[ad_1]

Kwasi Kwarteng’s assertion was a borrow and hope Funds on a scale not seen since 1972.

Ditching the Conservatives’ rigorously crafted status for prudence with the general public funds, the brand new chancellor sought to borrow to chop taxes, enhance progress charges and enhance the underlying efficiency of the UK economic system.

In what he termed “a brand new period” that “prioritises progress”, Kwarteng promised the extra borrowing would “launch the big potential of this nation”.

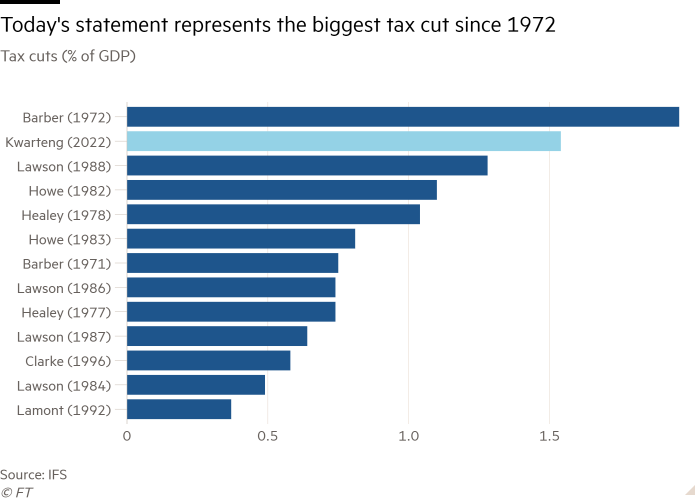

Economists had been in little question in regards to the significance of the assertion, noting that the everlasting cuts in taxes had been the biggest in a Funds since Anthony Barber’s in 1972. Torsten Bell, director of the Decision Basis think-tank, described himself as “awed” that Kwarteng was “completely rejecting not simply Treasury orthodoxy, however Boris Johnson too”.

However most apprehensive that further progress is perhaps non permanent and inflationary, and result in unsustainable public funds.

There is no such thing as a doubt in regards to the scale of further borrowing required. The federal government’s Debt Administration Workplace instantly set out new plans to borrow a further £72bn earlier than subsequent April, elevating the financing remit in 2022-23 to £234bn.

This may cowl the power worth assure for each households and enterprise this winter alongside the extra value of presidency debt, which rose sharply on Wednesday. The everlasting tax cuts, largely coming in subsequent April, will want further financing, which the Institute for Fiscal Research estimated would lead to public borrowing remaining above £100bn a yr into the medium time period.

In these circumstances, public debt would hold rising as a share of nationwide revenue, regardless of Kwarteng’s pledge that “sooner or later” he would present it coming down.

There are a lot of large gambles being made by the chancellor’s new staff on the Treasury. It hopes that borrowing to permit the UK to purchase fuel at inflated costs has little impact apart from to cut back the chance of recession.

It hopes the fiscal stimulus is not going to enhance inflationary strain at a time of full employment. And it’s placing its religion in a lift to the provision facet of the UK economic system that can elevate the underlying fee of progress to 2.5 per cent a yr and thereby gather extra tax revenues.

The extra borrowing may also considerably worsen the UK’s commerce deficit, already at historic highs, and the federal government is relying on this not pulling the rug from below sterling.

Kwarteng’s staff included an “illustrative” desk within the Funds paperwork exhibiting that if the development progress fee was raised 1 proportion level a yr, after 5 years tax revenues could be £47bn increased than earlier than.

Whereas enterprise teams and lots of taxpayers cheered the discount in taxes, the Treasury didn’t present any proof that such a lift within the progress fee could possibly be achieved by the measures introduced.

Economists had been sceptical. Richard Hyde, senior researcher on the Social Market Basis, mentioned the goal of accelerating progress charges was welcome, however “it’s not clear that tax cuts are one of the simplest ways to ship it. The proof of earlier cuts in company tax is that they don’t reliably result in will increase in enterprise funding.”

Because the 2008-09 monetary disaster a number of totally different progress methods, involving increased and decrease taxes, have failed to spice up Britain’s underlying fee of productiveness progress, which has remained low.

The larger rapid fear in monetary markets and the Financial institution of England was that the big quantities of borrowing for spending and tax cuts would supply a sugar rush for progress, creating inflationary strain, increased rates of interest and unsustainable public funds.

Jonathan Haskel, one of many members of the BoE’s Financial Coverage Committee, mentioned on Thursday evening that, “the problem with the fiscal enlargement is we’re doing it within the context of a really tight labour market and difficulties in China, which imply that our provide chains are quite compromised”.

With the BoE already having raised rates of interest to 2.25 per cent on Thursday, Haskel’s feedback confirmed that policymakers on the central financial institution would need no less than partially to offset Kwarteng’s assist for enterprise and households with increased rates of interest.

The priority is that the UK economic system merely can not take the high-pressure increase to demand with out producing inflation. Kwarteng and the Treasury paperwork made no point out of the likelihood that the tax cuts would elevate inflationary strain.

However monetary markets took fright and rapidly priced in increased borrowing prices to finance the UK authorities. The price of authorities borrowing over two years hit 3.9 per cent shortly after the chancellor completed talking, up from 0.4 per cent a yr in the past. There have been related rises throughout the spectrum of presidency borrowing.

Most economists mentioned the Funds was subsequently extremely dangerous and — as a result of increased borrowing prices — unlikely to encourage firms to borrow and make investments.

Ruth Gregory, senior UK economist at Capital Economics, mentioned that until the gamble to spice up the underlying progress fee works, “at the moment’s fiscal bundle simply means extra inflation, increased rates of interest and the next debt ratio sooner or later”.

Source link