[ad_1]

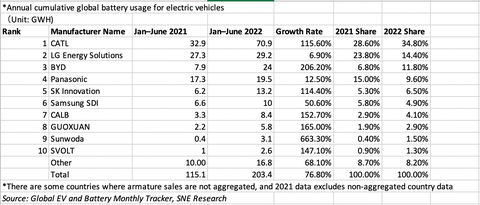

Modern Amperex Expertise Co. Ltd., higher referred to as CATL, is poised to stay the biggest world vendor of batteries for electrical and hybrid vehicles in 2022. The Chinese language firm bought roughly 70.9 gigawatt hours value of batteries by way of the primary half of 2022, marking a 115.6 p.c improve in gross sales relative to the identical interval the yr earlier than, in response to South Korea’s SNE Research.

Established in 2011, CATL shortly entered right into a strategic partnership with BMW. Since then, the corporate with a market cap of practically $1.3 trillion (as of this writing) has entered joint-venture enterprise preparations with Chinese language automobile producers comparable to SAIC Motor, Dongfeng Motor, GAC Group, Geely Auto Group, and FAW Group. CATL additionally provides battery elements to Tesla for automobiles constructed on the automaker’s Shanghai plant.

Electrical Automobile Development

The recognition of battery-electric automobiles continues to develop in China, with BEVs accounting for practically 20 p.c of total passenger-car gross sales by way of the primary half of 2022, per the China Association of Automobile Manufacturers. In reality, greater than double the quantity of battery-electric passenger vehicles have been bought in China by way of June 2022 than throughout the identical interval the yr prior. Plug-in-hybrid automobile gross sales in China, in the meantime, are up greater than 150 p.c in comparison with the primary half of 2021. No shock, then, {that a} Chinese language battery firm is seeing such dominance within the automotive business.

Regardless of its dimension, CATL doesn’t have a single battery manufacturing facility in america. That stated, that is anticipated to alter within the coming years, as the corporate is rumored to be asserting plans to construct a battery manufacturing unit in America within the coming months.

Different High EV Battery Producers

Although People are adopting battery-powered automobiles at a slower charge than Chinese language shoppers, our urge for food for electrical and battery-electric vehicles nonetheless continues to develop. It definitely accounts for a few of LG Vitality Answer’s gross sales success, because the South Korean firm provides battery elements to the likes of Lucid, Porsche, and Tesla. Credit score the latter automaker for a lot of LG Vitality Answer’s progress, as booming gross sales of the Tesla Model 3 and Mannequin Y in Europe and China helped the South Korean firm transfer its batteries into Tesla consumers’ driveways and garages.

LG Vitality Answer can be a key stakeholder in Ultium Cells, a three way partnership between it and Common Motors with a completed manufacturing unit in Warren, Ohio. Moreover, factories in Spring Hill, Tennessee, and Lansing, Michigan, are underway. Ultium batteries at the moment energy the likes of the GMC Hummer EV and Cadillac Lyriq.

Whereas LG Vitality Answer is certain to extend its world battery manufacturing within the coming months and years, its 29.2 gigawatt hours value of batteries bought all through the primary half of the yr is lower than half of what CATL moved. It’s additionally simply 5.2 gigawatt hours greater than what BYD bought throughout this identical interval. BYD’s 24.0 gigawatt hours value of batteries bought within the first half of 2022 marks a jaw-dropping improve of greater than 200 p.c in comparison with what the corporate bought throughout the identical time interval in 2021.

Like CATL, BYD is a Chinese language firm, although BYD additionally occurs to make battery-electric automobiles of its personal. In reality, the corporate’s automotive division not produces automobiles with internal-combustion engines. BYD’s passenger vehicles are at the moment unavailable in America; nonetheless, the corporate does promote a battery-electric bus on our shores.

Whereas Chinese language battery producers noticed important will increase in gigawatt-hour gross sales within the first half of 2022, Japanese ones “present progress charges under the market common and proceed to say no,” per SNE Analysis. Panasonic took prime honors amongst Japan’s automotive battery builders with its 19.5 gigawatt hours value of gross sales by way of the primary six months of 2022. Regardless of this marking a 12.5 p.c improve relative to the identical interval final yr, this determine leaves Panasonic holding only a 9.6 p.c share of the market—5.4 p.c lower than it held within the first half of 2021.

Even so, Panasonic is poised to stay a serious automotive battery provider because of its long-standing relationship with Tesla. The 2 firms collectively function a battery factory in Sparks, Nevada. Panasonic plans to open one other battery manufacturing facility in Kansas earlier than the center of the last decade too.

Mixed, CATL, LG Vitality Answer, BYD, and Panasonic make up greater than 70 p.c of the worldwide market share of automotive battery gross sales within the first six months of 2022, with a complete of 143.6 gigawatt hours value of batteries bought. The remaining six firms that make up the highest 10 world automotive battery sellers within the first half of 2021 (SK Innovation, Samsung SDI, CALB, Guoxuan, Sunwoda, and Svolt), account for 21.2 p.c of the worldwide market. In the meantime, all different battery producers account for simply 8.2 p.c of the worldwide market.

With world demand for battery-powered automobiles persevering with to surge, it is sure all the automotive-battery business will witness a notable improve within the gigawatt hours value of batteries it sells globally within the coming years. Solely time will inform simply how lengthy CATL continues to take gold as the biggest world producer and vendor of automotive batteries. Regardless of which battery producer finally finally ends up on prime within the years to return, we wager the highest 10 positions for world gross sales dominance on this business will routinely shift as client pursuits evolve, extra electric-powered vehicles enter {the marketplace}, and extra firms be a part of the battery-building enterprise.

Source link