As soon as providing the worst return on Wall Road, money is now wanting like the very best asset to personal, says Morgan Stanley

[ad_1]

Inventory sellers are prepared to choose up the place they left off on Friday, because the market seems to be is waking up from its August slumber with a vengeance.

As Goldman Sach’s chief U.S. fairness strategist David Kostin advised shoppers after the S&P 500

SPX,

took simply 17 weeks to achieve his yr finish goal of 4,300, “upside appears restricted whereas draw back dangers loom.” His concern is that we might be strolling right into a 2000 entice, the place the market declines even after climbing stops if the U.S. enters recession.

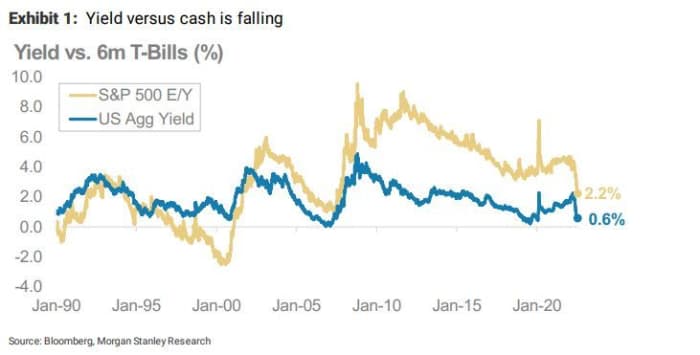

That brings us to our name of the day from Morgan Stanley strategist Andrew Sheets who says traders ought to contemplate money as a viable funding technique, even when that hasn’t appeared like such a profitable proposal up to now.

“Holding money…was an explicitly defensive resolution for a lot of the final 12 years. After all it provided a worse return than the rest out there,” Sheets advised shoppers within the financial institution’s Sunday be aware. That technique additionally proved costly, with the greenback underperforming each the S&P 500

SPX,

and U.S. 10-year Treasury be aware

TMUBMUSD10Y,

between 2010 and 2020 (barring 2013 and 2018), he added.

Bloomberg, Morgan Stanley Analysis

“However the concept holding money means paying for insurance coverage is now not correct,” mentioned Sheets, who notes that U.S. 6-month Treasury payments

TMUBMUSD06M,

yields (3.1%) are the very best since late 2007, providing 157 foundation factors greater than S&P 500 dividends, 21 foundation factors greater than 10-year Treasurys

TMUBMUSD10Y,

and simply 60 foundation factors below the U.S. combination bond index

AGG,

“For USD traders, money has ceased to be a cloth drag on a portfolio’s present yield,” he mentioned. Even holding money in Europe, which was extraordinarily pricey, is now not, as German 6-month invoice

TMBMBDE-06M,

yields are constructive for the primary time since 2014.

Streets mentioned that on a cross-asset foundation, U.S. greenback money gives a excessive present yield, liquidity, and a greater 12-month complete return than Morgan Stanley’s personal implied forecasts for U.S. fairness, U.S. Treasurys, funding grade and excessive yield credit score — “with significantly much less volatility.”

This is the reason Morgan Stanley’s core optimized fixed-income portfolios are obese short-dated mounted earnings, he mentioned. Towards different currencies the greenback additionally holds up, and the financial institution’s international trade consultants see extra of that energy forward, particularly towards the euro

EURUSD,

which was as soon as once more tapping parity on Monday as worries over Europe winter gas shortages construct.

Table of Contents

The market

Inventory futures

ES00,

NQ00,

are sliding south, with bond yields

TMUBMUSD10Y,

TMUBMUSD02Y,

reflecting a cautious temper and oil costs

CL.1,

BRN00,

below stress. Traders proceed to push the greenback

DXY,

increased. Elsewhere, it was a choppy day in Asia and Europe shares

SXXP,

are below stress.

The excitement

Amongst information and occasions this week, we’ll get PMI numbers, second quarter GDP, the Fed’s favourite inflation indicator and the central financial institution’s Jackson Gap assembly, with Chairman Jerome Powell as a consequence of converse Friday morning.

On the meme-stock beat, AMC Leisure

AMC,

is tumbling forward of the start of trading for preferred equity units, or ApesL, and London-based Cineworld

CINE,

confirmed it was considering a U.S. bankruptcy filing. Inventory in fellow meme, Mattress Tub & Past

BBBY,

can be dropping.

CEO Elon Musk mentioned the Tesla

TSLA,

will raise the price of its ‘Full Self-Driving’ feature to $15,000.

Becoming a member of CVS

CVS,

Amazon

AMZN,

is reportedly among the bidders for healthcare firm Signify Well being

SGFY,

China’s central financial institution cut its loan prime rate, a transfer geared toward pumping up its shaky real-estate market. In the meantime, energy rationing within the drought stricken southwest affecting industrial corporations and Tesla in Shanghai, has been prolonged.

Retail and tech names might be reporting this week, with Zoom Video

ZM,

and Palo Alto Networks

PANW,

due after Monday’s shut. Macy’s

M,

Dick’s Sporting Items

DKS,

Greenback Tree

DLTR,

and Greenback Normal

DG,

Peloton

PTON,

Nvidia

NVDA,

Salesforce

CRM,

and Marvell

MRVL,

amongst different highlights.

A gaggle of Apple

AAPL,

employees are reportedly pushing again towards a return-to-office order for subsequent month.

Followers dashing to observe HBO’s “Sport of Thrones” prequel “Home of the Dragon,” which has a $100 million market marketing campaign behind it, sent the app crashing.

Better of the net

As war nears six-month mark, top Russian diplomat warns of a long conflict ahead

Americans see a threat to democracy as No. 1 issue, new poll finds

The crypto geniuses who vaporized a trillion dollars.

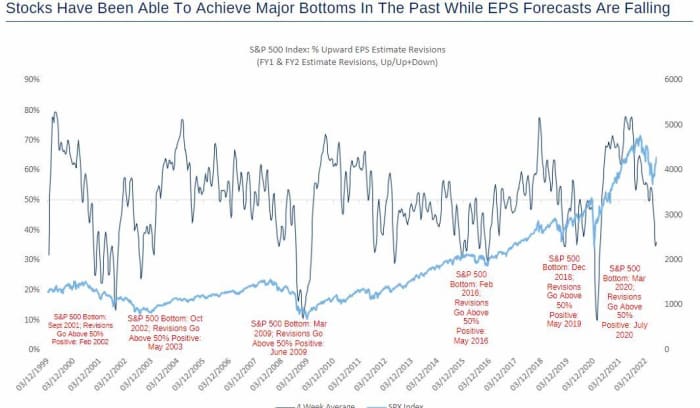

The chart

RBC Capital’s head of U.S. fairness technique, Lori Calvasina, argues shares can and have put in main bottoms even amid falling earnings forecasts, along with her chart under exhibiting these moments in historical past. Whereas Calvasina stays involved that doubtless additional strikes down for 2022 and 2023 EPS forecasts might make for a extra risky inventory market, she doesn’t assume that may result in carving out a brand new low for equities.

RBC US Fairness Technique, S&P Capital IQ/ClariFI, CIQ estimates

High tickers

These had been the highest searched tickers on MarketWatch as of 6 a.m. Jap Time:

| Ticker | Safety title |

|

AMC, |

AMC Leisure |

|

BBBY, |

Mattress Tub & Past |

|

GME, |

GameStop |

|

TSLA, |

Tesla |

|

GCT, |

GigaCloud Know-how |

|

AAPL, |

Apple |

|

NIO, |

NIO |

|

ENDP, |

Endo Worldwide |

|

AMZN, |

Amazon |

|

BBY, |

Finest Purchase |

Random reads

“I don’t want to be part of a slow decline. Why a 3-star Michelin chef is quitting

You gotta struggle to your proper to have fun.

Have to Know begins early and is up to date till the opening bell, however sign up here to get it delivered as soon as to your e mail field. The emailed model might be despatched out at about 7:30 a.m. Jap.

Source link