[ad_1]

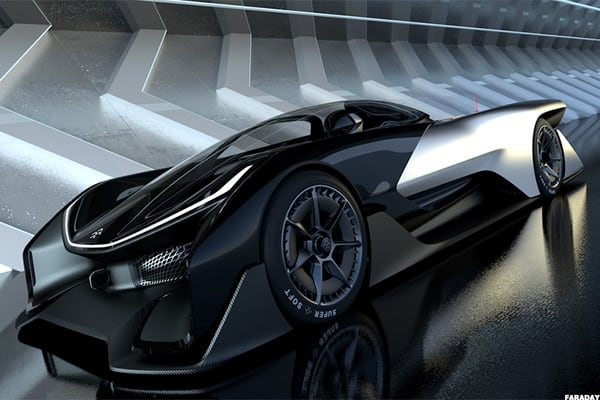

An electrical car startup whose design has drawn comparisons with the Batmobile is on the ropes, and it is not the primary time.

Faraday Future Clever (FFIE) has already had a number of lives in its very younger and brief historical past.

Since its creation in 2014, the startup has all the time been on the point of the monetary abyss.

The issue is all the time the identical: will the younger producer of electrical automobiles, as soon as offered as a possible rival of Tesla (TSLA) , survive? The query comes up each quarter. And the second quarter isn’t any exception because the agency has simply revealed quarterly earnings which depict a disastrous monetary scenario.

The online loss practically tripled in comparison with the second quarter of 2021, in response to a press release. This loss amounted to $142 million in the course of the quarter ended June 30, in comparison with $53 million for a similar interval in 2021.

Hovering Prices

This degradation of the monetary scenario is because of a pointy enhance within the working bills of the corporate, which continues to be struggling to provide and ship its first automobiles to prospects. Working bills amounted to $137.5 million, in comparison with solely $28 million within the second quarter of 2021.

The associated fee will increase, the agency defined, “are primarily attributable to sure product enhancements and upgrades regarding the capabilities of the FF 91, skilled charges, price overruns, and up to date macroeconomic challenges, together with elevated development and labor prices, uncooked materials worth will increase, semiconductor chip shortages, tariffs, Covid-19 associated disruptions and added prices, and different provide chain constraints.”

The corporate’s repeated difficulties in producing a car for eight years and the uncertainties about its future have additionally pushed suppliers to dictate their phrases.

“Extra just lately, some suppliers have requested accelerated funds and different phrases and situations because of our previous fee historical past and considerations in regards to the firm’s monetary situation, resulting in much less favorable fee phrases than the corporate had anticipated, and delaying or placing in danger sure deliveries,” Faraday Future (FF) mentioned.

Faraday Future shares are down 60% since January. The shares have fallen greater than 24% because the publication of the second quarter earnings on August 15.

Working Out of Money

The corporate had delayed producing the flagship mannequin, FF 91 Collection, which has been in growth since at the very least 2016, quite a few occasions. The final time was final month: FF then announced that manufacturing would begin both within the third quarter or within the fourth of 2022. Manufacturing was to start out final July.

Scroll to Proceed

Since its inception, the corporate has collected a deficit of roughly $3.2 billion as of June 30, 2022. And the scenario will not be going to get higher because the startup has simply warned that it “expects to proceed to generate vital working losses for the foreseeable future, as we proceed to incur bills earlier than we generate significant income.”

FF hardly generates any earnings because the group nonetheless hasn’t delivered a car. The agency nonetheless obtained 399 pre-orders, which means there have been two cancellations since March 31. These prospects needed to advance a deposit of at the very least $1,500 which might be “absolutely refundable, non-binding.”

For the reason that starting of the 12 months, the corporate has already warned on a number of events that it dangers discovering itself wanting cash to remain open. Faraday Future has simply repeated this warning saying that it’s going to want recent money in early September to fund its operations.

“Though the corporate has taken steps to protect its present money place, together with decreasing spending, extending fee cycles and different comparable measures, it initiatives that it’s going to require extra funds by early September 2022 as a way to proceed operations.”

FF added that it’s going to additionally “want to boost extra financing in the course of the the rest of 2022 and past 2022 to help the ramp-up of manufacturing of the FF 91 to generate revenues to place the corporate on a path to money circulate break-even.”

FF began the second quarter with $505 million in money readily available and burned via most of that in a short time as the corporate was right down to $121 million in money as of June 30. The agency due to this fact plans to boost a further $600 million and is at the moment in discussions with potential buyers, however doesn’t assure that these will result in an settlement.

Departure of the Chairman?

“The Firm stays in lively discussions with each U.S. institutional buyers and worldwide funding sources. These discussions might or might not result in extra funding commitments past what has already been executed,” FF mentioned in a separate press release.

One of many positives is that Faraday Future managed to keep away from being delisted on the Nasdaq when this menace hung over the corporate as a result of it was late in publishing its first-quarter earnings. This time round, the agency launched its second-quarter outcomes on time.

“Importantly, we additionally grew to become present with our monetary statements and regained compliance with Nasdaq itemizing necessities,” mentioned Dr. Carsten Breitfeld, World CEO of Faraday Future. “Fundraising efforts are underway, and we at the moment anticipate to ship the FF 91 to prospects within the third or fourth quarter of 2022.”

Apart from these monetary issues, Faraday Future can be affected by inner issues. FF Prime Holding, an entity which brings collectively a lot of shareholders, is asking for the speedy departure of Brian Krolicki, chairman of the board of administrators.

“The corporate’s operational outcomes are constantly falling wanting the objectives the Firm has set forth in its public filings, and this case will not be bettering,” FF Prime Holding mentioned in a proxy submitting with the U.S Securities and Trade Fee (SEC). “We imagine that this poor efficiency is due in vital half to the failings of Mr. Krolicki.”

Krolicki, a member of the board since 2020, was Lieutenant Governor of Nevada (from 2007 to 2015).

[ad_2]

Source link