[ad_1]

“Europe will likely be solid in disaster and would be the sum of the options adopted for these crises.” These phrases from the memoirs of Jean Monnet, one of many architects of European integration, echo at present, as Russia closes its essential gasoline pipeline. That is certainly now a disaster. Whether or not Monnet’s optimistic perspective prevails, we have no idea. However Vladimir Putin has assaulted the rules on which postwar Europe was constructed. He merely must be resisted.

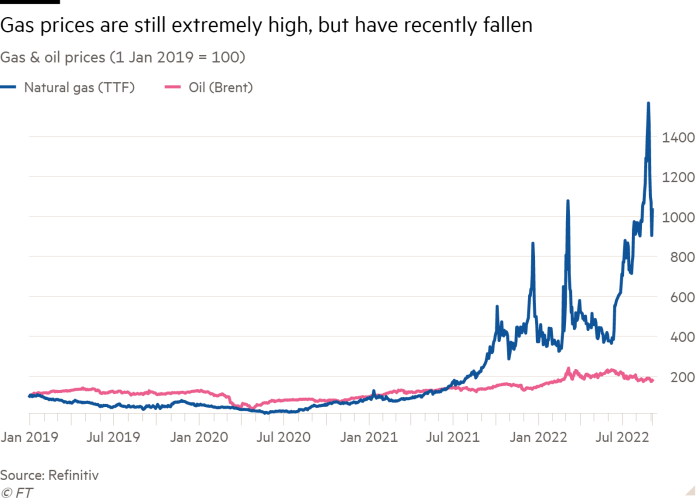

Power is a crucial entrance in his warfare. Will probably be expensive to win this battle. But Europe can and should free itself from Russia’s chokehold. This isn’t to underestimate the problem. Capital Economics argues that at at present’s costs the worsening of the phrases of commerce would quantity to as a lot as 5.3 per cent of Italy’s gross home product over a yr and three.3 per cent of Germany’s. These losses are greater than both of the 2 oil shocks of the Nineteen Seventies. Furthermore, this ignores the disruption to industrial exercise and the influence of hovering vitality costs on poorer households.

It’s inevitable, too, that sharply rising vitality costs will result in excessive inflation. The expertise of the Nineteen Seventies signifies that one of the best response is to maintain inflation firmly below management, because the Bundesbank then did, moderately than enable determined makes an attempt to stop the inevitable reductions in actual incomes to show into a unbroken wage-price spiral. But this mixture of huge losses in actual incomes with lower than totally accommodative financial coverage signifies that a recession is inevitable.

Tough although the longer term appears to be like, there may be additionally hope. As Chris Giles has written: “There’s nearly no method to escape a Europe-wide recession, however it want be neither deep nor extended.” The chance of a recession has in all probability risen additional since then. However work by IMF workers reveals that substantial adjustment is possible, even within the brief run. In the long term, Europe can dispense with Russian gasoline. Putin will lose if Europe can solely maintain on.

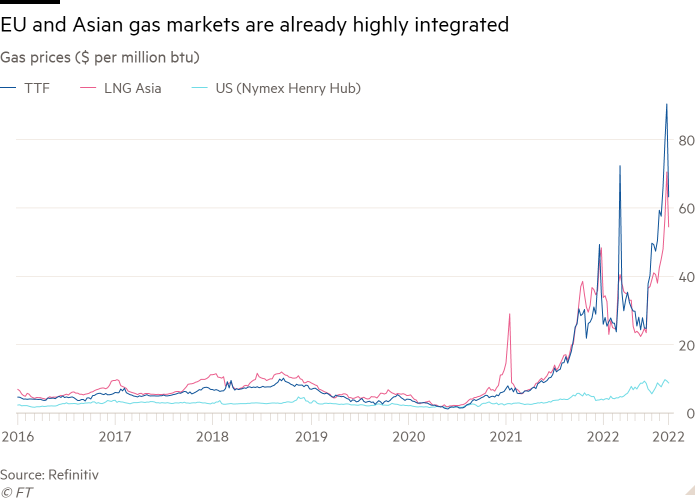

A latest paper from the IMF factors to the potential position of the worldwide liquefied pure gasoline market in cushioning the shock to Europe. European integration inside world LNG markets is imperfect, however substantial.

The paper concludes {that a} Russian shut-off would result in a decline in EU gross nationwide expenditure of solely about 0.4 per cent a yr after the shock, as soon as one takes the worldwide LNG market into consideration. With out the latter, the decline can be between 1.4 and a pair of.5 per cent. However the former, whereas much better for Europe, would additionally imply increased costs elsewhere, particularly in Asia. The estimated fall of 0.4 per cent additionally ignores demand-side results and assumes full integration of world markets. For these and different causes, the precise influence will certainly be far better.

One other IMF paper means that, with uncertainty added, Germany’s GDP could possibly be 1.5 per cent beneath baseline in 2022, 2.7 per cent in 2023 and 0.4 per cent in 2024. IMF work on particular person EU nations additionally concludes that Germany wouldn’t be the worst hit member state. Italy remains to be extra weak. However the worst hit are going to be Hungary, the Slovak Republic and Czechia.

The large lesson of the oil shocks of the Nineteen Seventies was that by the mid-Eighties there was a worldwide glut. Market forces will certainly ship the identical consequence in time. The short-term influence may also be manageable. The wanted actions are to cushion the shock on the weak and encourage wanted changes, which could embrace emergency reopening of gasfields.

Ursula von der Leyen, European Fee president, has asserted that the intention of coverage ought to now be to scale back peak electrical energy demand, cap the worth on pipeline gasoline, assist weak shoppers and companies with windfall income from the vitality sector, and help electrical energy producers dealing with liquidity challenges brought on by market volatility. All that is wise, as far as it goes.

An important facet of this disaster is that, like Covid, however not like the monetary disaster, virtually all European nations are adversely affected, with Norway the massive exception. On this case, above all, Germany is among the many most weak. Which means the shock, and so additionally the response, are in widespread: it’s a shared predicament. However it’s also true that particular person members not solely face challenges that differ in severity, but in addition possess considerably completely different fiscal capability. If the eurozone is to get by way of this problem efficiently, the query of sharing fiscal sources will once more come up. It should finally be unsustainable to anticipate the European Central Financial institution to be the principle fiscal backstop in such a disaster. But if weaker nations have been to be deserted, the political penalties can be dire.

At the least two additional huge points come up. The narrower one is the position of the UK below its new prime minister, Liz Truss. She has an instantaneous selection: to fix the nation’s fences with its European allies in response to the shared menace of Putin, or to interrupt the treaty her predecessor made to “get Brexit performed”. Europeans will rightly neither neglect nor forgive if she chooses the latter on this hour of want.

The second and much greater challenge is local weather change. As Fatih Birol of the Worldwide Power Company writes, this isn’t a “clear vitality disaster”, however the reverse. We’d like way more clear energy, each due to local weather dangers and to scale back reliance on unreliable suppliers of fossil fuels. We learnt this lesson within the Nineteen Seventies. We’re studying it once more. The case for an vitality revolution has grow to be stronger, not weaker.

How Europe responds to this disaster will form its quick and longer-term future. It should resist Putin’s blackmail. It should alter, co-operate and endure. That’s the coronary heart of the matter.

[ad_2]

Source link