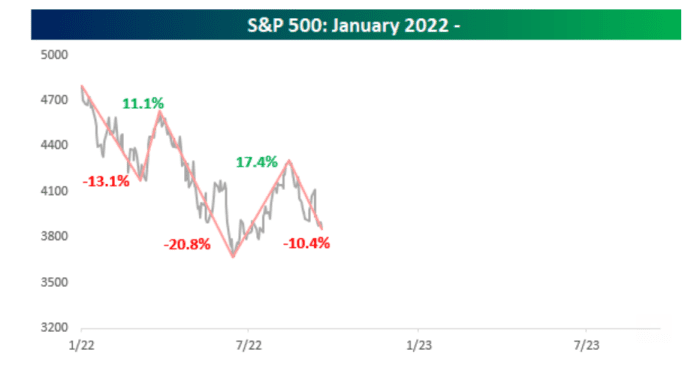

S&P 500 sees its third leg down of greater than 10%. Right here’s what historical past reveals about previous bear markets hitting new lows from there, based on Bespoke.

[ad_1]

Shares fell sharply after the Federal Reserve introduced Wednesday that it was elevating its benchmark price by three-quarters of a share level because it battles inflation, with the S&P 500 persevering with a slide described by Bespoke Funding Group as its third leg down.

“The place this bear market finally bottoms is anybody’s guess, and occasions exterior of the Fed’s management will seemingly play a job in the place the market ends up,” Bespoke stated in a observe emailed Wednesday. “In occasions like this, although, it’s at all times good to take a look at how the present interval compares to different intervals, if for no different cause than to see how dangerous we now have it or how a lot worse it may well get.”

The S&P 500, which hit a document excessive on Jan. 3, has sunk 20.5% up to now this yr, based on FactSet knowledge. The index dropped 1.7% Wednesday for its largest drop since Sept. 13, the day inflation knowledge launched for August got here in hotter than expected.

The S&P 500 is down greater than 10% from its August excessive, its third such leg down within the present bear market, based on Bespoke, although it’s nonetheless above its June low.

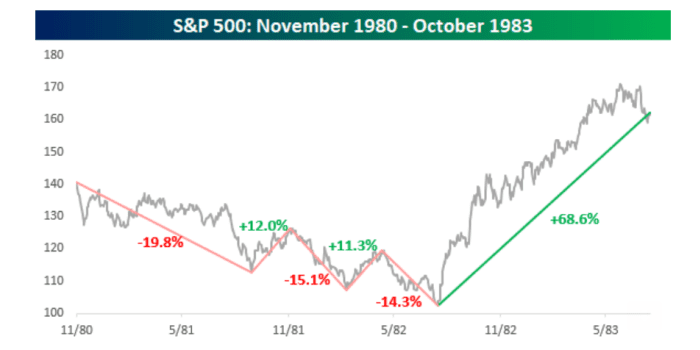

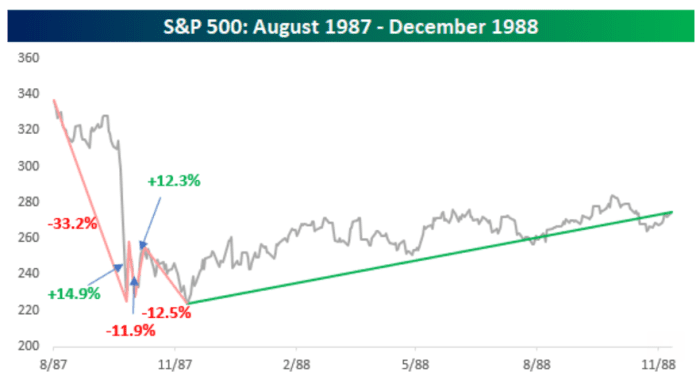

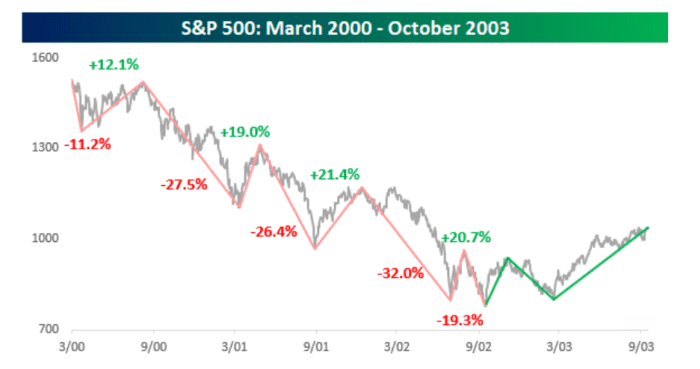

The agency studied previous bear markets throughout the post-World Conflict II interval that started at all-time highs and noticed at the least three legs down of 10% or extra earlier than the S&P 500 finally bottomed. These started in January 1973, November 1980, August 1987, March 2000 and October 2007, based on Bespoke.

“If there was one constant sample inside all 5 of the prior intervals highlighted, it’s that in each one, the S&P 500 made a decrease low in its third leg decrease,” Bespoke stated. The S&P 500 shouldn’t be far above its June low, “so both the market has additional to fall,” or if the index can rally again to 4,250, “it could provide some faint hope to bulls that the worst of the declines could be behind us.”

BESPOKE INVESTMENT GROUP

The S&P 500 on Tuesday closed down 10.4% from its current excessive on Aug. 16, confirming “the index is within the third leg decrease of at the least 10% throughout the present bear market,” the Bespoke observe reveals.

“After some excessive oversold readings in mid-June, the S&P 500 rallied 17.5% by mid-August, however the rally failed simply shy” of its 200-day transferring common, the agency stated. That very same month, Fed Chair Jerome Powell’s clear message in his Aug. 26 speech on the Jackson Gap. Wyo., financial symposium that he would hold combating inflation by tighter financial coverage even whereas inflicting ache to companies and households, sparking a selloff in stocks.

The slump deepened after a stronger-than-anticipated studying on August inflation primarily based on the consumer-price index, with traders questioning whether or not the S&P 500 will retest its June low.

Previous bear markets

“The bear market that started in January 1973 and stretched to October 1974 was fairly relentless,” stated Bespoke. The third leg decrease then was significantly painful, because the S&P 500 declined greater than 37% in a sell-off that solely accelerated in August of that yr after” the resignation of President Richard Nixon.

The bear market of 1980-’82 was notable for “the truth that the rally within the yr after greater than erased the entire earlier declines,” the observe reveals.

BESPOKE INVESTMENT GROUP

The 1987 bear market was as deep, however fast, spanning lower than 5 months, Bespoke stated. “This bear market was additionally distinctive in that it’s the just one with at the least three legs decrease the place every 10%+ decline didn’t lead to a decrease low.”

BESPOKE INVESTMENT GROUP

“Exterior of the COVID crash, bear markets of the twenty first century have been extra drawn out,” based on the observe.

From the height in March 2000 by the October 2002 low, Bespoke tallied 5 separate legs that had been at the least 10% decrease earlier than the S&P 500 lastly bottomed. “Most of them had been extreme,” based on the agency’s analysis.

BESPOKE INVESTMENT GROUP

Extra just lately, “the bear market that started in 2007 included 5 separate declines of at the least 15%, with three exceeding 25%, Bespoke stated. The 18.5% rally from October to November 2008 was the one bounce of greater than 10% throughout that interval when the S&P 500 made a better excessive, based on the observe.

“Sadly for any bulls who pounced on that optimistic technical growth on the time, it ended up being a serious fake-out,” Bespoke stated.

All three main U.S. inventory benchmarks completed sharply decrease Wednesday, as traders digested the most recent massive price hike from the Fed because it goals to tame inflation by tighter financial coverage. The blue-chip Dow Jones Industrial Common

DJIA,

dropped 1.7%, whereas the technology-heavy Nasdaq Composite

COMP,

sank 1.8%.

In the meantime, the S&P 500

SPX,

is approaching its 2022 trough. The index ended Wednesday up 3.4% from its closing low this yr of three,666.77 on June 16, based on Dow Jones Market Information.

Learn: Fed predicts big slowdown in economy and rising unemployment as it battles inflation

Source link