[ad_1]

Traders are spending 24% much less time pitch decks in 2022, in comparison with 2021. On common, you will have slightly below three minutes to persuade them to take a gathering with you. In reality, for decks that fail to lift funding, traders quit in simply 2 minutes and 13 seconds. That’s not numerous time to make a primary impression, so that you’ve acquired to make it rely.

It’s fairly uncommon that I get to speak to somebody who’s as huge of a pitch deck nerd as I’m, however after I was lastly capable of nerd out with the analysis lead at DocSend, how may I not? We go deep into what the info tells us about what makes a pitch deck profitable, and indicators for what works much less properly.

The most important development change in how traders are pitch decks is that traders are spending loads much less time on slides total, however the place that point is spent is shifting.

“This yr, we all know that traders are spending much less and fewer time on pitch decks. That’s not essentially shocking: The variety of hyperlinks to pitch decks despatched out has gone up, and the time spent on decks is staying very low,” explains Justin Izzo, analysis lead for DocSend. “What’s shocking to me is that we all know that the product and enterprise mannequin sections of decks are actually the place traders preferred to lean in, particularly for firms on the early phases. However traders have nearly halved their time spent on these sections on the pre-seed degree. Traders are nonetheless giving scrutiny to those sections, however they’re doing it a lot extra rapidly than ever earlier than. So founders have to actually assume deeply about their enterprise, however talk briefly.”

One of many greatest shifts is that traders spend much more time on what DocSend describes as the aim of a startup slide — the “why are you doing this” a part of the story.

“Founders have to actually assume deeply about their enterprise, however talk briefly,” laughs Izzo, “I wish to name it ‘compelling brevity.’ It isn’t straightforward to do, thoughts you, however it’s what founders needs to be striving for.”

The timeline to fundraising varies. This yr, 25% of startups raised in lower than six weeks; 58% raised in lower than 12 weeks; 70% raised in lower than 18 weeks; 90% raised in lower than 24 weeks. Final yr, the tempo was somewhat bit slower. Graph Credit score: DocSend.

The third-longest-viewed part is the Firm Function part (after the product and enterprise mannequin sections), however Izzo factors out that this part is normally solely a really small a part of the slide deck, typically only a line or two of textual content on slides one or two of the deck.

“Often it’s one sentence, a pointed and well-balanced assertion of what the corporate is. We normally see that on the very entrance of the deck, typically on the intro slide. What was surprising to me after I first began our newest dataset, was that over the previous couple of years, it’s been type of middling when it comes to viewing occasions,” says Izzo. “This yr, it actually shot up, and traders are usually utilizing this part as a type of gatekeeper. They wish to know at a look whether or not this firm has a motive to exist earlier than even going via the remainder of the deck.”

That makes numerous sense; a enterprise function assertion is usually formulated as “Venmo for Fundraising” or “Transform customer experiences with human-centered AI” or “Issue-tracking SaaS for Physical Product Developers.” By the way, these are all actual examples from our Pitch Deck Teardown sequence. The good factor is that traders can use these statements to see if the funding would possibly doubtlessly be an excellent match with their investment thesis. In case you don’t spend money on SaaS, or if you happen to don’t care about fintech, or if you happen to couldn’t give a crap about buyer help — that turns into a really fast filter to provide a startup crew a “no,” with no need to go deep on product, crew or market dimension.

“It’s whether or not founders can talk a imaginative and prescient and specificity however what their firm does, in in a compelling means. As a result of if you are able to do that, you already know, you’re hooking traders, you’re exhibiting that there’s this thesis match, after which that will get traders prepared, you already know, primed to learn the remainder of their story,” says Izzo. “And you already know, doing this in a sentence, sentence and a half or one thing like that, is hard to do. However we’re seeing it turns into a lot extra vital for early-stage founders.”

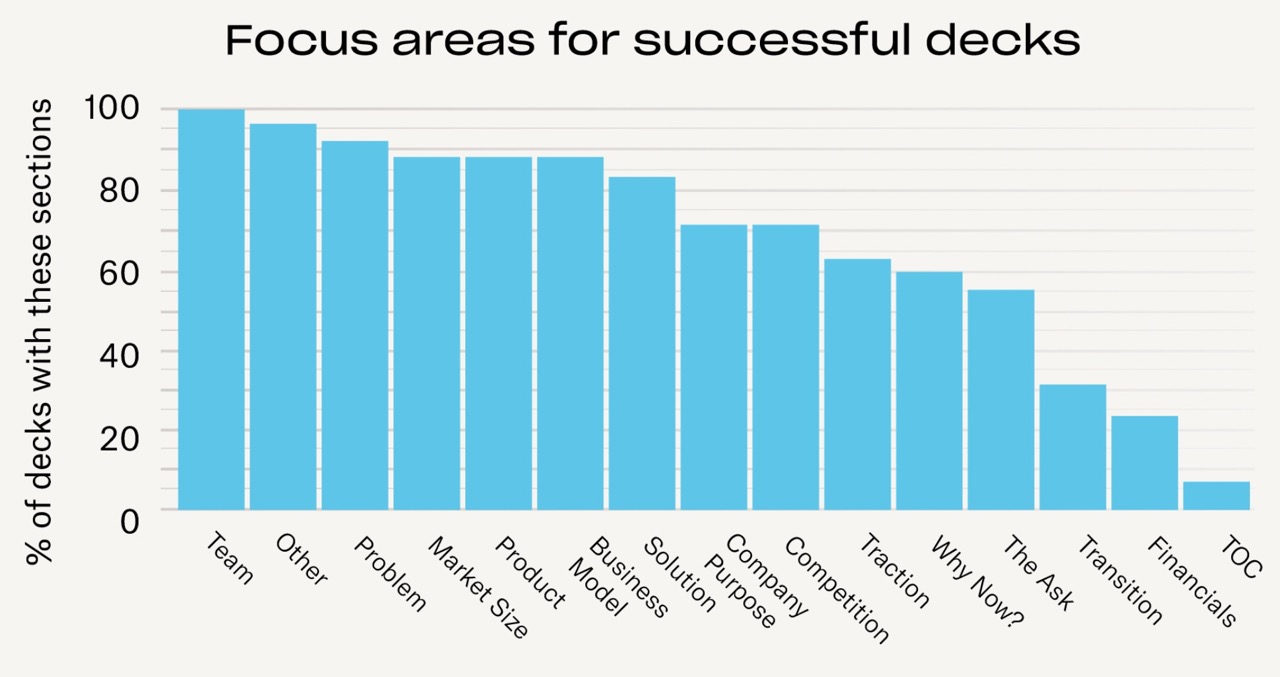

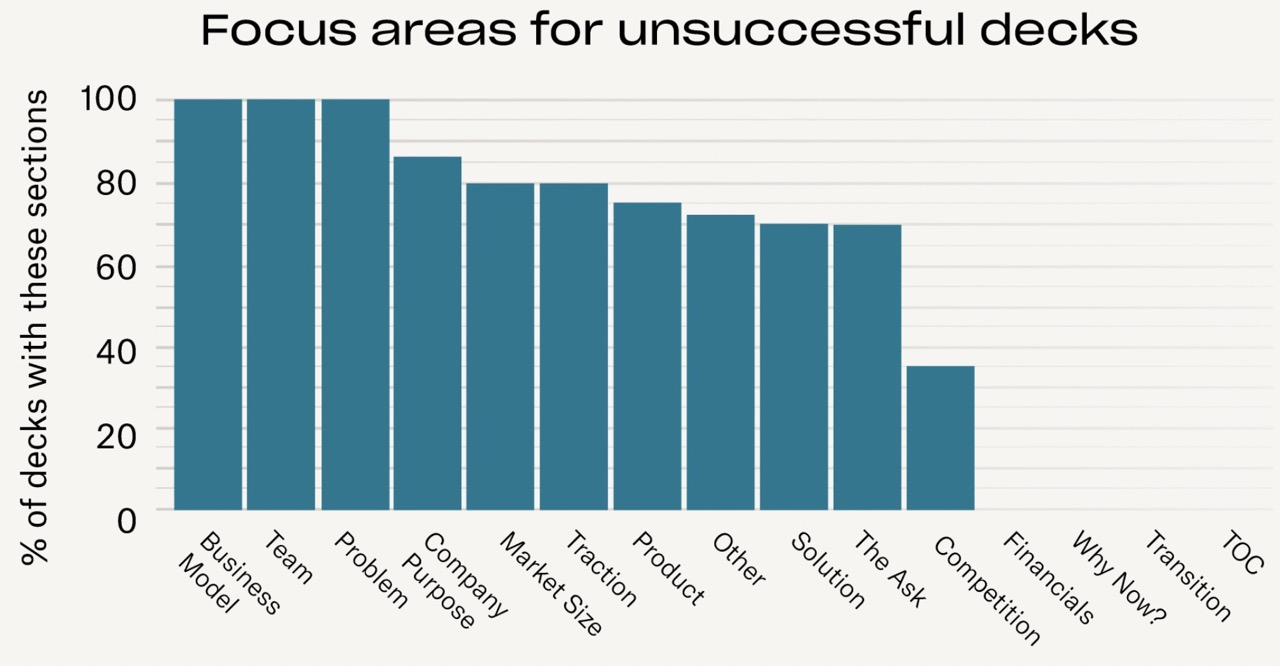

Slides in profitable versus unsuccessful decks

The DocSend crew analyzed 320 decks and checked out which slides had been current in every. The one slide that was out there in 100% of decks, each profitable and unsuccessful, was Staff, however from there, issues begin various a bit.

Profitable Decks. Graph Credit score: DocSend.

Essentially the most attention-grabbing distinction between profitable and unsuccessful decks is the slides which are lacking; I used to be stunned that solely a few quarter of startup decks had financials (belief me on this one, you really need an operating plan), however I used to be unsurprised that not one of the failed decks had financials.

Slides in unsuccessful decks. Graph Credit score: DocSend.

The opposite huge distinction is competitors slides; all decks ought to have an outline overlaying the aggressive panorama.

“The very first thing that’s lacking is usually a contest slide. Founders typically don’t assume to incorporate it, or after they do, they’re utilizing it as a not-so-subtle indicator that there is no such thing as a competitors,” laughs Izzo. “I at all times inform them to incorporate some type of evaluation of different gamers within the discipline, nevertheless you outline that discipline.”

DocSend’s crew created a fundraising playbook of kinds, and a “state of the union” report for fundraising, evaluating the shifts from 2021 to 2022, which makes for an interesting in-depth learn to tell the way you’re your fundraising course of.

Source link