[ad_1]

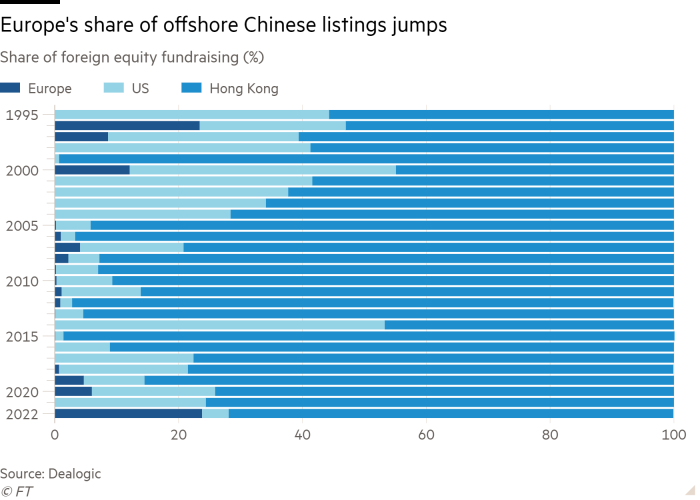

Chinese language firms have raised greater than 5 instances as a lot cash by share gross sales in Europe than the US this yr, as exchanges in London and Zurich profit from fraying geopolitical ties between the superpowers.

The fundraising haul marks the primary time that Chinese language company dealmaking in Europe has exceeded that in New York. It underscores the excessive stakes of a landmark audit inspection agreement between Beijing and Washington, which can be examined this month because the destiny of about 200 Chinese language firms’ listings on Wall Road hangs within the steadiness.

5 Chinese language firms have raised greater than $2.1bn on inventory exchanges in Zurich and London this yr, based on knowledge from Dealogic. By comparability, lower than $400mn in whole has been raised from listings in New York.

Zurich, particularly, has benefited from a brand new “inventory join” scheme with mainland Chinese language exchanges and its much less demanding necessities over the transparency of firm audits.

Chinese language listings on Wall Road, which raised $12.4bn within the first half of final yr, had been successfully shuttered in July 2021, when regulators in Beijing focused ride-hailing app Didi Chuxing over cyber safety breaches simply days after its $4.4bn preliminary public providing. By the point it delisted from the New York Inventory Alternate 11 months later, Didi’s market worth had fallen by about 80 per cent.

The incident additional soured a long-running dispute over US regulators’ entry to Chinese language audit recordsdata, which may result in Washington banning buying and selling in all Chinese language firms in 2024.

Beijing has launched an overhaul of guidelines for Chinese language firms itemizing abroad and cracked down on sectors from know-how to schooling, including to bearish sentiment amongst world traders.

The regulatory escalation has additionally damped Chinese language company fundraising in Hong Kong. IPOs within the Chinese language territory are at their lowest level in two decades, with a whole lot of firms given the inexperienced gentle to listing within the metropolis delaying or abandoning their plans.

Nevertheless, Hong Kong was nonetheless China’s largest offshore market with IPO fundraising totalling $6.6bn this yr, which is about 80 per cent decrease than a yr in the past.

The push of offers on European inventory exchanges is a results of “Chinese language regulators saying the US dialogue is ongoing, the Hong Kong market is small, so let’s have a look at the European market — London, Switzerland and Germany”, mentioned a associate at a world legislation agency in China that had labored on Chinese language IPOs in Europe this yr.

In July, exchanges in Shanghai and Shenzhen signed a deal for Chinese language firms to hold out secondary listings on the SIX Swiss change through a “inventory join” scheme. 4 Chinese language firms have raised $1.5bn for the reason that scheme was launched.

Chinese language monetary teams have additionally been increasing their footprint in Europe’s monetary centres. In June, the UK arm of CICC, a state-run funding financial institution, grew to become the primary Chinese language member of the Swiss change, and final month, the chief govt of Huatai Securities, China’s second-largest dealer, mentioned the corporate deliberate to acquire licences to run fairness offers in Zurich and Frankfurt.

There was one new Chinese language itemizing in London this yr. The UK capital has the same “join” scheme with Shanghai and hosted a secondary share sale for Ming Yang Good Vitality in July that raised virtually $660mn. Qingdao Haier, the electronics producer, raised about $330mn in Frankfurt in 2018.

“Listings in Zurich and Frankfurt present Chinese language issuers’ rising potential to entry continental traders extra straight,” mentioned Jason Elder, associate at legislation agency Mayer Brown in Hong Kong.

Nevertheless, he cautioned that the European share gross sales had been unlikely to rival the movement of dealmaking by Chinese language teams in New York, which raised greater than $100bn from share gross sales on Wall Road over the previous twenty years.

“I don’t see the inventory join offers in Europe as being in the identical vein as what you get within the US,” mentioned Elder.

An individual concerned in establishing the inventory join scheme between China and Switzerland mentioned the association was enticing to Beijing as a result of it didn’t power Chinese language firms to make their audit recordsdata obtainable to Swiss regulators, in distinction to regulatory requirements within the US.

Officers from the Public Firm Accounting Oversight Board, the US accounting regulator, will journey to Hong Kong in mid-September to look at the audit working recordsdata of a number of Chinese language firms listed in New York, together with Jack Ma’s Alibaba and Yum China, which owns the KFC and Pizza Hut manufacturers in China.

The PCAOB will decide on the finish of the yr whether or not China is compliant with US audit disclosure laws. Chinese language firms can be delisted from the US in 2024 if they’re dominated non-compliant this and subsequent yr.

This text has been amended to mirror the truth that Chinese language firms have raised simply over 5 instances as a lot cash by share gross sales in Europe than the US this yr

Source link