[ad_1]

Two weeks after Nvidia issued a gross sales and margin warning, all eyes are on the quarterly steering that’s anticipated within the firm’s Wednesday earnings report.

Amongst analysts polled by FactSet, the consensus is for Nvidia to report July quarter (fiscal second quarter) income of $6.7 billion, GAAP EPS of $0.35 and non-GAAP EPS of $0.50. The income consensus matches the determine for the quarter given in Nvidia’s August 8 pre-announcement.

For the October quarter — Nvidia sometimes shares quarterly gross sales, margin and expense steering in its reviews — the income consensus stands at $6.91 billion (down 3%).

Eric Jhonsa, Actual Cash’s tech columnist, will likely be live-blogging Nvidia’s earnings, which is anticipated at 4:20 P.M. Japanese Time, together with a convention name with administration that’s scheduled for five P.M.

Please refresh your browser for updates.

5:14 PM ET: Kress notes Nvidia’s stock fees are associated to buy commitments, whereas including Nvidia thinks its long-term gross margin profile is unbroken.

5:13 PM ET: Kress goes over Nvidia’s ongoing Information Heart momentum with hyperscalers. Additionally highlights a latest AI inference win with Pinterest, an AI coaching win with Tesla, (which revealed its proprietary D1 Dojo AI coaching chip final 12 months), and engagements with main server OEMs for its Grace Arm CPU (due in 2023).

5:09 PM ET: Relating to Automotive, Kress says self-driving options have been a selected sturdy level, and that Nvidia thinks FQ2 was “an inflection level” for the section. Notes Nvidia’s Automotive design win pipeline stands at $11B.

5:06 PM ET: Kress notes registered customers for the GeForce Now cloud gaming service now high 20M. Additionally says GeForce GPU sell-through stays 70% above pre-pandemic ranges.

Relating to ProViz (workstation GPU) income, Kress says enterprise demand softened and that OEMs are paring stock.

5:05 PM ET: Kress is speaking. She begins off by going over present Gaming headwinds, noting each unit and ASPs fell for the section through the quarter and that macro points weighed on shopper demand.

She additionally says (according to previous remarks) Nvidia cannot quantify the influence decrease crypto-related demand had on Gaming income.

5:03 PM ET: Nvidia goes over its safe-harbor assertion. Its name sometimes options ready remarks from CFO Colette Kress, after which Kress and CEO Jensen Huang take questions from analysts.

5:01 PM ET: The decision is beginning. Nvidia’s inventory is down 2.8% AH going into it.

4:56 PM ET: The earnings name ought to kick off shortly. Here’s the webcast link, for these seeking to tune in.

4:55 PM ET: FQ2 free money circulate was $824M, down from $1.35B in FQ1 and $2.48B a 12 months earlier. Nvidia ended the quarter with $17B in money/equivalents and $10.9B in debt.

Scroll to Proceed

4:50 PM ET: Amid its stock fees, Nvidia’s stock rose to $3.89B in FQ2 from $3.16B in FQ1 and $2.11B a 12 months earlier.

“Gross stock buy and long-term provide obligations,” a big portion of that are believed to contain foundry companions TSMC and Samsung, totaled $9.22B at quarter’s finish. That is up from $4.79B a 12 months earlier, however down a bit from $9.59B on the finish of FQ1.

4:48 PM ET: Of be aware: Nvidia says its FQ2 Information Heart income +61% to $3.81B) “included $287 million for orders initially scheduled for supply primarily within the third quarter that have been transformed to second-quarter supply with prolonged fee phrases.”

On the similar time, the corporate says “plenty of second-quarter [Data Center] orders will likely be fulfilled within the third quarter given provide chain disruptions.”

4:46 PM ET: Skilled Visualization income (a lot of it entails workstation GPU gross sales) was down 20% Q/Q and 4% Y/Y to $496M. Pocket book workstation GPU gross sales rose, however desktop gross sales fell, “significantly on the excessive finish.”

4:44 PM ET: Nvidia has pulled again a bit: Shares are actually down 2.9% AH to $167.31.

4:42 PM ET: Automotive income, which rose 59% Q/Q and 45% Y/Y to $220M, benefited from increased demand for “self-driving and AI cockpit options,” partly offset by decrease “legacy cockpit” (infotainment SoC) income.

4:40 PM ET: On the intense facet, Nvidia says Information Heart section gross sales to cloud giants (hyperscalers) almost doubled Y/Y. Hyperscalers have been an space of energy for some time, thanks partially to the big AI coaching and inference investments they’re making.

Gross sales to North American hyperscalers additionally rose Q/Q, whereas gross sales to Chinese language hyperscalers fell Q/Q. Gross sales to “vertical industries” shoppers (i.e. enterprises) rose Q/Q and Y/Y by an unspecified quantity.

4:36 PM ET: As indicated in its warning, Nvidia says gaming GPU gross sales have been damage by decrease sell-in to channel companions (i.e. graphics card makers), in addition to “pricing applications with channel companions to deal with difficult market circumstances which are anticipated to persist into the third quarter.”

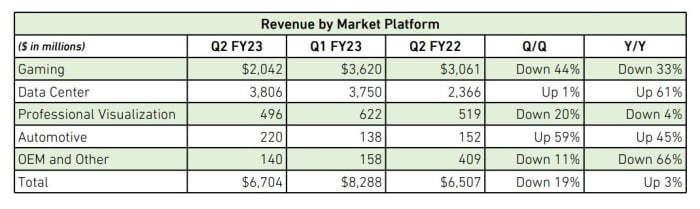

4:34 PM ET: Nvidia’s CFO commentary is up. This is a desk inside it that exhibits segment-level income:

4:30 PM ET: Nvidia notes it spent $3.44B on buybacks/dividends in FQ2, and says it plans to proceed buybacks in FY23 (ends in Jan. ’23).

The “funds associated to repurchases of widespread inventory” line in Nvidia’s cash-flow assertion exhibits $3.35B value of buyback-related funds.

4:26 PM ET: Additionally maybe serving to: The corporate is guiding for an FQ3 non-GAAP gross margin of 65%, plus or minus 50 bps. That means it would not anticipate to take main stock fees through the quarter.

4:25 PM ET: Maybe serving to out Nvidia’s shares: The corporate says that whereas Gaming and Skilled Visualization section income is anticipated to be down Q/Q in FQ3, Information Heart and Automotive income is anticipated to be up.

4:24 PM ET: The FQ3 gross sales information is effectively beneath consensus. However investor expectations have been low following Nvidia’s warning. Shares are actually up down simply 0.6%.

4:22 PM ET: Shares are down 1.9% after-hours.

4:21 PM ET: Outcomes are out. FQ2 income of $6.7B matches consensus. Non-GAAP EPS of $0.51 beats by $0.01.

Nvidia guides for FQ3 income of $5.9B, plus or minus 2%. That is beneath a $6.91B consensus.

4:11 PM ET: One factor to regulate as Nvidia reviews: Whether or not the corporate will likely be taking any extra inventory-related fees in FQ3.

In its warning, Nvidia mentioned it is taking $1.32B value of fees (primarily inventory-related) for FQ2, with the corporate’s GPU buy commitments with foundries believed to be the principle offender. As a result of fees, Nvidia forecast an FQ2 non-GAAP gross margin of simply 46.1% (+/- 50 bps), effectively beneath unique steering of 67.1%.

4:01 PM ET: Nvidia closed up 0.2%. The FQ2 report is anticipated at 4:20 PM ET.

4:00 PM ET: Together with its FQ3 gross sales steering, any commentary Nvidia shares about demand traits for its Gaming and Information Heart segments will likely be carefully watched.

In its warning, the corporate estimated Gaming section gross sales have been down 33% Y/Y in FQ2, because of softer gaming GPU demand and channel stock corrections. On the flip facet, Information Heart income was estimated to be up 61% Y/Y, thanks partially to sturdy server GPU demand from cloud giants.

3:56 PM ET: Forward of the report, Nvidia’s inventory is up 0.7% at this time to $172.90. However shares are nonetheless down 41% YTD, because of broader tech-sector weak point and considerations about gaming GPU demand traits.

3:53 PM ET: The FactSet consensus is for Nvidia to report FQ2 income of $6.7B (according to the quantity given of their warning) and non-GAAP EPS of $0.50.

The FQ3 income consensus stands at $6.91B, although it is potential (given Nvidia’s warning) that casual expectations are decrease.

3:51 PM ET: Hello, that is Eric Jhonsa. I will be live-blogging Nvidia’s earnings report and name.

[ad_2]

Source link