Opinion: The inventory market is unrelentingly bearish however nonetheless nowhere near triggering a ‘purchase’ sign

[ad_1]

The S&P 500 Index

SPX,

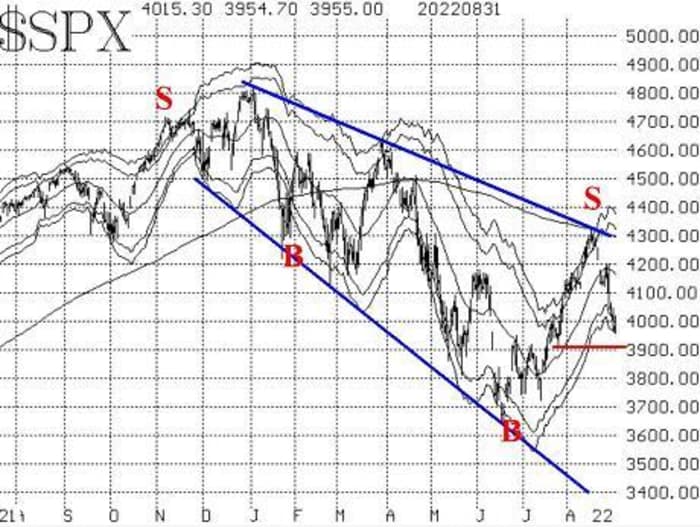

has been in a bearish part because the mid-summer rally fizzled out close to 4,300 factors.

The declining 200-day shifting common of the benchmark index occurred to be near 4,300, and the mixture of the 2 not solely put an finish to that rally however appears to have kicked off a leg down in inventory costs.

A number of assist areas have been damaged. There may be an island formation on the SPX chart fashioned by a niche up on Aug. 10 after which a niche down on Aug. 22.

That may be a very unfavourable technical formation, and it’s uncommon to see it in an Index. I recall the same one within the Dow Jones Industrial Common

DJIA,

in March 1974 that set off the subsequent leg of that bear market, and it’s doable this one is doing the identical.

This previous week, promoting broke by assist at 4,070, so the subsequent assist stage is simply above 3,900. The promoting has been intense sufficient that SPX traded all the way down to its –4σ “modified Bollinger Band” (mBB) this week, and that terminates the McMillan Volatility Band (MVB) promote sign that had occurred nearly two weeks in the past.

Nonetheless, the market must transfer decrease — closing beneath that –4σ Band — as a way to arrange a brand new MVB purchase sign.

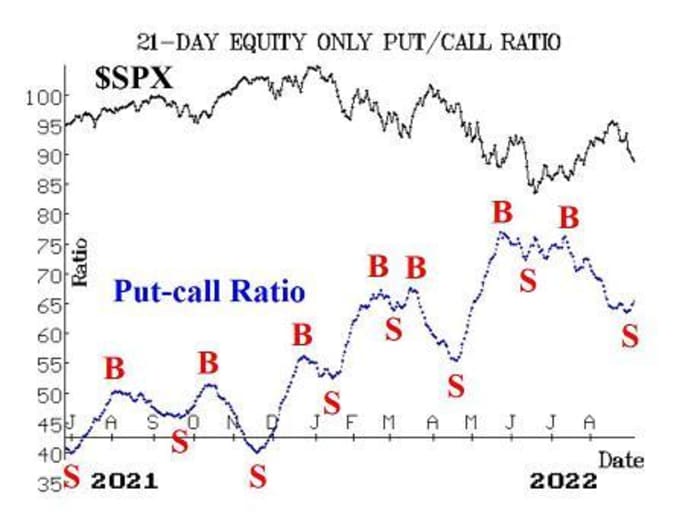

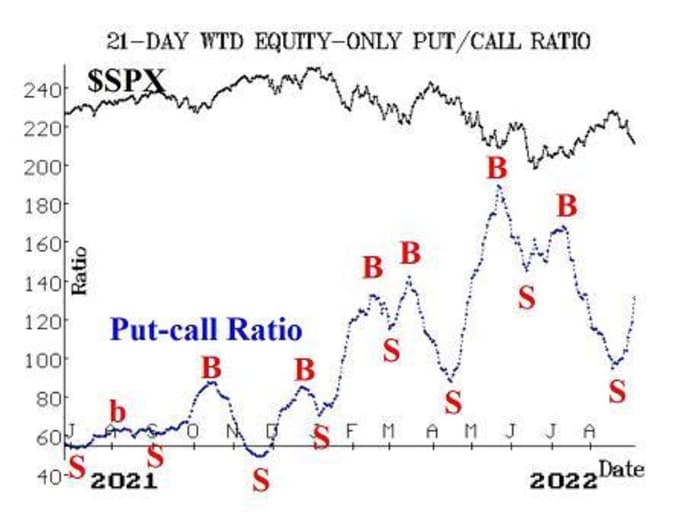

Fairness-only put-call ratios are lastly each in settlement and on promote indicators. The weighted ratio began shifting larger — thus producing a promote sign — about 10 days in the past. The normal ratio was reluctant to observe, and has solely confirmed its promote sign prior to now few days. So long as each ratios are rising, that’s bearish for the inventory market.

Breadth has been poor, and the breadth oscillator promote indicators that have been generated on Aug. 19 are nonetheless in place. Nonetheless, each breadth oscillators at the moment are deeply into oversold territory — that means {that a} purchase sign lies sooner or later, however in fact it’s too early to say the place or when. “Oversold doesn’t imply purchase” is one among our strongest mottos, and it merely implies that an oversold market can proceed to say no multiple would possibly count on.

New 52-week highs are virtually nonexistent as soon as once more (11 on the NYSE yesterday), and so this indicator stays on a promote sign because it has since final April. It by no means did give a purchase sign this summer season, as many different indicators have been doing.

VIX

VIX,

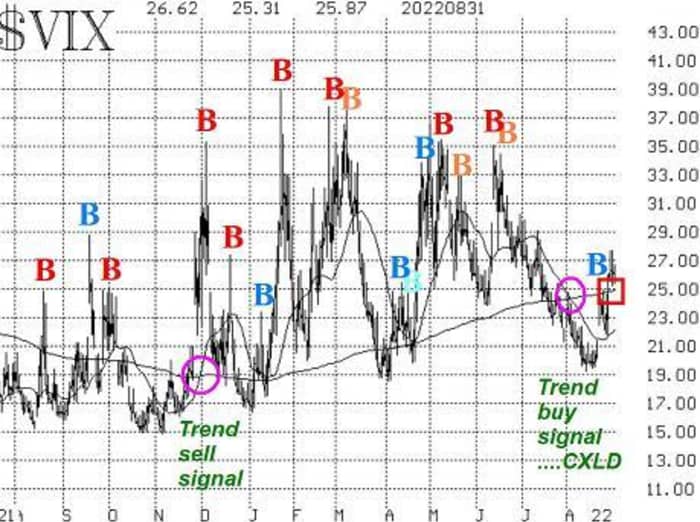

has jumped larger this week, and that has had some repercussions amongst our volatility indicators. First, a VIX “spike peak” purchase sign was given as of the shut of buying and selling on Aug. 25 and was instantly stopped out by a big rise in VIX on Aug. 26. VIX stays in “spiking mode” presently, so a brand new VIX “spike peak” purchase sign will arrange within the close to future.

The second byproduct of this latest rise in VIX is that the intermediate-term development of VIX purchase sign that had taken place when each VIX and its 20-day shifting common crossed beneath its 200-day MA again in early August, is now canceled as a result of VIX is again above the 200-day MA. That is not a promote sign, although, for that might additionally require the 20-day MA to cross again above the 200-day MA, which isn’t imminent. Nonetheless, the purchase sign has been canceled for now.

If VIX have been to fall again beneath its 200-day MA, the development purchase sign can be reinstated. By coincidence, the extent at which each of those VIX purchase indicators would happen can be a VIX shut beneath 24.60.

The assemble of volatility derivatives stays slightly stubbornly in a modestly optimistic state for shares. That’s, the time period construction of the VIX futures slopes upward out by January after which is flat after that.

In abstract, we proceed to carry a “core” bearish place, consistent with the downtrend that’s apparent on the SPX chart. Round that, particular person indicator indicators might be traded. The market is oversold proper now, so roll down worthwhile spreads or exit the place known as for (MVB promote sign, for instance), however don’t go lengthy simply because the market is oversold.

New advice: Potential VIX purchase indicators

As famous above, VIX is in “spiking” mode as soon as once more. A VIX “spike peak” purchase sign that occurred final week was stopped out for a small loss in simply in the future. Now one other one is establishing. To date this week, the excessive worth for VIX has been 27.69. An in depth by VIX of at the least 3 factors beneath its most up-to-date excessive worth would generate a brand new VIX “spike peak” purchase sign. As well as, if VIX closes again beneath its rising 200-day shifting common, that might as soon as once more verify that the development of VIX is downward, and that’s bullish for shares. So, let’s use a two-tiered method to enter these positions:

Step 1:

IF VIX closes at the least 3.00 factors beneath the very best worth that’s has reached from Aug. 29 going ahead,

THEN Purchase 1 SPY Oct (seventh) at-the-money name

And Promote 1 SPY Oct (seventh) name with a hanging worth 15 factors larger.

Step 2:

As well as, if VIX closes beneath 24.50 that might reinstate the development of VIX purchase sign, so purchase one other SPY unfold with the identical parameters as acknowledged in step 1 above.

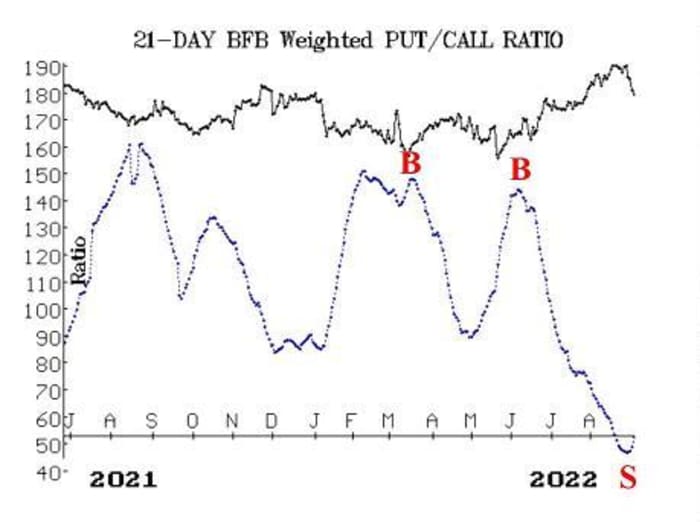

New advice: Brown-Forman

The choice image for Brown-Forman Corp.

BF.B,

is BFB. Name shopping for has been particularly heavy this summer season, forcing its put-call ratio all the way down to a particularly optimistic (overbought) state. One can see how a lot decrease it’s now, the place it’s producing a brand new promote sign, than it has been prior to now 12 months.

Purchase 2 BFB Oct (21st) 75 places

At a worth of 4.50 or much less

BF.B: 72.08 Oct (21st) 75 put: supplied at 5.20

Comply with-up motion

All stops are psychological closing stops except in any other case famous.

We’re going to implement a “normal” rolling process for our SPY spreads: In any vertical bull or bear unfold, if the underlying hits the quick strike, then roll the complete unfold. That may be roll up within the case of a name bull unfold, or roll down within the case of a bear put unfold. Keep in the identical expiration, and preserve the space between the strikes the identical except in any other case instructed.

Lengthy 10 CRNT Sept (16th) 2.5 calls: Aviat Networks (AVNW) has bid a worth of primarily $3.08 for CRNT, however CRNT will not be keen on promoting. We rolled to September final week. Proceed to carry.

Lengthy 0 AAPL Sep (16th) 170 calls: have been stopped out when AAPL closed beneath 166 on Aug. 26. Total, this was a properly worthwhile commerce, since we had rolled up twice beforehand.

Lengthy 1 SPY Sept (16th) 426 name and Quick 1 SPY Sept (16th) 439 calls: spreads have been initially purchased on July 21, when a number of indicators generated purchase indicators. Then they have been rolled up and finally out. Promote the unfold now, because the equity-only put-call ratios rolled again to promote indicators.

Lengthy 3 MRO Oct (21st) 24 calls: we are going to maintain this place so long as the put-call ratio for MRO stays on a purchase sign.

Lengthy 0 SPY Sept (16th) 414 name and quick 0 SPY Sept (16th) 429 name: was purchased consistent with VIX starting to development down on Aug. 4. It was stopped out on Aug. 29 when VIX had closed above 24.60 for 2 consecutive days, .

Lengthy 2 OIH Sept (16th) 230 calls and quick 2 OIH Sept (16th) 250 calls: promote this unfold now because the weighted put-call ratio for OIH has rolled again to a promote sign.

Lengthy 3 SGFY Sept (16th) 22.5 calls: we’re holding with no cease, as a way to see if anybody does submit a bid for SGFY. There may be nonetheless no bid, however there are supposedly a number of events keen on buying SGFY, with the very best bid rumored to be round $30.

Lengthy 1 SPY Oct (21st) 396 put and Quick 1 SPY Oct (21st) 366 put: that is our “core” bearish place. It was rolled down 30 factors on every strike, since SPY traded at 396 this week (per our normal rule of “rolling” acknowledged above). There isn’t a longer a cease for this place presently.

Lengthy 2 SGEN Sept (16th) 170 calls and Quick 2 SGEN Sept (16th) 185 calls: this unfold was purchased after rumors of a takeover by MRK have been spreading. Maintain these spreads with no cease.

Lengthy 0 SPY Oct (7th) 413 calls and Quick 0 SPY Oct (7th) 428 calls: this unfold was purchased consistent with the $VIX spike peak purchase sign of August 24th, however was stopped out the identify day, when $VIX returned to “spiking” mode – the place it nonetheless is immediately. See commentary within the e-newsletter above relating to taking a brand new place based mostly on the subsequent “spike peak” purchase sign.

Lengthy 6 CANO Oct (21st) 7 calls: cease your self out on a detailed beneath 5.50.

Ship inquiries to: [email protected].

Lawrence G. McMillan is president of McMillan Evaluation, a registered funding and commodity buying and selling advisor. McMillan could maintain positions in securities beneficial on this report, each personally and in shopper accounts. He’s an skilled dealer and cash supervisor and is the writer of the best-selling guide, Options as a Strategic Investment.

Disclaimer: ©McMillan Evaluation Company is registered with the SEC as an funding advisor and with the CFTC as a commodity buying and selling advisor. The knowledge on this e-newsletter has been fastidiously compiled from sources believed to be dependable, however accuracy and completeness are usually not assured. The officers or administrators of McMillan Evaluation Company, or accounts managed by such individuals could have positions within the securities beneficial within the advisory.

Source link