[ad_1]

Will Ross and William Steenbergen have been AI researchers at Stanford engaged on local weather and atmospheric modeling and reinforcement studying, respectively, after they started to collaborate on wildfire modeling and hurricane modeling initiatives for the insurance coverage business. They have been shocked to learn the way huge of a distinction there was between what the info advised insurers to do and what carriers have been truly doing, in keeping with Ross. After finding out the issue, Steenbergen and Ross launched Federato to offer insurers a unified view of knowledge to pick and worth dangers.

Now, Federato is elevating new capital to develop the enterprise. Emergence Capital led a $15 million Sequence A spherical within the firm, which just lately closed with participation from traders, together with Caffeinated Capital and Pear. A portion of the money will go towards increasing headcount, Ross advised TechCrunch through e mail, from Federato’s present 23 workers to 50 by the tip of the yr.

The best way Ross sees it, the insurance coverage business faces three main challenges at this time: climate-related will increase in pure disasters; “loss uncertainty” in insurance coverage dangers, together with state-sponsored cyberattacks and ransomware; and payout inflation brought on by verdicts in opposition to insurers in a litigious surroundings. He pointed to Russia sponsoring cyberattacks on U.S. companies, which could or won’t be lined below the “battle exclusion” clauses typical in cyber insurance policies, and up to date rulings associated to the opioid disaster, accidents involving business vans and asbestos that increase questions on whether or not firms needs to be allowed to switch dangers.

“Many insurers come to Federato in search of a software to assist create operational efficiencies, one thing the unified underwriting workflow aspect of the platform does very nicely,” Ross mentioned. “The fact is, they find yourself shopping for as a result of they arrive to grasp the worth of the reinforcement studying pushed strategy to portfolio administration, which offers invaluable insights for managing portfolio threat, balancing and rising their guide of enterprise.”

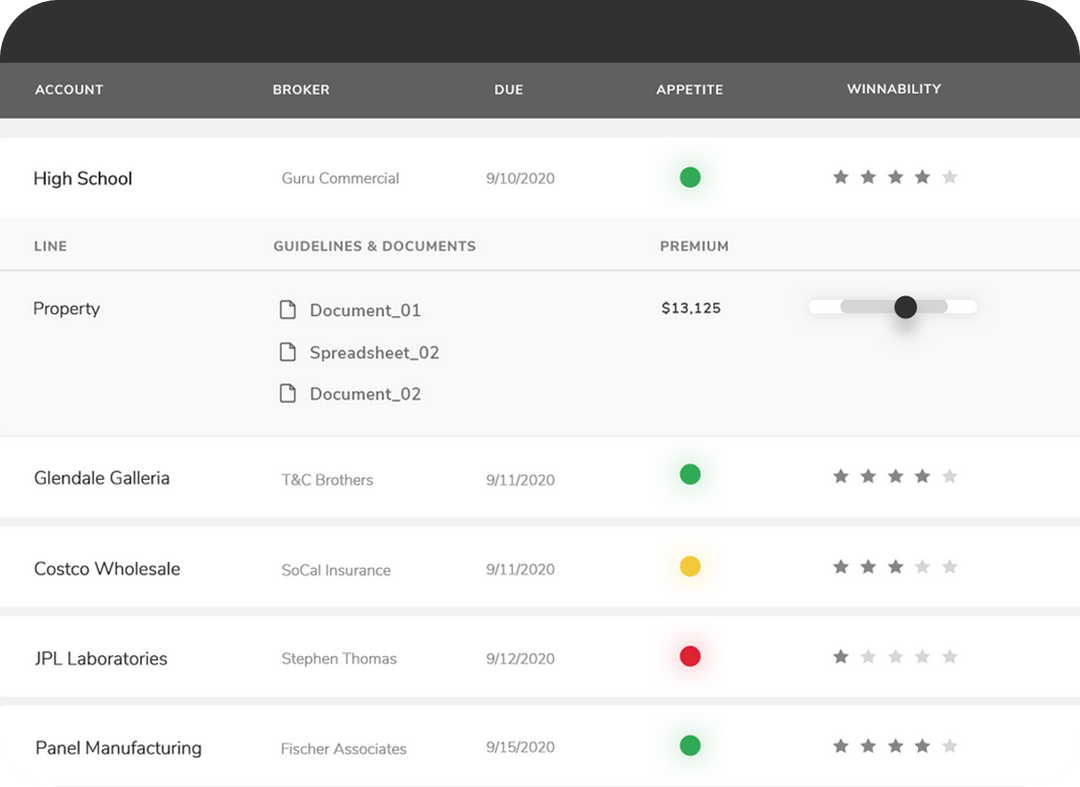

Utilizing the platform, prospects — primarily insurers — can visually monitor threat and handle their coverage portfolios, leveraging workflows geared toward minimizing the necessity for handbook duties like trying to find threat knowledge and arising with underwriting steerage.

Picture Credit: Federato

Federato additionally claims to make use of machine studying, creating a standard framework for portfolio administration whereas making certain it’s optimized to every group’s constraints. The platform makes use of a “mathematical illustration” of underwriting methods to establish tendencies, Ross says, fine-tuning from there as needed.

“[T]he fantastic thing about Federato’s strategy is that every one of its buyer contracts are fairly clear that it doesn’t share or pool prospects’ proprietary info,” Ross defined. “[Any] meta-learning that happens primarily based on very-high-level utilization knowledge nonetheless permits for some degree of moat to be developed, however prospects know that their buyer knowledge and loss expertise is just not being shared.”

Ross positions Federato as a substitute for in-house companies suppliers like Accenture and EY, in addition to legacy distributors akin to FirstBest and Pegasystems. He declined to reveal what number of prospects the startup presently has, however he recognized a number of by title, together with Insurate, QBE North America and Propeller Bonds.

Ross says that Federato will possible break even by way of money movement within the second half of this yr.

“The property and casualty insurance coverage business is in a uniquely countercyclical second as inflation and excessive rates of interest imply that property and casualty shares are literally up during the last six months, whereas different industries are struggling,” Ross assist. “That dynamic, mixed with a higher emphasis on expertise (the Nice Resignation) and digital instruments and workflows because of the pandemic (the transfer to distant work), has truly accelerated Federato’s progress … Previous to the pandemic, insurance coverage was closely reliant on handbook processes — and it nonetheless is.”

Source link