[ad_1]

The nation is returning to a extra regular life. Nevertheless it won’t be that ordinary. Liz Truss will see to that.

On Friday, Kwasi Kwarteng, chancellor of the exchequer, will observe up his emergency energy package with a mini-Budget. The latter is anticipated to reverse the rise in nationwide insurance coverage contributions and cease a deliberate improve in company tax. It should additionally set a goal of annual development at 2.5 per cent. Ought to we take that critically? No and sure. No, as a result of the concept the federal government of a market financial system can meet a development goal is ridiculous. Sure, as a result of it would information coverage. The query is whether or not it would information it for good or dangerous. My wager is on the latter.

Neither Hayek nor Friedman would have thought a development goal in any respect smart. That’s planning. Hayek would rightly insist now we have neither the information nor instruments to ship one. In Britannia Unchained, printed in 2012 (two of whose authors have been Kwarteng and Truss), Brazil was proposed as a mannequin. Ten years later, that appears foolish.

A development goal is not only unworkable, however a hazard. Suppose Kwarteng tells the Treasury and Workplace for Funds Accountability they need to assume this goal of their forecasts (if they’re allowed to make any.) If he’s mistaken, deteriorating public funds may generate a disaster of confidence, as happened in the 1970s. He appears to dismiss such worries as mere “managerialism”.

So, allow us to put the goal to at least one facet and think about coverage. Truss says “the financial debate for the previous 20 years has been dominated by discussions about distribution.” But, says the OECD, the UK has, after the US, the highest inequality within the distribution of family disposable incomes of all high-income international locations. Nor have been George Osborne’s post-crisis austerity insurance policies in any respect involved with “distribution”. Her view of the UK’s previous debate is a pink herring.

We have to recognise as a substitute that 40 years on, Thatcherism is a zombie concept, for 2 opposing causes — each what was achieved and what was not.

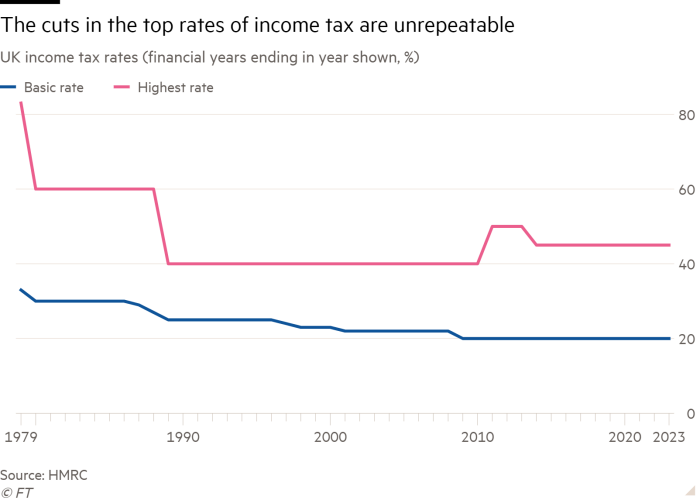

Thatcher did liberalise labour markets, curb commerce unions, privatise nationalised industries and slash high tax charges. Her insurance policies (which included promotion of the EU’s single market), in addition to these of later governments, additionally strengthened competitors in product markets. General, at present’s UK is a low-tax nation, by the requirements of different high-income economies. It has a deregulated financial system, by which the profitable are properly rewarded, however those who do less well are penalised. Such Thatcherite goals then are actually a actuality.

What then did Thatcher and those that adopted her fail to attain? They didn’t liberalise the largest distortion within the financial system, which is land use. They didn’t rework the abilities of the inhabitants, which has been made tougher by the circumstances by which many youngsters develop up. They failed to deal with defects in company governance, which bias spending towards funding. They allowed the seek for security in corporate pensions to shift portfolios away from the availability of threat capital to enterprise to possession of presidency bonds. This in impact turned the plans into state-backed pay-as-you-go schemes.

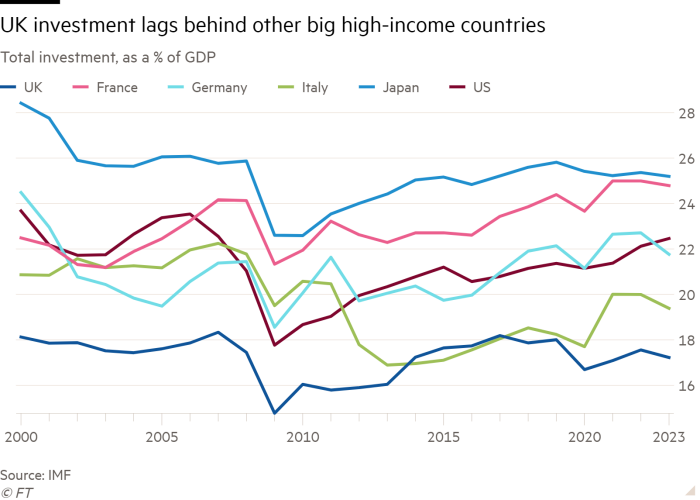

In all, financial efficiency has not been durably reworked for the higher. In 2019, output per hour labored within the UK was a lot the identical, relative to France and Germany, because it had been in 1979. Above all, productiveness has stagnated for the reason that monetary disaster. Funding is the bottom as a share of GDP of all large high-income international locations. Enterprise funding has remained beneath its peak in actual phrases for the reason that Brexit referendum. The earlier implosion of the monetary sector below “gentle contact regulation” didn’t assist. Nor did post-crisis austerity or the folly of Brexit itself. The uncertainty alone is dangerous for confidence and so for funding

The concept that additional tax cuts and deregulation (such as lifting the cap on bankers’ bonuses) will rework this efficiency is a fantasy. What is easy has already been completed. What’s left is tough to do. To take one instance: increased funding requires increased financial savings. From the place are these to come back? There are additionally the linked complexities of local weather change and vitality. Furthermore, the proof is that each higher financial efficiency and political stability could rely on lower inequality, not nonetheless greater than the nation has at present.

The Truss authorities is not only dedicated to tax cuts and deregulation. It additionally continues to recommend the potential for breaking with the EU over the Northern Ireland protocol, which might even be a breach with the US. This is able to undermine confidence within the UK’s probity, add to uncertainty, show that Brexit has not been completed and recommend that the federal government can’t dwell with the alternatives it made by itself flagship coverage. So as to add to all this, Truss appears set on breaking with China, too. Her UK seems determined to be friendless.

Moreover, the Tories received their majority below Boris Johnson on getting Brexit completed, strengthening the NHS and “levelling up” poorer areas. In so doing, they created a brand new coalition of conventional supporters with former Labour voters. At the moment, Brexit is just not completed, the NHS is in crisis and levelling up appears on the way in which to oblivion. Just 81,000 Tory party members have chosen as prime minister somebody who was not even the primary alternative of their elected members of parliament. She has no mandate for the insurance policies she needs to pursue. One can think about little higher designed to exacerbate at present’s pervasive cynicism about politics and politicians.

Belief is simple to destroy, however exhausting to get well. This is the reason retaining one’s phrase issues. Britannia is just not “unchained”. It’s as a substitute crusing in perilous waters. Can the brand new captain and first mate even see the rocks that lie forward?

[ad_2]

Source link