[ad_1]

On the Blockchain Futurist Convention in Toronto in early August, Ethereum co-founder Vitalik Buterin stood earlier than an excitable viewers to ship some huge information. “The Merge is coming,” he instructed the group, “this effort that we have now been engaged on for principally the final eight years . . . Ethereum will lastly grow to be a proof-of-stake system . . . Yay!” The viewers cheered.

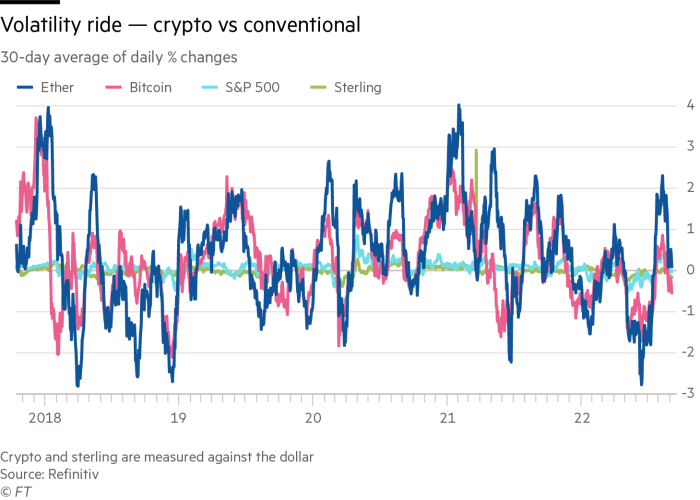

If there may be one factor the crypto group has in good provide, it’s guarantees. Within the comparatively quick historical past of digital belongings — beginning with bitcoin in 2009 — evangelists have trailed an inventory of improvements that, they are saying, may clear up inflation, revolutionise enterprise, or present a monetary lifeline to folks dwelling below authoritarian regimes all over the world.

In response, critics of the largely unregulated trade have highlighted its hyperlinks to felony exercise and big carbon footprint, to not point out the monetary wreck it has dropped at many weak folks — the identical ones trade representatives typically declare they need to assist.

The devoted now have a chance to show their critics incorrect. On the horizon is arguably crypto’s most formidable mission but, dubbed “the Merge”. The time period describes the second when the Ethereum blockchain will merge with a system referred to as the Beacon Chain. Ethereum is the preferred platform for elements of the Web3 world which have tried to enter the mainstream, comparable to NFTs and decentralised finance.

When the Merge occurs, in all probability someday this week, the stage shall be set for improvements meant to deal with a number of the harshest assaults on the trade. These are excessive stakes for a mission that most individuals exterior the crypto world have by no means heard of — and that many who’ve solely vaguely perceive. If the fusion goes off with no hitch, Ethereum will shift from a “proof-of-work” system to 1 often known as “proof of stake”.

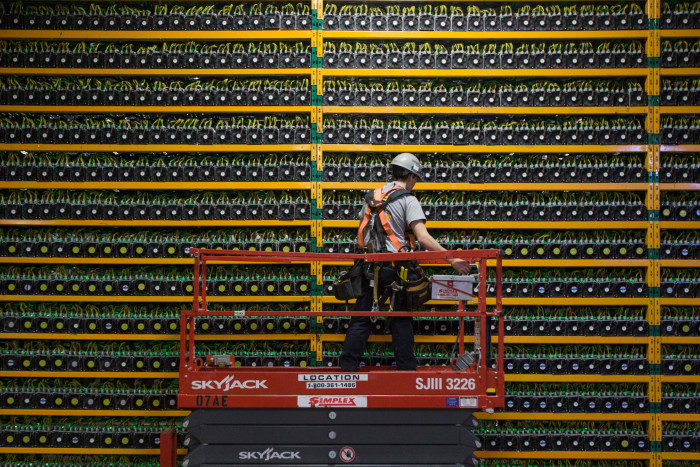

Proof-of-work methods such because the bitcoin and Ethereum blockchains are stored safe by highly effective computer systems. These “nodes” race in opposition to one another 24/7 to resolve advanced mathematical calculations so as to validate every new block of transactions added to the chain. The system defends in opposition to particular person nodes having the ability to corrupt the blockchain, however it additionally calls for an immense quantity of vitality to run. That interprets to a carbon footprint too huge for environmentalists and crypto-sceptics to abdomen.

Against this, in a proof-of-stake system such because the one Ethereum is shifting to, the blockchain doesn’t want highly effective computer systems for its safety. As a substitute, people or firms act because the validators, staking their very own ether tokens (the native foreign money of the Ethereum blockchain) as collateral against bad behaviour. They’re incentivised to take action by rewards, together with the possibility to earn recent ether.

Some see the Merge as a historic second that may take crypto mainstream by drastically lowering the trade’s ranges of vitality consumption — the Ethereum blockchain’s annual stage is currently estimated to be as excessive as that of Finland. “This can be a fairly crucial step for the infrastructure to truly scale, to ensure that Ethereum to grow to be what it might probably grow to be — a 24/7, international permissionless capital market,” says Avichal Garg, accomplice at early stage enterprise agency Electrical Capital.

Noam Hurwitz, a software program engineer at Web3 improvement platform Alchemy, describes it as “the most important milestone to this point of proof [the developers] can execute on their street map”.

However to others, the shift represents a betrayal of the blockchain’s basic traits — to be an open, clear and decentralised community, self-policing by design and managed by no group of people. The Merge won’t revolutionise the entire Web3 world, and it’ll not directly solve most of the greatest issues going through the Ethereum blockchain, comparable to excessive transaction charges and gradual transaction speeds.

Nonetheless, after years of discuss, a profitable Merge not less than units the scene for future innovation, notably by permitting the Ethereum blockchain to scale and deal with heavier workloads. That is excellent news for the functions that construct their companies on the blockchain, such because the NFT market OpenSea, or decentralised crypto exchanges like Uniswap. Charles Storry, head of development at crypto index platform Phuture, who works within the area of interest worlds of decentralised finance and Web3 tech, is filled with optimism.

It “is huge for Ethereum and the broader crypto group, as a result of it unlocks new functions which wouldn’t be doable within the present system, will increase scalability and radically improves Ethereum vitality effectivity,” he says. “We’re simply getting began.”

Fuel guzzlers

Regardless of the hype, whether or not the Merge actually heralds the mainstreaming of crypto tasks is a matter of great doubt. This yr’s turmoil in crypto markets has tainted the temper: a crash in coin costs wiped about $2tn off the full worth of cryptocurrencies and blockchain-based ventures have been caught in its wake.

A number of the greatest firms within the sector have declared chapter this summer time, together with hedge fund Three Arrows Capital and lending platform Celsius. Tumbling valuations within the tech world have additionally threatened to achieve deeper into the crypto and fintech sectors.

Ethereum isn’t the one blockchain on the town. Others — such because the bitcoin blockchain — will nonetheless use proof-of-work methods after the Merge. Based on estimates by Cambridge university, the bitcoin blockchain consumes a lot vitality that if it have been a rustic, it could rank on the planet’s prime 35 by vitality consumption, surpassing Belgium and Finland.

So why does the Merge matter if different blockchains are nonetheless guzzling vitality and harming the atmosphere? Alex de Vries, founding father of the web site Digiconomist, claims the Merge may shed roughly 99 per cent of Ethereum’s present vitality consumption.

Even when bitcoin’s soiled local weather file is about to proceed, de Vries argues any progress in direction of greening the trade is best than none: “You may’t say we have now cleaned up cryptocurrency when the most important polluter continues to be on the market . . . however I might say this can be a huge step ahead on the very least . . . the skin world additionally must see that that is doable.”

Lots of the “second layer” tasks which can be constructed on the Ethereum blockchain (comparable to NFTs and decentralised finance platforms) may also be affected. “It makes Ethereum greener, which is essential as a result of that has truly been a stumbling block to adoption,” says Alkesh Shah, crypto and digital asset strategist at Financial institution of America. “Many individuals [who would otherwise] use these digital belongings don’t due to the vitality use and the negatives for the atmosphere.”

“It’s going to dramatically scale back the carbon footprint for the entire trade,” says Ilan Solot, a accomplice at enterprise capital agency Tagus Capital.

Ought to the Merge efficiently inoculate Ethereum in opposition to criticism from environmentalists, strain will develop on its foremost rival, bitcoin. If one of many two most distinguished blockchains can ditch its soiled popularity, why not the opposite?

Ethereum core developer Preston Van Loon, who co-founded Prysmatic Labs, a workforce of software program engineers devoted to constructing the Ethereum blockchain, says the Merge can’t come quickly sufficient. “Proof of stake has been coming quickly since 2016 . . . it’s nearly a meme at this level,” he says. “I really feel like [the energy cost] can be a barrier to international scale, persons are not going to make use of it in the event that they realize it has such costly vitality prices.”

Altering engines mid-flight

The carbon footprint downside has been a persistent hurdle to efforts to push blockchain expertise to mainstream customers, says Ryan Wyatt, former head of gaming at YouTube who now runs blockchain gaming firm Polygon Studios. The Merge “actually does away with that in its entirety,” he says. “You may then concentrate on what the opposite factors of friction are for onboarding the subsequent billion customers into Web3.”

However others within the trade say Ethereum’s issues with gradual transactions and excessive charges will proceed to disqualify the blockchain from driving any form of Web3 revolution. “I don’t perceive this insistence of utilizing one thing [Ethereum] that at its core, doesn’t work very nicely,” says Lars Seier Christensen, co-founder of Saxo Financial institution who now runs a proof-of-stake blockchain referred to as Concordium.

What’s extra, there isn’t a assure the Merge will even work from a technical perspective. The method has already been set in movement and can occur as soon as a pre-determined goal on the blockchain is reached — at the moment anticipated to occur as early as Tuesday. The Merge shall be gradual, extra just like the solar developing than switching on a light-weight.

“It’s nearly like altering the engines on a aircraft while flying it . . . a big engineering feat,” says Edward Machin, a senior lawyer in Ropes & Grey’s information, privateness and cyber safety apply.

Even when the massive second does come off with no hitch, there are many dangers that lie in wait. The primary is a theoretical one: dubbed the “51 per cent assault”. Publish-Merge, the Ethereum blockchain shall be secured by a bunch of people by advantage of the ether tokens they’ve staked. Meaning, in principle, that any group or particular person who good points management of 51 per cent or extra of the staked ether on the blockchain would successfully management the system.

It’s an unlikely state of affairs — not least as a result of it could in all probability be prohibitively costly to personal over half the staked ether on the blockchain. But in addition as a result of an attacker would lose their staked holdings in the event that they tried to meddle with the chain. “I might suppose smaller blockchains might have the next danger for that,” says Shah.

Nonetheless, the hazard is there and crypto sceptics have witnessed sufficient hacks and collapses to not dismiss it. “It’s a excessive stakes take a look at . . . The hackers aren’t going to return out till it’s stay,” says crypto critic and angel investor Liron Shapira. One other critic, software program engineer Stephen Diehl, says it’s risks comparable to these that make people who find themselves contemplating investing in crypto markets suppose twice, as a result of “there may be this underlying platform danger the place, not like [with] bodily commodities, crypto belongings can merely stop to exist because of technical black swan occasions.”

A extra rapid downside is the tail danger of an entire collection of market mechanisms which have but to be examined within the wild. “People are fairly unhealthy at pricing tail danger. I feel most individuals are in all probability not fascinated about [it], and there are quite a lot of dangers right here,” says Garg of Electrical Capital.

Existential angst

Probably the most pressing concern for a lot of Ethereum backers is the existential query that proof of stake presents to “decentralisation” — a sacred tenet amongst advocates of blockchains.

Based on DeFi Llama, a well-liked analytics web site, the Ethereum blockchain holds over 50 per cent of the full worth of the decentralised finance trade, which champions direct peer-to-peer transactions and is supposed to take away all want for third-party intermediaries comparable to banks or brokers. Like different blockchains, Ethereum is supposed to be censorship-resistant. Its design is meant to carry out in opposition to highly effective people or entities searching for to exert management over different members.

However in its new guise, safeguarded by a group of people or firms, Ethereum loses that autonomy. “You have got what’s a shining beacon of decentralisation however in a brand new mannequin it is going to be extra centralised than folks suppose,” says Machin.

This downside has grow to be clearer because the US Treasury’s Workplace of Overseas Property Management (Ofac) final month imposed sanctions in opposition to Twister Money, an Ethereum-based platform that the federal government accused of facilitating billions-worth of laundered crypto. The staunchest of crypto’s libertarian army had mentioned the heavy hand of presidency would show ineffective in opposition to the sorts of “sensible contracts” — laptop software program designed to automate transactions — that run on decentralised platforms. But, sanctions have proved efficient in any case. Within the weeks since Twister Money was focused, transactions on the platform nosedived.

That fear is sure to cross the minds of Ethereum’s future guardians, together with exchanges Binance and Coinbase, and staking platform Lido Finance. Based on Nansen information, these firms are already a number of the greatest Ethereum staking gamers round, and thus shall be trusted to safe the community post-Merge. Final month, Coinbase chief government Brian Armstrong said his trade would probably give up the staking enterprise earlier than censoring the community.

As guardians of the Ethereum community, these entities should resolve whether or not or to not validate and course of blocks of transactions that will include transactions coming from entities below sanctions comparable to Twister Money. That hardly sounds just like the censorship-resistant utopia envisioned by the idealists — though critics of bitcoin level out that the focus of miners (who’re overwhelmingly based mostly in sure international locations such because the US and Russia) in that blockchain additionally quantities to a centralised system.

If the Merge does usher in a brand new period of centralisation, these idealists might need to pack their luggage and go away. “If persons are frightened . . . OK, nice, go elsewhere,” says Jeff Dorman, chief funding officer at asset administration agency Arca.

There may be one more reason for optimism: since July, the worth of ether — in addition to of different widespread cryptocurrencies — has partly rebounded, giving traders some respite following a turbulent few months. When BlackRock, the world’s largest asset administration agency, launched a bitcoin private trust last month, it signalled that the beleaguered trade would possibly already be repositioning itself for the subsequent bull market cycle.

If the worth of digital belongings — and, extra particularly, ether — ought to revive, then it’s probably that the post-Merge Ethereum blockchain shall be one of many greatest beneficiaries of one other crypto bull run. “I prefer to name it the lazy man’s ETF,” says Dorman. “By proudly owning ether, you now have publicity to stablecoins, you’ve publicity to NFTs, you’ve publicity to decentralised finance.”

Even so, Dorman isn’t satisfied that wider curiosity in decentralised finance will essentially comply with from the Merge. That, he feels, is “a separate dialog”. “Do [people] need to take loans by means of [DeFi] moderately than strolling right into a financial institution? Do folks need to commerce digital collectibles moderately than conventional baseball playing cards or stamps? All these elements, person development, transaction development, quantity development, these are impartial of the Merge,” he says.

In the end, solutions to those questions will grow to be clear as soon as the Merge occurs. Loads of dry-run merges have taken place on “testnets” — basically non-live blockchains — the newest simply final month. However there’s nothing fairly like the actual factor.

Further reporting by Richard Waters in San Francisco and Joshua Oliver in London

[ad_2]

Source link