[ad_1]

Final yr, a British oil exploration firm and a tech start-up joined forces on a mission to completely lock away untapped fossil gas reserves in Greenland.

The concept was easy: the power firm, Greenland Gasoline and Oil, wouldn’t extract oil from an space on the east coast that it had exploration licences for. As an alternative it will monetise preserving the oil within the floor by way of a partnership with the tech firm, Carbonbase, which works on offsetting carbon emissions.

The mechanics have been extra advanced. The partnership aimed to promote NFTs, digital collectibles that include possession certificates, linked to the unexplored land. The earnings would then be utilized in half to compensate the power firm and the oil would keep underground. And, for the reason that Greenland authorities had stopped issuing new exploration licences, the power firm wouldn’t be capable of merely apply for one more and faucet a special a part of the nation.

The pitch to consumers was that they might make sure their NFT funding was doing a little environmental good. The tokens would even be paired with a brand new kind of “non-production” carbon credit score the enterprise hoped to develop, which house owners might use to compensate for their very own emissions.

However, after months of discussions, the partnership bumped into issues. Carbonbase and Greenland Gasoline and Oil didn’t agree on the best way to construction the three way partnership. Carbonbase additionally found that the nation of Greenland had by no means efficiently produced any oil, a indisputable fact that they mentioned undermined the entire thought. Pursuing the mission “would have destroyed our public popularity” and appeared like “greenwashing”, says Max Track, founding father of Carbonbase.

Eric Sondergaard, chief working officer at Greenland Gasoline and Oil, concedes the scheme was not “good” and that it will have been higher if an oil producing firm was “turning off the stream of oil or gasoline from a wellhead”. However, he says, it was simpler for a gaggle not but tapping reserves to win investor backing for such a proposal: “as soon as the [oil] growth wheels are in movement, it’s more durable to persuade shareholders to go for a blockchain various.”

The try is only one instance in a mass of tech ventures that hope to fuse issues about international warming with the general public’s curiosity in Web3 expertise. A surfeit of start-ups have burst on to the scene this yr, variously promising to “inexperienced” bitcoin, make NFTs sustainable and resolve niggling issues in carbon markets as soon as and for all.

These initiatives vary from the comparatively mundane to the outlandish and wacky, with curiosity coming from main firms in addition to fringe teams. One River Digital Asset Administration launched “the world’s first carbon-neutral crypto asset fund” final yr, whereas the world’s largest meatpacking group, JBS, has developed a blockchain platform to hint its cattle provide chain in an effort to fight deforestation. Diamond miner De Beers is utilizing blockchain expertise to trace the provenance of its gems.

Many new initiatives give attention to the booming marketplace for carbon offsets — every of which is meant to characterize a tonne of carbon completely eliminated or averted from the environment. They’ve soared in recognition prior to now 18 months as firms search to compensate for his or her emissions. WeWork founder Adam Neumann’s enterprise Flowcarbon, which obtained funding from Andreessen Horowitz earlier this yr, is certainly one of a spread of efforts to supply carbon tokens, which might both be used to compensate for emissions like conventional carbon credit or traded on sure crypto exchanges.

The pattern for “tokenising” carbon offsets, or changing them into the form of fungible, digital tokens acquainted to crypto merchants has been notable: hundreds of thousands of credit have been digitised since late 2021.

Used nicely, analysts say Web3 applied sciences might convey higher integrity to the carbon market and assist confirm the credentials of merchandise labelled as “sustainable”. However critics say difficult new initiatives might simply as simply exacerbate current issues in two unregulated markets (offsets and crypto finance), lure extra individuals into an area with its personal huge emissions downside, and contribute to extra greenwashing.

William Pazos, cofounder of AirCarbon Trade, says some new teams usually are not displaying “the extent of rigour that’s essential” to provide you with credible local weather options. “They’re ticking the containers: the local weather field, the blockchain field — all these buzzwords that doubtlessly might make them very rich.”

Table of Contents

A messy market

It was solely a matter of time earlier than advocates of blockchain — the distributed digital ledgers on which cryptocurrencies run and which were hailed as options to all the things from poverty to id theft — turned to local weather change.

These supporters say the expertise, which retains an unchangeable file of transactions, can convey higher readability to the messy marketplace for carbon offsets. “Distributed ledgers are going to assist with transparency” and with monitoring the acquisition and use of credit, says James Cameron, coverage adviser at Systemiq, the advisory group. Carbon-crypto initiatives may also be a approach for retail consumers, who’ve historically discovered it troublesome to purchase offsets, to entry the market.

However Pete Howson, who researches environmental applied sciences on the UK’s Northumbria College, says he fears some tech pioneers “don’t perceive the best way the carbon market works”.

The sector is notoriously difficult, with its personal well-rehearsed issues: a scarcity of liquidity, opaque pricing and issues concerning the high quality of credit. Because the late Nineteen Nineties the decentralised market has solely change into extra difficult because it has grown. Hundreds of initiatives that generate offsets exist, corresponding to tree planting schemes that may promote credit both instantly to finish customers or by way of middlemen. Completely different mission sorts are ruled by varied advanced guidelines, set by certainly one of numerous third-party carbon offset normal setters corresponding to Verra.

Some offsets are of a dependable high quality, however others might not ship the local weather advantages they promise. That makes it laborious for non-experts to know what to purchase, who to purchase from and what to pay.

The blockchain group is the most recent to take up the gauntlet. Tokenising credit has change into a preferred place to begin. The method can contain some mystifying jargon, however the aim tends to be the identical: the creation of digital variations of current offsets which might be easier for individuals to grasp, extra liquid and transparently priced.

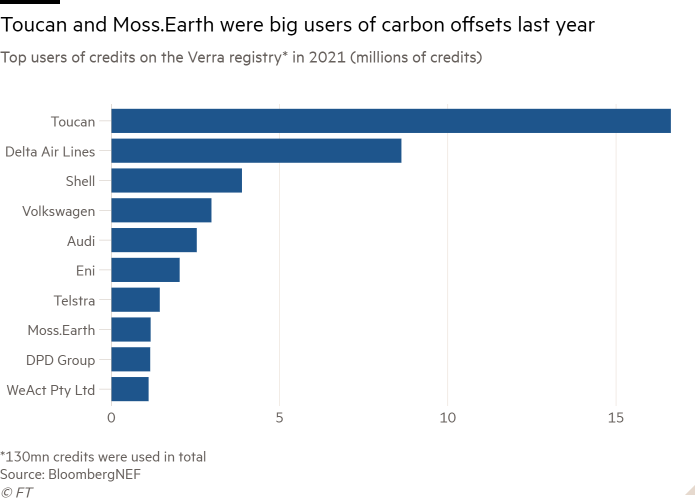

Carbon tokens have been launched by firms together with Toucan, JustCarbon and Moss.Earth. Hype concerning the prospect of the tokens has bubbled up on social media. However the tokens have additionally drawn the eye of company buyers: final yr Anthony Scaramucci’s various funding agency SkyBridge Capital purchased practically 40,000 of Moss.Earth’s tokens to offset the “historic carbon footprint” of its bitcoin holdings.

Adrian Rimmer, cofounder of JustCarbon, says the design of carbon tokens is less complicated for non-expert consumers to grasp than the normal offset market, which he describes as “horrible”. “It requires an unfeasibly great amount of information,” he says.

And whereas conventional offsets can come from hundreds of various environmental initiatives and are troublesome to check, every of the brand new digital tokens on supply — JustCarbon’s JCRs or Moss.Earth’s MCO2s, for instance — are uniform and commerce on the identical value. Every firm decides on a spread of offsets, corresponding to any from forestry schemes, that may be transformed into its standardised token.

‘No thought what you’re shopping for’

Not everyone seems to be satisfied. Louis Redshaw, managing director of carbon consultancy Redshaw Advisors, says including one other layer of complexity to the already complicated carbon market might be “not making it higher”. Blockchain could also be no extra helpful for elucidating the method than “ spreadsheet”, he says. Redshaw insists the difficult nature of many initiatives is motive sufficient to be cautious: “In the event you can’t perceive what it’s you’re stepping into you shouldn’t get into it,” he says.

Steve Zwick, a senior media relations supervisor for Verra, the offsets registry, says creating standardised tokens from a broad class of offsets masks key info, corresponding to which mission a credit score got here from. Such particulars are necessary, since some offsets are of doubtful high quality. “That transparency aspect is important, particularly now with new consumers coming in. You’ve acquired to verify the labelling is true,” says Zwick.

Cryptofinance

Crucial intelligence on the digital asset trade. Explore the FT’s coverage here.

Whereas consumers of Moss.Earth’s tokens know they’re underpinned by credit from a listing of forest safety schemes printed by the corporate, they have no idea which particular mission a given token is linked to. The group mentioned its design ensured token fungibility.

Final yr Vaughan Lindsay, chief government of offset vendor Local weather Affect Companions, told the Monetary Occasions that efforts to make credit fungible “remind me of collateralised debt devices . . . In the event you preserve rolling stuff up, you don’t have any thought what you’re shopping for.”

One other threat is the temptation to make use of the tokens for monetary hypothesis. Offsets are speculated to be purchased to compensate for particular emissions, quite than endlessly traded. However the house owners of tokenised credit can simply be swept up within the highly effective currents of decentralised finance.

Verra banned the tokenisation of sure credit in Might. In August it launched a session about designing “anti-fraud measures” for crypto-carbon — new guidelines that would permit tokenisation to renew.

Toucan’s tokens soared in recognition on the finish of final yr, largely as a result of consumers can convert them right into a new cryptocurrency, Klima. However consultants identified that most of the hundreds of thousands of credit underpinning Toucan’s tokens had remained unsold for years on account of high quality issues. Toucan mentioned it had tightened up its guidelines about which credit may very well be tokenised.

“If persons are bundling credit and promoting them, what’s necessary is the underlying credit score,” says William McDonnell, chief working officer of the Integrity Council for the Voluntary Carbon Market, an trade group that’s drawing up guidelines for what constitutes a “good” credit score. “Whether or not it’s tokenised or not, what’s necessary is the standard of the credit.”

Fiorenzo Manganiello, a professor of blockchain applied sciences at Geneva Enterprise Faculty, warned of scams focusing on these on the lookout for “inexperienced” crypto. “I’ve been approached three or 4 occasions by individuals saying they’re promoting ‘inexperienced’” tokens they claimed have been backed by carbon credit, he says. “In actuality, they [looked like] a pump-and-dump scheme.”

Then there’s the broader menace posed by a turbulent crypto market, which crashed this yr. The worth of Toucan’s “BCT” tokens fell from a excessive of practically $9 final yr to round $1.50 in August. Moss.Earth’s MCO2s dropped from greater than $17 in January to below $4 this month, whereas JustCarbon’s JCR moved from practically $40 in Might to round $24 in August.

The emissions elephant

The crypto-climate crossover goes past carbon tokens. Customers can now take part in metaverses the place they’re inspired to buy digital variations of style objects corresponding to clothes, as a substitute of shopping for in the actual world.

Conservation-linked cryptocurrencies are additionally showing, corresponding to one developed by Estonia-based Single.Earth. The group generates “Advantage” tokens, which landowners earn every time they retailer 100kg of carbon of their forests. Their woodland have to be not less than 20 years previous to be eligible, and Single.Earth screens the method utilizing satellites and machine studying.

Nonetheless, since there isn’t a penalty for landowners who later minimize down the bushes, besides that they don’t earn extra tokens, the saved carbon may very well be launched again into the environment. Advantage Valdsalu, Single.Earth co-founder, concedes it is a concern, however says she hopes the prospect of incomes extra tokens will incentivise landowners to maintain bushes standing.

The elephant within the room is the power consumption concerned in lots of crypto and blockchain transactions. Minting bitcoin, for instance, requires enormous computing energy, which frequently runs on coal-generated electrical energy. That subject is drawing extra consideration. This yr, the US Workplace of Science and Know-how Coverage referred to as for proof on the power and local weather implications of digital belongings.

Lovers have pushed again towards this characterisation of crypto, arguing that many cash and blockchains are a lot much less power intensive than bitcoin. However the notion of digital belongings as a gas-guzzling, carbon producing downside is so prevalent that an NFT public sale by the UK arm of conservation charity WWF was abruptly cancelled in February following a backlash.

Regardless of such criticisms, many analysts do see a task for digital applied sciences within the struggle towards local weather change and are inspired by the curiosity in sustainability from some within the crypto group. The “recognition of the power conundrum by main gamers . . . might sign a turning level for the crypto market in adapting greener algorithms,” wrote HSBC analyst Camila Sarmiento.

Banks and exchanges are exploring a center floor between the normal carbon market and the crypto-carbon crossover. AirCarbon Trade has designed sensible contracts that would permit credit to be bought in smaller portions than one tonne of carbon. That may very well be helpful for individuals making small, common purchases, corresponding to offsetting a taxi journey, says Pazos. “Identical to we see energy counts on meals [packaging], we’re going to see carbon counts on all varieties of completely different actions.”

Lenders together with NatWest, Customary Chartered and BNP Paribas have developed a blockchain-based settlement platform, Carbonplace, which goals to make shopping for offsets easier and improve the traceability of transactions. Consumers obtain tokens representing credit score possession, which embody the main points of the offsets — not digital variations of the credit.

Even the UN Framework Conference on Local weather Change has taken an curiosity: it supported the creation of the Local weather Chain Coalition initiative in 2017, which works to “advance blockchain . . . and associated digital options” to mobilise local weather finance and motion on local weather.

However for now, the proliferation of recent firms and the “low obstacles to launching new initiatives” make it “laborious to grasp who you need to work with,” says Claudia Herbert, from the advisory group Carbon Direct. “We’re seeing the teachings of the [real-world offsets market] being relearnt.”

Local weather Capital

The place local weather change meets enterprise, markets and politics. Explore the FT’s coverage here.

Are you interested by the FT’s environmental sustainability commitments? Find out more about our science-based targets here

Source link