Do not study cash the onerous method — get forward with this information for faculty college students

[ad_1]

Some faculty college students have sufficient monetary assist to deal with schoolwork and forging new friendships. Others are pressured about cash on a regular basis.

However no matter your present means, monetary literacy is a necessary life ability for all younger adults.

A number of the choices you’re making now will have an effect on the race you’ll be working for years to return — particularly if student loan debt is placing you 10 ft behind the beginning line.

In the long run, time is the one useful resource you’ll be able to’t recuperate, and you’ll’t all the time make up for missed alternatives later. Right here’s how one can rise up to hurry.

Table of Contents

Don’t miss

What’s monetary literacy?

Monetary literacy refers to a primary understanding of important monetary subjects and abilities. You don’t must discover ways to run a enterprise; it’s about private finance, the sort that grows and shrinks your personal checking account.

Ideas that fall beneath the monetary literacy umbrella embrace saving, studying how to build credit, investing, paying off debt, retirement planning and extra.

Take note, monetary literacy doesn’t simply encompass realizing all of the definitions. It is also making use of that data in the true world by sensible cash administration.

Upon getting the instruments, your long-term monetary success gained’t be based mostly on hopes, desires and guesswork. You’ll know what you might want to do to realize your monetary targets.

Why is monetary literacy necessary for college students?

At first, monetary literacy would possibly seem to be a sport for older individuals — people who’re far alongside of their careers and have extra disposable earnings than the common faculty scholar.

In reality, monetary literacy is particularly related to varsity college students exactly due to their youth and restricted funds.

Many college students reside on their very own for the primary time however don’t have money to burn on easy errors. That turns budgeting and monetary planning into pressing priorities.

1 / 4 of faculty college students have skilled meals insecurity, and 17% have skilled housing insecurity, a latest survey revealed.

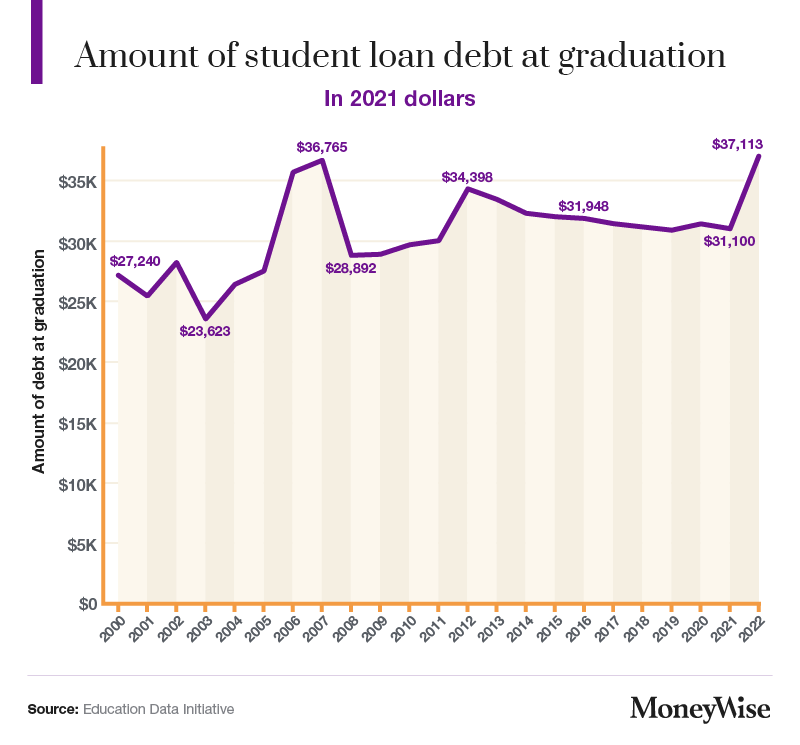

And it’s not like commencement brings rapid aid. Common scholar debt upon leaving faculty has skyrocketed to $37,113 — that’s up 317% since 1970, when adjusted for inflation.

That appears like some huge cash for a latest grad — and it’s — however you’ll have the ability to begin mapping out a plan when you get an thought of your beginning wage.

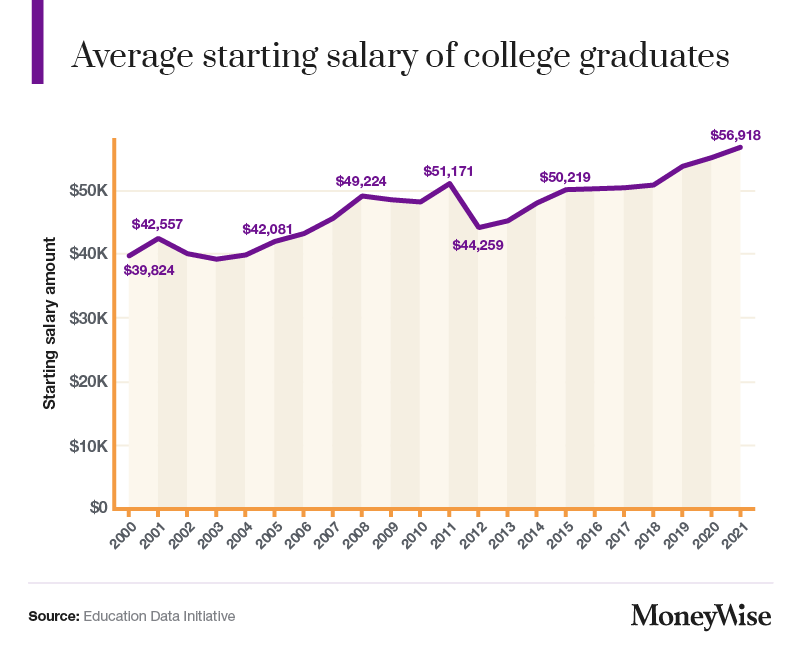

Proper now, the common beginning wage for all faculty graduates is around $56,000 a 12 months. Clearly, rather a lot is determined by your subject. You will get a greater thought of your particular person prospects by trying to find the job you need on the federal government’s Bureau of Labor Statistics website.

This may allow you to calculate your debt-to-income ratio, or DTI, which is a key budgeting and borrowing measurement.

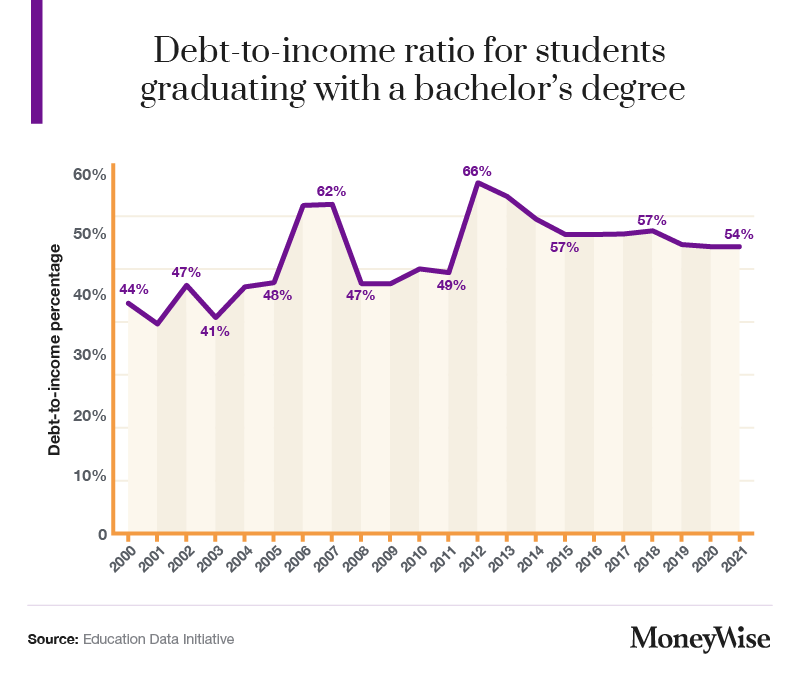

To calculate your DTI, take your whole month-to-month debt funds and divide the determine by your gross month-to-month earnings (how a lot cash you earn every month earlier than taxes and deductions are subtracted).

The DTI for the category of 2021 is round 54% — not as unhealthy as the category of 2012 at 66%, however nonetheless a excessive DTI.

Lenders sometimes wish to see this share a lot decrease in the case of approving loans, particularly large ones like mortgages and auto loans, as a result of it alerts the next chance of compensation.

A DTI of lower than 43% exhibits you’ll be able to deal with your money owed and can make it simpler to get a reasonable loan.

5 pillars of monetary literacy

Monetary literacy covers a variety of subjects, however they are often sorted into 5 key classes.

Right here’s a fast take a look at every one, referring to a few of the most necessary parts you’ll wish to study:

Earn

It’s not sufficient to know the way a lot you make; you might want to perceive what occurs to the cash.

Say you apply for a summer season job. Your employer will quote you a pre-tax wage, usually by a written work contract. You’ll wish to do the math to find out what that quantity will appear to be after federal taxes in addition to different deductions together with states taxes and Social Safety contributions.

This provides you with an correct expectation of your web or take-home pay so you’ll be able to price range accordingly.

Spend

Some spending is crucial: You should eat, get round, pay for varsity and preserve a roof over your head. Some spending isn’t.

Your job is to appropriately determine which is which, and to remain on price range whereas minimizing your prices and maximizing the worth you get again.

Begin by monitoring your spending, both manually or with an app that watches your checking account. You possibly can solely decide about whether or not $150 a month is an excessive amount of to spend on takeout if you’re spending $150 a month.

Then, take the time to essentially analysis your choices. Loads of related services and products are bought for wildly different prices — together with meals, garments and insurance coverage — and you need to solely spend further when it makes you happier.

Save and make investments

Many faculty college students deal with this as an issue for “later,” however you’d be shocked how shortly “later” can arrive. Saving and investing usually are not voluntary however crucial to long-term monetary stability and reaching your life targets.

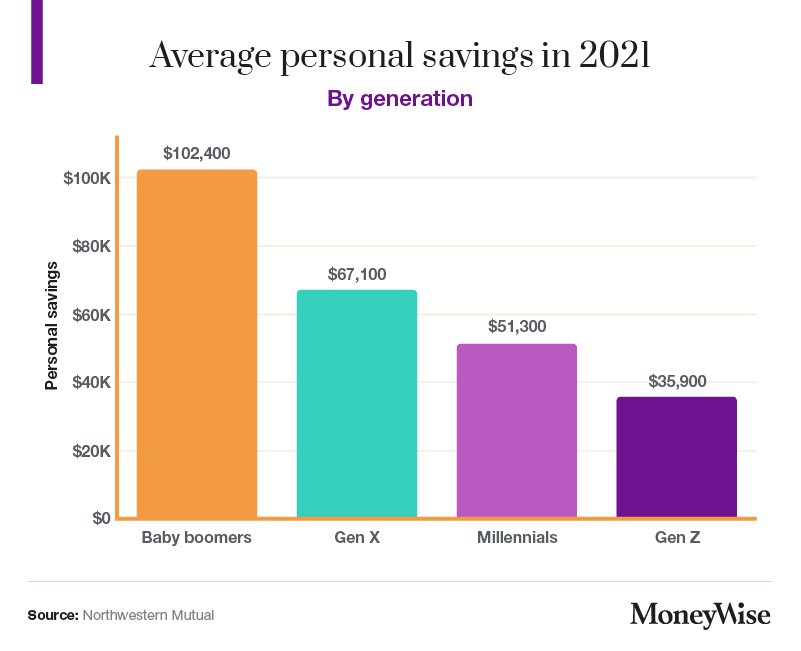

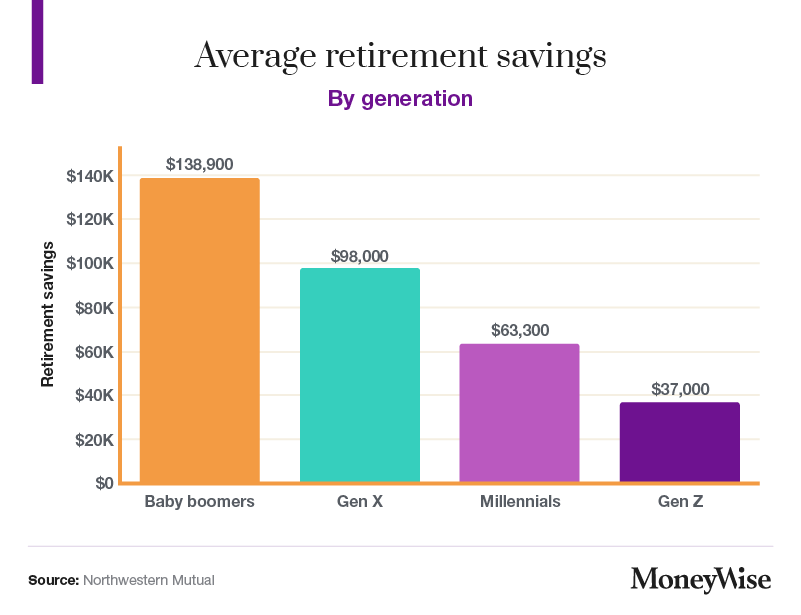

The primary purpose now could be to make saving and investing a constant behavior as you develop your earnings over time. A latest study by Northwestern Mutual exhibits how totally different generations are doing at build up their private and retirement financial savings — and Gen Z is holding its personal — however you need to attempt to be forward of the curve every time attainable.

Plus, as a consequence of compounding, the saving and investing you do now could be price much more than the saving and investing you’ll do later.

Compounding occurs when the curiosity you make in a savings account begins producing its personal curiosity, or the earnings you make in your investments get reinvested and start producing their very own earnings.

This impact can ramp up shortly, even with a small sum of money. It’s beginning early that’s the important thing.

Younger individuals don’t personal a really large slice of the inventory market, knowledge from the Federal Reserve exhibits, however don’t let that cease you from studying about totally different sorts of investments and placing any spare money it’s important to work.

Borrow

Even should you’ve managed to pay for faculty with out taking out big scholar loans, you’ll doubtless borrow a lot of cash in a lot of alternative ways all through your life.

That features mortgages for buying a home, auto loans for financing a automotive and credit cards for day-to-day purchases. Understanding how these loans work and what choices can be found will allow you to keep away from main pitfalls.

Bank cards, for instance, are handy however far dearer than different types of borrowing. Some loans are secured, that are cheaper however you could conform to give up one thing of worth should you cease paying. Some loans are closed, that means you’ll be able to’t merely pay them off shortly if you wish to.

Take the time to find out the best kind of loan on your scenario, then examine presents from totally different lenders. Pay shut consideration to the rate of interest and the way lengthy it’s important to pay the mortgage again, and be careful for charges hidden within the advantageous print.

Shield

Being profitable isn’t simple, so don’t lose it to a disaster you weren’t ready for.

Defending your self begins with an emergency fund — a set amount of money you permit apart in your checking account for sudden monetary wants. That method, when your laptop computer will get stolen, you don’t must borrow cash (and thus spend extra) to pay for it.

The opposite large ingredient is insurance coverage. Automobile insurance coverage, renter’s insurance and medical insurance will all drain your funds, however you’ll be glad you will have them whenever you want them.

The important thing is choosing the right sort and quantity of protection — so that you’re not overprotected and overspending, or underprotected and underspending — and evaluating presents from a number of suppliers. Completely different corporations use totally different formulation to find out their charges, so it can save you rather a lot simply by buying round.

12 statistics on monetary literacy

Do not feel like a star scholar in the case of monetary literacy? The reality is that many Individuals are missing on this space, which may have a cascade of penalties for his or her monetary well-being.

Check out these 12 statistics — and be impressed to do higher than your classmates and neighbors.

-

Individuals rank 14th in monetary literacy globally.

-

Nearly 58% of Americans failed a Nationwide Monetary Literacy Take a look at.

-

The typical rating on the Nationwide Monetary Literacy Take a look at amongst individuals aged 19 to 24 is 71% — barely a passing grade.

-

Solely 1 in 3 adults worldwide perceive primary monetary ideas.

-

32% of Americans really feel they turned extra disciplined about their cash administration on account of the Covid-19 pandemic.

-

Roughly 25% of consumers estimate that non-public finance missteps have value them $30,000 or extra of their lifetime.

-

60% of U.S. adults really feel anxious eager about private funds, whereas 50% really feel pressured discussing the subject.

-

Girls usually tend to expertise monetary nervousness than males: 65% compared to 54%.

-

For Gen Z, monetary literacy tends to be lowest amongst those that have by no means attended faculty.

-

Roughly 83% of U.S. adults say dad and mom are essentially the most chargeable for instructing their children about cash. Nevertheless, 31% do not truly discuss to their children about funds.

-

Less than half of states require excessive faculties to show private finance.

-

Monetary literacy tends to be greatest among baby boomers and lowest amongst Gen Z.

5 locations to go to enhance your monetary literacy

Except you’re born wealthy, you gained’t have the ability to attain monetary safety with out working in your monetary literacy.

Now, if you have not had any monetary schooling till now — and that describes loads of younger individuals — it’s possible you’ll not know the place to show.

There isn’t one proper reply, so listed here are just some of your choices to get the monetary data you want.

Take finance programs in school

You are a scholar, so take advantage of this time. In case your faculty or college presents monetary literacy programs, seize the chance to be taught in a structured setting and possibly earn a pair credit.

If private finance programs aren’t out there, even one thing as broad as economics can show helpful in studying about subjects similar to inflation, inventory market crashes and housing bubbles — all issues that may have a really actual affect in your life now and sooner or later.

Leverage authorities and nonprofit sources

Whereas schooling is primarily a state and native duty, there are some federal sources out there to all Individuals.

The U.S. authorities has arrange numerous platforms to assist individuals study private finance and get particular questions answered. MyMoney.gov, run by the U.S. Treasury’s Monetary Literacy and Training Fee, is a good place to begin.

Different companies embrace the Consumer Financial Protection Bureau, the U.S. Securities and Exchange Commission and the Internal Revenue Service.

Nonprofits are an alternative choice. For instance, United Approach generally presents free monetary teaching.

Flip to monetary establishments and specialists

Banks and credit score unions present a wealth of monetary data to clients and most of the people. Test your financial institution’s web site to see which companies it has that can assist you, from article libraries to budgeting instruments and calculators.

You can too consult financial professionals, both by your financial institution or independently, to assist with duties like establishing funding accounts.

Take note: Not all recommendation is free, and never all recommendation is unbiased, so ask a variety of questions and examine with different sources earlier than accepting what you hear.

Think about much less conventional sources

Not all people has the time or persistence to take a category or poke round on authorities websites. Typically you need data to achieve you the place you’re.

Whereas social media is a swamp of bad advice, you could find individuals who actually know their stuff.

Simply do your due diligence when consulting on-line sources, and all the time take a look at an individual’s {qualifications} and background. Being on social media doesn’t imply somebody is neutral, and having a variety of followers doesn’t imply they’re giving good recommendation.

Comply with private finance websites

MoneyWise isn’t your solely choice, in fact, however we attempt to present easy accessibility to instruments and sources that can assist you grasp important cash issues.

We’re not know-it-alls — in reality, we strive onerous to not develop into know-it-alls. We’re all the time curious and all the time studying, and we wish to take our readers alongside for the trip as we uncover new methods to get essentially the most out of your cash.

In case you’re in search of well-researched articles that gained’t make your eyes glaze over, head over to MoneyWise or join our email newsletter.

What to learn subsequent

This text supplies data solely and shouldn’t be construed as recommendation. It’s supplied with out guarantee of any sort.

Source link