Kenyan fintech Pezesha raises $11M backed by Girls’s World Banking, Cardano mother or father IOG – TechCrunch

[ad_1]

Entry to finance stays a key progress constraint for small companies, with data exhibiting a $330 billion financing deficit for the small enterprises that make up 90% of Africa’s companies.

That is the hole that Kenya’s embedded finance fintech Pezesha seeks to bridge because it expands into Nigeria, Rwanda and Francophone Africa following a $11 million pre-Sequence A equity-debt spherical led by Girls’s World Banking Capital Companions II with participation from Verdant Frontiers Fintech Fund, cFund and Cardano blockchain builder Enter Output International (IOG). The spherical additionally included a $5 million debt from Talanton and Verdant Capital Specialist Funds.

The fintech’s new progress technique follows its plan to energy its embedded finance providing past its present markets together with Uganda and Ghana, to bridge the financing hole affecting thousands and thousands of micro, small medium-sized enterprises (MSMEs) throughout these markets.

Based in 2017 by Hilda Moraa, Pezesha has constructed a scalable digital lending infrastructure that enables each conventional and non-traditional finance establishments to supply working capital to MSMEs.

“The chance and influence in fixing working capital issues for SMEs is big. [We are] fixing the foundation trigger, which is info asymmetry points, to make sure high quality and accountable borrowing. Pezesha solves this by our sturdy API pushed credit score scoring know-how,” Moraa, additionally the CEO, advised TechCrunch.

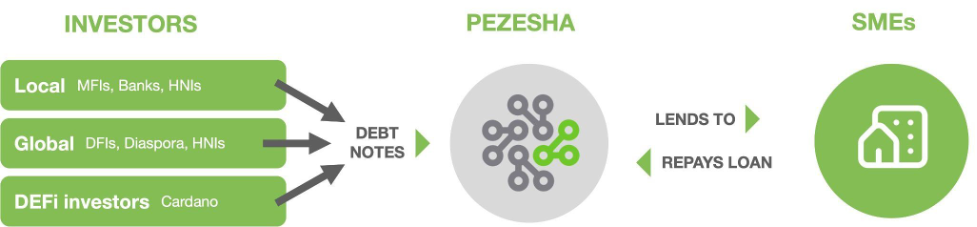

Pezesha is tapping native and worldwide banking establishments, HNWIs and DeFi for added liquidity for onward lending. Picture Credit: Pezesha

The fintech works with accomplice corporations reminiscent of Twiga and MarketForce, which combine its credit score scoring APIs of their platforms to allow their prospects get actual time mortgage gives.

Pezesha stated it’s at the moment working with over 20 accomplice corporations which have enabled it to increase loans to over 100,000 companies thus far. It expects this quantity to develop earlier than the top of the 12 months as a further 10 corporations combine with its infrastructure. The fintech is ready to prolong loans of as much as $10,000 at single digit rates of interest, and a compensation interval of 1 12 months.

Pezesha plans to create a $100 million financing alternative every year for companies by tapping native and worldwide banking establishments, excessive net-worth people and decentralized finance.

“We’re constructing for the longer term and this implies tapping new improvements for added liquidity that enables us to supply inexpensive loans to SMEs,” stated Moraa, a two-time founder, who began Pezesha after efficiently exiting Weza Tele in 2015.

Charles Hoskinson, the co-founder of IOG and Cardano, whereas commenting on their funding in Pezesha stated in an announcement that, “Facilitating the motion of capital into rising markets to assist financial progress and job creation is a core promise of blockchain and cryptocurrencies. Our imaginative and prescient is centered on utilizing know-how to make it simpler for individuals throughout the globe to borrow and lend to one another in a regulated method. This funding in Pezesha is a vital milestone, and we’re excited to be part of their progress story.”

The IOG’s funding into Pezesha follows an earlier announcement that the 2 corporations had partnered to construct a peer-to-peer monetary working system for Africa.

Picture Credit: Pezesha

Moraa stated that working with strategic companions like Cardano will open up the debt liquidity market and supply the inexpensive capital vital for the expansion of all sectors of the economic system.

The fintech plans to open up extra lending alternatives for girls entrepreneurs who proceed to be locked out by the formal banking sector.

“Pezesha is devoted to fixing Africa’s working capital drawback by its sturdy lending infrastructure, and this funding will enable them to deepen the vary of monetary merchandise providing particularly to girls owned MSMEs,” stated Christina “CJ” Juhasz, the chief funding officer of Girls’s World Banking Asset Administration.

Pezesha didn’t reveal how a lot it has raised up to now, however Moraa famous that 20% of its preliminary pre-seed funding in 2017 was from native angels. The fintech, which raised seven figures final 12 months, counts Seedstarts, GreenHouse Capital and Consonance Funding Managers, amongst its a number of buyers.

“Now we have the fitting enterprise mannequin, are worthwhile, and proceed to pursue the sort of buyers which are aligned with our objectives and values,” Moraa stated.

[ad_2]

Source link