Oppenheimer Says Biotech Shares Look a Bit Brighter Proper Now; Right here Are 2 Names to Think about

[ad_1]

The biotech sector, like most sections of the market, took a sound beating within the 12 months’s first half. Not too long ago, nonetheless, the section’s efficiency has improved, and that has helped the NASDAQ Biotechnology Index (NBI) pull forward of the NASDAQ (Up 13% over the previous 3 months vs. the NASDAQ’s 3%).

The Oppenheimer biotech staff thinks there’s a easy clarification for this: “We imagine that a lot of the current outperformance has been pushed by SMID caps, of which many have risen admirably up to now few months… We observe quite a few profitable outcomes from key scientific trials on this group [Alnylam Pharma, Caribou Biosciences, Cincor Pharma, amongst others].” Moreover, “Rising variety of high-profile M&A bulletins could also be reinvigorating curiosity amongst specialists and generalists.”

This makes Oppenheimer state that skies are trying a ‘bit brighter’ for the biotech trade in 2H. In actual fact, Oppenheimer analysts anticipate two names to comply with within the footsteps of their friends, by releasing profitable trial outcomes shortly which may assist propel them ahead.

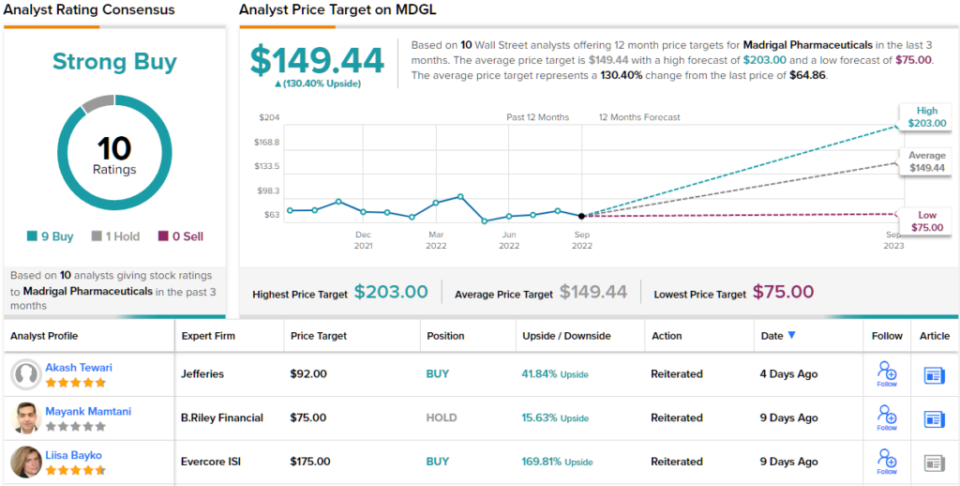

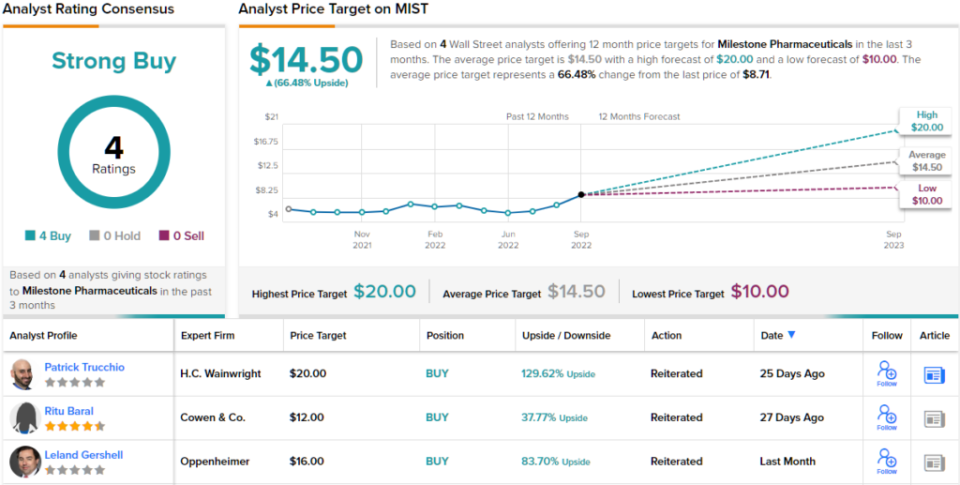

We ran each tickers by means of the TipRanks platform to see what the remainder of the Road had in thoughts for them. It appears to be like just like the Oppenheimer analysts are usually not the one ones exhibiting confidence; each are rated as Robust Buys by the analyst consensus with loads of potential upside in retailer. So, let’s get the small print.

Madrigal Prescribed drugs (MDGL)

The primary Oppenheimer decide we’ll have a look at is Madrigal Prescribed drugs, a clinical-stage biopharma targeted on discovering novel remedies for fatty liver ailments. Extra particularly, the corporate is in pursuit of discovering a viable remedy for NASH illness (Non-Alcoholic SteatoHepatitis). It is a extra superior type of non-alcoholic fatty liver illness (NAFLD).

It’s thought that round 20% of world adults are affected by NAFLD and 30% of U.S. adults; 20% of that inhabitants have NASH. Given there are at present no FDA-approved NASH-specific medicine accessible, there’ll almost definitely be ample reward for whoever brings a viable resolution to market first.

Madrigal’s lead product candidate is resmetirom (MGL-3196), a liver-directed selective thyroid hormone receptor-ß agonist, which is at present in Part 3 scientific research, indicated to deal with NASH. As such, the drug may doubtlessly develop into the primary treatment to achieve approval for this illness.

In June, the corporate introduced knowledge on the European Affiliation for the Examine of the Liver’s Worldwide Liver Congress (EASL 2022) the place Madrigal introduced in-depth outcomes from the Part 3 MAESTRO-NAFLD-1 trial double-blind/placebo-controlled section.

Oppenheimer analyst Jay Olson notes the outcomes have been decidedly constructive, highlighting the very fact resmetirom drove “favorable adjustments in Fibroscan and MRE the place the biggest enhancements have been seen in essentially the most superior sufferers.” In actual fact, the analyst thinks the outcomes lay the groundwork for an upcoming knowledge readout.

“We imagine that Ph3 MAESTRO-NAFLD-1 outcomes present de-risking assist to the Ph3 MAESTRO-NASH biopsy examine in NASH sufferers (N≈2,000), which is ongoing with interim outcomes anticipated in 4Q22 that would doubtlessly assist subpart-H submitting for accelerated approval,” the analyst defined. “Prior Ph2 knowledge confirmed that decreased liver fats on MRI-PDFF interprets into NASH decision and fibrosis enchancment.”

What does all of it imply for buyers? Whereas Olson thinks unfavorable outcomes may ship the inventory down by ~80%, constructive top-line outcomes from the examine may see the shares greater than double.

Olson is evidently assured Madrigal will convey the products. Backing the analyst’s Outperform (i.e. Purchase) ranking, is a $170 value goal; this determine makes room for 12-month positive factors of a whopping 162%. (To observe Olson’s monitor report, click here)

It’s not as if different Road analysts are shy of predicting large issues for this title, both. With 9 Buys and 1 Maintain obtained within the final three months, the consensus is that MDGL is a Robust Purchase. Whereas lower than Olson’s forecast, the $149.44 common value goal nonetheless signifies substantial upside potential of 130%. (See MDGL stock forecast on TipRanks)

Milestone Prescribed drugs (MIST)

Let’s now check out Milestone Prescribed drugs, one other biotech however with an altogether completely different remit. The corporate is intent on discovering a remedy for arrhythmias and different cardiac situations.

Milestone has put all its eggs in growing etripamil, a self-administered nasal spray indicated as a remedy for sufferers with paroxysmal supraventricular tachycardia (PSVT) and atrial fibrillation (AFib).

The drug is at present in a Part 2 proof-of-concept examine the place it’s being assessed for the acute remedy of AFib with fast ventricular charge (RVR). However extra importantly proper now, is the extra superior program for which there’s an upcoming catalyst.

Etripamil is present process testing within the Part 3 RAPID trial for the remedy of paroxysmal supraventricular tachycardia (PSVT) – a situation through which the guts’s uncommon, electrical “wiring” ends in an unpredictable and recurring high-speed coronary heart charge. The situation impacts the lives of round 1.6 million individuals within the US, and discovering an answer won’t solely quantity to a significant growth, however will even symbolize a technique to decrease healthcare masses and prices.

Milestone expects to report top-line knowledge from the examine halfway by means of 2H22, and heading into the readout, Oppenheimer’s Leland Gershell likes the “risk-reward” right here.

“Major endpoint success (time to episode termination over the primary half-hour) ought to full registrational necessities and allow an NDA submitting in 2023,” the analyst famous. “We imagine etripamil represents an essential therapeutic advance in addition to a way to cut back healthcare burden and expense, and that it’s poised to generate peak internet gross sales of $500M in PSVT alone. A Part 2 examine in atrial fibrillation w/fast ventricular charge has begun, and will pave the way in which to a key label growth alternative.”

It is no shock, then, that Gershell charges Milestone as Outperform (i.e. Purchase) together with a $16 value goal. The implication for buyers? Potential upside of ~84% from present ranges. (To observe Gershell’s monitor report, click here)

It’s clear Wall Road likes this title; MIST has garnered 3 different analyst opinions lately and all are constructive, offering the inventory with a Robust Purchase consensus ranking. Going by the $14.50 common goal, a 12 months from now, these shares can be 66% extra helpful than they’re at current. (See MIST stock forecast on TipRanks)

To search out good concepts for biotech shares buying and selling at engaging valuations, go to TipRanks’ Best Stocks to Buy, a newly launched device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analyst. The content material is meant for use for informational functions solely. It is rather essential to do your personal evaluation earlier than making any funding.

Source link