[ad_1]

Denim, the fintech platform for freight and logistics previously referred to as Axle Funds, at present introduced that it raised $126 million in a Collection B funding spherical led by Pelion Enterprise Companions with participation from Crosslink Capital, Anthemis, Vehicles VC, FJ Labs, Tribeca Early Stage Companions and Refashiond Ventures at a “nine-figure” valuation. CEO and co-founder Bharath Krishnamoorthy tells TechCrunch that the brand new money, a mix of fairness ($26 million) and debt ($100 million), will likely be put towards scaling the enterprise and offering Denim’s clients with working capital.

Krishnamoorthy and Denim’s different co-founder, Shawn Vo, had been mates for 16 years earlier than they launched the corporate. Vo was within the credit score threat division at Barclays and a full-stack developer at Fintria, a fintech firm, whereas Krishnamoorthy was an affiliate at a number of legislation corporations together with Gibson, Dunn & Crutcher.

“We witnessed a major hole within the freight dealer market, the place legacy techniques — i.e., paper checks, bodily submitting — have been nonetheless in place, and developed an intuitive funds know-how to assist streamline dealer operations and entice the most effective provider relationships by the platform,” Krishnamoorthy advised TechCrunch through e mail.

To that finish, Denim offers monetary merchandise, operations instruments, and automatic workflows for freight brokers — the middlemen between shippers and carriers. The corporate handles dealer invoicing, collections, and funds and as well as offers entry to debt financing.

“The trade has proven reluctance to desert its legacy processes — many shippers nonetheless pay freight brokers on 30-60 day phrases regardless of carriers anticipating near-instantaneous funds. These longer time frames can create money circulation issues,” Krishnamoorthy added.

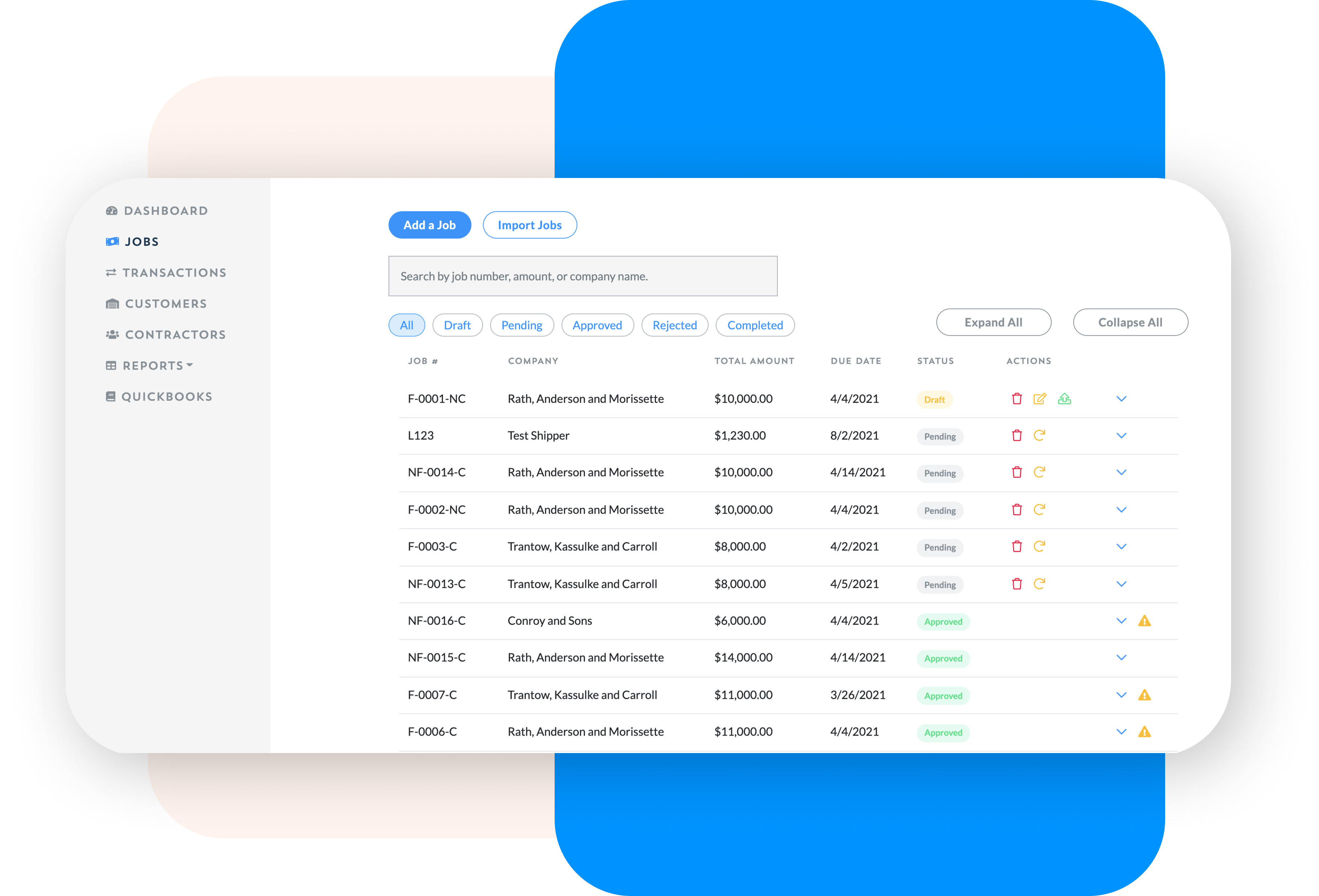

Managing jobs in Denim.

Denim makes use of algorithms to scale back the period of time its operations group spends evaluating the danger of invoices it purchases from brokers. For every cargo, these algorithms overview 20 completely different knowledge factors and both approve the acquisition or flag {that a} guide overview is required.

Past this, the Denim platform integrates with accounting software program like QuickBooks to permit brokers to share knowledge between varied present techniques. From a dashboard, customers can see metrics like pending or accomplished jobs, complete factored quantities, essentially the most regularly used carriers and the fastest-paying clients.

“This mix of automation, monetary stability and correct reporting permits freight brokers and their companions to navigate unstable shifts within the financial system. And most significantly, it ensures the whole provide chain continues transferring in the best path,” Krishnamoorthy continued. “In our present financial atmosphere, firms can’t afford to disregard back-end dangers and sluggish processes.”

Denim competes with different fintech corporations within the area, together with TriumphPay, HaulPay and OTR Capital. Curiously, Krishnamoorthy declined to say what number of clients the corporate at the moment has or the place its income stands. However he did volunteer that Denim has related over 7,000 freight brokers, shippers and carriers since its launch three years in the past.

“Regardless of the slowdown, Denim is uniquely positioned to proceed scaling its platform and workforce. We’ve established a monetary mannequin primarily based on wholesome unit economics,” Krishnamoorthy mentioned. “We’re bringing new options to market to offer freight brokers the flexibility to seamlessly function at full capability and adapt to adjustments within the provide chain. And we’re hiring expertise that not solely aligns with our enterprise targets however with our core values.”

Denim has 100 full-time staff and plans to succeed in 120 by the tip of the 12 months, funded partly by the brand new fairness. Thus far, the startup has raised a complete of $165 million.

Source link