First main Wall Avenue financial institution to name a U.S. recession says ‘the pessimists will sadly prevail’

[ad_1]

Deutsche Financial institution, which grew to become the primary main Wall Avenue financial institution to forecast a U.S. recession in April, is working by its checklist of execs and cons for why the world’s largest economic system may obtain a gentle touchdown — and coming to the conclusion that it gained’t.

“Our view is that the pessimists will sadly prevail on this event,” Henry Allen, a Deutsche Financial institution analysis analyst, wrote in a word launched quickly after Tuesday’s launch of the August consumer-price index, which confirmed inflation spreading extra broadly regardless of falling gasoline costs. One of many greatest causes is that the total influence of the Federal Reserve’s string of rate of interest hikes gained’t be felt for a yr, or till 2023, Allen mentioned.

Monetary markets had been reeling after the August CPI knowledge was revealed which contained indicators of inflation spreading additional into companies and got here in greater than each economists and merchants had anticipated, at an annual headline fee of 8.3%. The Dow industrials

DJIA,

dropped greater than 800 factors in morning buying and selling, falling alongside the S&P 500

SPX,

and the Nasdaq Composite

COMP,

In the meantime, traders offered off Treasurys, sending the policy-sensitive 2-year yield

TMUBMUSD02Y,

to a recent 2007 excessive, and merchants boosted their expectations for an additional aggressive Fed fee hike in November.

“Cussed inflation pressures are prone to drive the Fed to show up the warmth on its tightening marketing campaign, which places the broader economic system at additional threat of a fabric downturn/recession inside the subsequent yr,” mentioned Jason Pleasure, chief funding officer of personal wealth at Glenmede, which manages $40.2 billion in belongings. “In recognition of those uncertainties, traders ought to keep an underweight threat posture, notably given the premium valuations nonetheless prevalent in fairness markets,” Pleasure wrote in a word.

In April, Deutsche Financial institution

DB,

based mostly in Frankfurt, Germany, grew to become the first major Wall Avenue financial institution to foretell a U.S. recession, citing inflation psychology that had shifted considerably and long-term expectations that had been liable to coming unanchored. It continued to see downside risks to its personal pessimistic outlook that month, and has referred to as itself “the intense outlier on the road.” In June, Deutsche Financial institution additionally mentioned it noticed an opportunity that inflation would fail to decelerate.

Right here is Deutsche Financial institution’s checklist of causes for why a tough touchdown continues to be forward for the U.S. economic system, regardless of hopes that offer chains and the labor market are starting to normalize.

Table of Contents

Financial coverage lags

Fed fee hikes function with a lag of roughly a yr, which means that the majority of the central financial institution’s rate-hike marketing campaign nonetheless hasn’t labored its means by the U.S. economic system but.

To make certain, interest-rate-sensitive sectors like housing are already feeling the consequences of Fed fee hikes, with the Nationwide Affiliation of Residence Builders’ market index plummeting in latest months, and an index of pending gross sales close to certainly one of its lowest ranges in additional than a decade, Allen wrote. However these results are anticipated to develop into extra distinguished over the months to come back.

Fed officers are broadly anticipated to carry their important coverage fee goal once more subsequent week to between 3% and three.25%, from a present stage of two.25% and a pair of.5%. Merchants additionally now see a 50% likelihood they’ll hike charges to between 3.75% and 4% by November, up from a 14% probability seen on Monday.

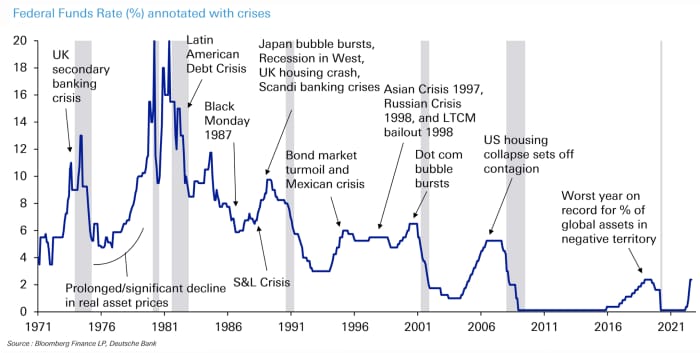

The chart beneath exhibits how Fed tightening cycles have coincided with main disaster someplace on the planet.

Supply: Bloomberg, Deutsche Financial institution

Tight labor market

The tight U.S. labor market has typically been cited by optimists as the largest purpose that the world’s largest economic system can keep away from a downturn, given the widespread availability of jobs and continued demand for staff. Nevertheless, Deutsche Financial institution’s Allen mentioned the “extremely” tight labor market will make it tougher to curb inflation and will even “necessitate extra fee hikes.”

The variety of vacancies per unemployed employee is simply shy of the document reached in March, and broad-based labor-force participation past simply prime-age staff stays a full proportion level beneath its pre-Covid ranges, the analysis analyst mentioned.

“There’s additionally no precedent for managing to chill down the labour market by solely lowering vacancies and not using a rise in unemployment,” he wrote.

Recession indicators are ‘flashing pink’

The unfold between the 2- and 10-year Treasury yields

TMUBMUSD10Y,

lengthy seen as a dependable harbinger of a recession, first inverted this yr in March and stays deeply damaging, at minus 31 foundation factors on Tuesday after the CPI report.

That a part of the curve has inverted prior to every one of many final 10 U.S. recessions and, based mostly on historic averages of how lengthy it takes for a downturn to materialize, a recession might arrive by the second half of subsequent yr, Allen mentioned.

Inflation outliers

Current declines in inflation, which gave some hope that elevated value beneficial properties is perhaps turning a nook, had been pushed by what Allen calls “outliers” quite than broad-based strikes. That was the case for the August and July CPI, which each mirrored decrease vitality costs. Power costs are usually unstable anyway and are sometimes excluded by coverage makers once they attempt to decide the place inflation might go from right here.

Conclusions

Primarily based on how far the Fed has deviated from each its price-stability and most employment mandates over time, no gentle touchdown has ever been achieved, in line with Deutsche Financial institution.

“We very a lot hope we’re fallacious right here, however given the difficulties the economic system is ready to come across into 2023 because the lagged results of fee hikes kick in, a gentle touchdown might be very difficult to keep away from,” Allen mentioned. “Specifically, the empirical proof exhibits that the type of gentle touchdown individuals are hoping for has by no means occurred earlier than from a place like the current one with inflation properly above goal and a really tight labour market.”

Source link