[ad_1]

There’s little question, Wall Avenue didn’t like Fed Chair Jerome Powell’s Jackson Gap speech. The markets tumbled after Powell pressured the central financial institution is dedicated to taming inflation and can implement one other 75bp hike if that’s what is required to get the job carried out.

The markets may need thrown the toys out of the pram, however whereas cognizant of a bearish situation, Goldman Sachs’ chief economist Jan Hatzius isn’t overly involved, preferring to deal with Powell’s much less hawkish commentary.

“We proceed to anticipate the FOMC to sluggish the tempo from right here, delivering a 50bp hike in September and 25bp hikes in November and December, for a terminal fee of three.25-3.5%. Nevertheless, further CPI and employment reviews shall be accessible by the September assembly, and Powell pressured that the choice will ‘rely upon the totality of the incoming knowledge and the evolving outlook,’” the economist defined. “We see the dangers to each the near-term tempo and our terminal fee forecast as tilted to the upside.”

Upside is definitely on the menu for a pair of shares Goldman Sachs is bullish on proper now – the agency’s analyst Kash Rangan has pinpointed two names which he thinks have not less than 100% development on the menu for the approaching months. We’ve used the TipRanks platform to learn the way different Wall Avenue consultants assume the following yr will pan out for these shares.

Splunk (SPLK)

The primary Goldman decide we’ll have a look at is Splunk, a giant knowledge analytics firm. Splunk offers companies with the instruments to get insights from enormous troves of information. The info can be utilized to tell enterprise choices and assist operations run easily. The corporate is a recognized chief in IT operations and safety, has an put in base of greater than 20,000 clients, and boasts differentiated tech and a robust monitor file of innovation.

All which may be true, however Splunk has not been proof against the financial downturn, as was evident when the corporate delivered FQ2 earnings (July quarter) just lately.

That’s to not say the report itself was a dud. The corporate’s income elevated by 32% year-over-year to succeed in $798.75 million, whereas beating the analysts’ expectation for $747.7 million. EPS of $0.09 additionally fared much better than the lack of $0.35 per share Wall Avenue predicted.

Nevertheless, shares took a battering within the post-earnings session on account of the corporate’s disappointing outlook. Annual recurring income (ARR) – a key metric within the software program area – is now anticipated to succeed in $3.65 billion this yr, down from the prior forecast of $3.9 billion. Additional souring sentiment, the corporate now sees this yr’s cloud annual recurring income hitting $1.8 billion, additionally beneath the earlier outlook of $2 billion.

Traders had been fast to point out their disappointment, which Goldman’s Kash Rangan believes is “legitimate.” Nevertheless, the lowered outlook doesn’t alter the long-term thesis in any method.

“We’re bullish on Splunk’s quickly scaling cloud enterprise, important perpetual license and Non-Cloud ARR renewal alternative, long-term fundamentals and enhanced worth proposition exiting COVID. Furthermore, Splunk is a horny asset with a novel and strategic worth proposition,” Rangan opined

“We stay optimistic on the long-term upside as the corporate efficiently navigates the cloud transition underneath the course of the brand new CEO. Moreover, approaching the Rule of 40 (income development + free money movement margin) in FY23 may drive the inventory into a better valuation territory,” Rangan added.

These feedback underpin Rangan’s Purchase score whereas his $200 value goal makes room for one-year good points of a hefty 114%. (To observe Rangan’s monitor file, click here)

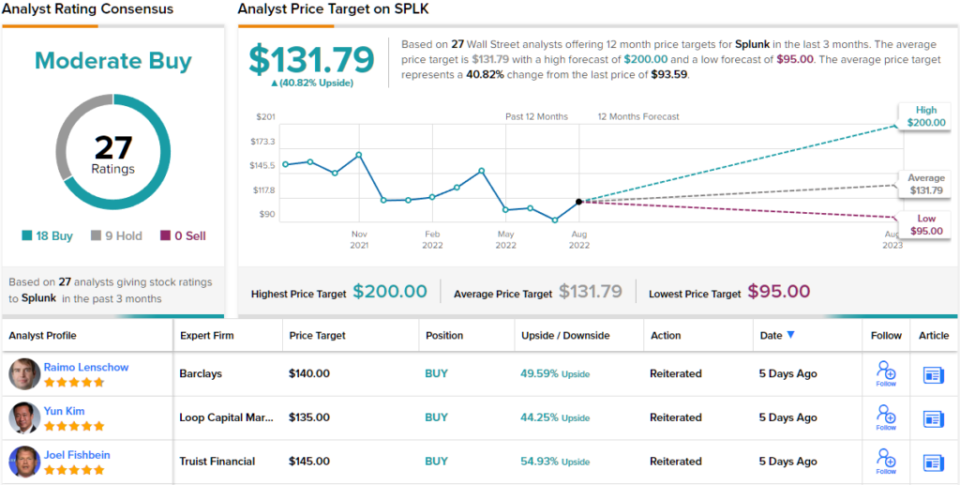

Splunk will get quite a lot of protection on Wall Avenue; over the previous 3 months there have been 27 analyst opinions, tilting 18 to 9 in favor of Buys over Holds, all leading to a Reasonable Purchase consensus score. Going by the $131.79 value goal, the shares are anticipated to see ~41% development over the next months. (See Splunk stock forecast on TipRanks)

Salesforce (CRM)

Within the sector of cloud-based buyer relationship administration software program, Salesforce is a market chief, constructing and creating its merchandise for enterprises. Its product portfolio spans throughout gross sales, advertising, analytics, synthetic intelligence, e-commerce, buyer purposes, integration and collaboration. In truth, it virtually covers all sides of the continuing development of digital transformation. In keeping with the corporate, the TAM (whole addressable market) for its mixed companies by FY26 ought to attain $284 billion.

As has develop into de rigueur, Salesforce delivered one other robust set of leads to its just lately launched second quarter fiscal 2023 report (July quarter).

Income clocked in at $7.72 billion, amounting to a 22% enchancment vs. the identical interval final yr, whereas additionally trumping the consensus estimate of $7.69 billion. The corporate beat expectations on the bottom-line too, as adj. EPS of $1.19 got here in forward of the Avenue’s name for $1.02 per share.

Nevertheless, regardless of the robust headline metrics, the report didn’t please traders; like many others within the present atmosphere, Salesforce has needed to tame expectations for the remainder of the yr. The corporate diminished its full-year income forecast to the vary between $30.9 billion and $31 billion. Beforehand, the corporate has guided for income between $31.7 billion to $31.8 billion.

Whereas shares trended south within the post-earnings session, Goldman’s Rangan thinks the response was unmerited and he sees loads of causes to remain bullish.

“Salesforce stays positioned to capitalize on various secular traits driving development inside the firm’s giant and increasing TAM,” the analyst wrote. “In our view, the corporate stays broadly positioned to capitalize on digital transformation as corporations look to kind extra holistic views of their clients. We see continued room for enchancment in unit economics, as the corporate’s giant put in base and expansive portfolio throughout a number of product classes place the corporate to broaden share of pockets inside clients’ general IT budgets.”

To this finish, Rangan charges CRM a Purchase together with a $320 value goal. What’s in it for traders? Upside of a sturdy 100%.

Tech shares have a tendency to draw quite a lot of consideration, and Salesforce isn’t any exception – the inventory has 35 analyst opinions on file, and so they embody 30 Buys in opposition to simply 4 Holds and 1 Promote to offer the corporate its Sturdy Purchase consensus advice. Whereas the common goal isn’t fairly as upbeat as Rangan’s, at $227.67, traders may very well be sitting on returns of 42% in a yr’s time. (See Salesforce stock forecast on TipRanks)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Best Stocks to Buy, a newly launched software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analyst. The content material is meant for use for informational functions solely. It is rather vital to do your personal evaluation earlier than making any funding.

Source link