Jenkins, a 5-star analyst from Raymond James, who writes of WMB: “The Williams Firms’ (WMB) enticing mixture of core enterprise stability and working leverage through G&P, advertising and marketing, manufacturing, and mission execution continues to be under-appreciated. WMB’s giant cap, C-Corp., and demand-pull pure gas-focused traits (and supply-push tailwinds in a number of G&P areas and the Deepwater) place it effectively for each the short- and long-term, in our view. Potential buybacks and JV optimization affords extra catalysts all year long, bolstering an anticipated premium valuation.”

Jenkins goes on to present WMB shares a Sturdy Purchase ranking, and his $42 worth goal implies a 31% upside for the following 12 months. (To observe Jenkins’ observe file, click here)

Jenkins isn’t alongside in seeing Williams as a Sturdy Purchase; that’s the consensus ranking, based mostly on 10 current analyst opinions that embrace 9 Buys and 1 Promote. The shares have a mean worth goal of $38.90, suggesting ~22% one-year achieve from the present buying and selling worth of $32. (See WMB stock forecast on TipRanks)

To seek out good concepts for dividend shares buying and selling at enticing valuations, go to TipRanks’ Best Stocks to Buy, a newly launched device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally necessary to do your personal evaluation earlier than making any funding.

Source link