[ad_1]

Not lengthy after turning into the chief government of Goldman Sachs in 2018, David Solomon requested for a personal aircraft.

It was a controversial request. Goldman bankers historically eschewed ostentation, and when its chief executives used personal plane, they rented them from NetJets. Solomon reckoned that his misplaced time from flight delays value the financial institution cash and the Goldman group conducting a cost-benefit evaluation ended up seeing issues his approach. The financial institution wound up ordering two Gulfstream jets. Solomon even had a hand in selecting the decor, says an individual aware of the matter.

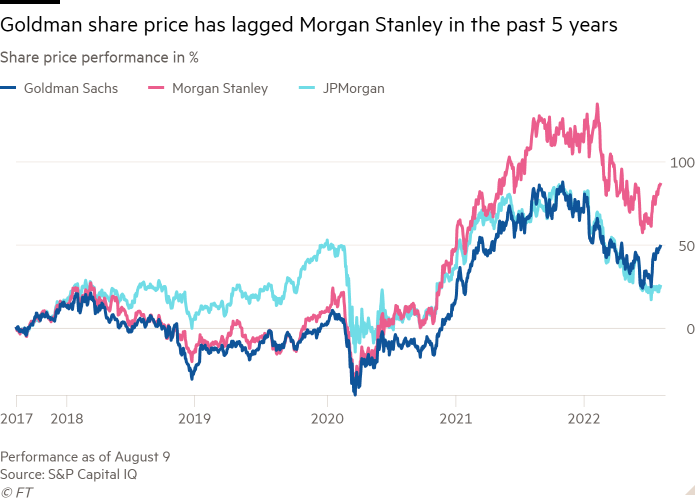

Goldman’s new boss was sending a sign. He wished to do issues in a different way, and in his personal approach. The corporate that Solomon inherited was nonetheless among the many crème de la crème of funding banking and buying and selling, however it wanted to be extra. Its inventory market valuation lagged friends equivalent to Morgan Stanley that earned a higher portion of their income from steadier, fee-generating companies like fund administration.

Solomon’s mission was to develop new revenue streams and “drive extra sturdy income,” within the course of making it simpler for outdoor traders to grasp a nonetheless enigmatic financial institution that had been structured as a personal partnership till its preliminary public providing in 1999.

But regardless of Solomon ploughing billions of {dollars} into companies equivalent to shopper banking, asset administration and transaction providers, little has modified in Goldman’s income combine because the days of his predecessor, Lloyd Blankfein. Buying and selling and funding banking nonetheless make up the lion’s share.

Goldman’s challenges are notably pronounced in retail finance. Six years after establishing its personal on-line shopper financial institution, referred to as Marcus, Goldman has but to say when the operation will flip a revenue, and folks aware of the matter say administration is at present conducting a evaluation of the division’s spending plans.

A rising variety of Wall Avenue analysts ponder whether the one approach for Solomon to essentially change Goldman is thru acquisition — maybe by following the lead of Morgan Stanley, which shifted its enterprise combine after the 2008 monetary disaster with the purchases of wealth supervisor Smith Barney, on-line buying and selling platform ETrade and asset supervisor Eaton Vance.

“True transformation might be laborious organically,” says Christian Bolu, banking analyst at Autonomous Analysis. “And we all know that from taking a look at Morgan Stanley, you don’t need to go that far.”

Thus far, Solomon has nibbled on the acquisition entrance, with offers together with paying $2.2bn for Atlanta-based shopper finance firm GreenSky and €1.6bn for the funding administration arm of Dutch insurer NN Group.

Larger offers could be more durable to deliver off. Goldman has an idiosyncratic tradition and — regardless of its historical past as an adviser on huge offers — little file of constructing main acquisitions itself. When Goldman lately surveyed traders, a few of whom owned its inventory and others who didn’t, about what it ought to do with extra capital, they rated acquisitions because the lowest precedence, behind reinvesting in its enterprise, dividends and share buybacks, in accordance with an individual with data of the survey.

By most measures, Solomon’s tenure to date appears like a hit: Goldman has delivered file income and seen its share worth hit a file excessive final yr. However these milestones had been largely on the again of the financial institution’s legacy buying and selling and funding banking companies placing up stellar numbers.

On one of many key measures by which Wall Avenue retains rating — its worth to ebook ratio, a metric which compares an organization’s inventory worth towards the worth of its belongings to offer a way of its true valuation — the financial institution’s efficiency stays stubbornly static and properly behind its main US rivals.

If Solomon’s strategic objective is to persuade outdoors traders that Goldman is a gradual guess, he nonetheless has some work left to do. After nearly 4 years in cost, his new Goldman nonetheless appears lots just like the previous one.

The track of Solomon

Solomon, 60, made his identify in leveraged finance and got here into the highest job with a fame as a cost-cutter and a blunt supervisor.

He was an unlikely determine to take cost of Goldman. Solomon and the financial institution’s president, John Waldron, 53, each got here to the corporate greater than twenty years in the past from Bear Stearns, a much less prestigious funding banking rival.

Regardless of the passage of time, some members of Goldman’s fabled alumni community nonetheless consult with him and Waldron as “the blokes from Bear”. Solomon’s flamboyant character — typified by his well-publicised stints as a musical competition DJ and appearances on the TV present Billions and in Jennifer Lopez’s latest Netflix documentary — can also be an incongruous match to steer a financial institution as soon as identified for its inscrutability.

On the financial institution’s first-ever investor day in January 2020, Solomon and Waldron outlined the brand new diversification technique. Whereas increase legacy companies, he outlined a concentrate on 4 development areas: shopper banking, transaction providers, asset administration (elevating funds from traders and managing them for a charge) and wealth administration (advising well-heeled shoppers on their investments). Solomon has additionally minimize $1bn in prices and promoted extra inner collaboration underneath the “OneGS” mantra.

The expectations for change at Goldman are notably excessive in asset and wealth administration, the place it has about $2.5tn in belongings underneath supervision, which incorporates cash managed by Goldman in addition to different shopper belongings. Goldman hopes to spice up its annual charges in these areas to greater than $10bn by 2024, up from about $6bn in 2019.

Solomon’s technique has been to construct on Goldman’s historic strengths. In asset administration, Goldman has lengthy made huge cash with its personal fairness investments in areas like personal fairness. To easy out the ensuing earnings volatility, Solomon is scaling again personal investments utilizing the financial institution’s capital and prioritising managing third-party funds, which promise extra secure charge revenue.

In transaction banking — the enterprise of serving to corporations transfer their cash round — Goldman is hoping to faucet into its huge company contact ebook to develop. Though its income goal of $750mn by 2024 is meagre, transaction banking guarantees secure returns and doesn’t require Goldman to carry massive portions of capital.

“You’ve received to offer [Solomon] 5 stars for the imaginative and prescient and the outlook on what he needs to do, and the way he needs to vary the financial institution,” says Gerard Cassidy, a banking analyst at RBC Capital Markets. “However we’ve all the time maintained with any financial institution, not simply Goldman, to essentially incorporate that form of change, it’s not possible to do it organically.”

The acquisitions it has made have been smaller, so the corporate can study new enterprise and get higher at integrating them, insiders say. The expertise has been optimistic; Goldman’s deal for NN Funding Companions, which had about $355bn in belongings underneath supervision, has stirred the financial institution’s urge for food to make related purchases. “If we will do just a few NNIPs, that might begin shifting the needle,” says one Goldman government.

The weakest hyperlink in Goldman’s diversification technique is shopper banking, the one one among its 4 development pillars that continues to be unprofitable. Goldman launched the buyer enterprise in 2016 underneath Blankfein, naming it Marcus after the financial institution’s founder, Marcus Goldman.

Marcus has cycled via a collection of leaders. Harit Talwar, the primary head of the buyer division and the previous US playing cards boss at Uncover, was changed in 2021 by his longtime deputy Omer Ismail, however he abruptly departed Goldman for Walmart. Marcus is now run by Peeyush Nahar, who joined Goldman final yr, having beforehand labored at Uber and Amazon.

Below Solomon, the mixed shopper and wealth administration division was initially run by Eric Lane and Tucker York, however Lane left in 2021. Now, York and Stephanie Cohen function co-heads of shopper and wealth administration, with Cohen overseeing shopper operations and York spending extra time on the wealth enterprise.

The buyer enterprise has a minimum of succeeded in amassing greater than $100bn in deposits, giving Goldman low-cost funding that the financial institution estimates saves it tens of thousands and thousands of {dollars} a yr. In 2021, sources together with financial savings accounts, retail loans and bank card partnerships with Apple and Common Motors introduced in $1.5bn in revenues, a determine the financial institution hopes may high $4bn by 2024.

However Goldman was snubbed by Apple and solely given a minimal position within the tech large’s new purchase now, pay later product. Goldman had been a monetary associate to the iPhone maker since 2019, offering the credit score underwriting and far of the monetary infrastructure behind Apple’s bank card.

The financial institution remains to be in talks with Apple to play a job in attainable growth of the latter’s purchase now, pay later providing, in accordance with one individual aware of the matter. In contrast to Apple Pay Later, which is curiosity free, shoppers could be charged curiosity for longer-term BNPL loans funded by Goldman if the growth takes place.

The regulatory dangers in shopper finance had been additionally highlighted this month when Goldman disclosed that the US shopper finance regulator was investigating the way it managed accounts at its bank card enterprise.

Goldman stays uncertain when its shopper operations will transfer into the black, resulting in the present evaluation of spending plans, in accordance with individuals aware of the matter. This has included value evaluation conferences between Cohen and the financial institution’s president. “Waldron has been holding Stephanie’s toes to the hearth,” one supply says.

Seller’s alternative

The emphasis on change has not made a lot of a distinction when it comes to how the enterprise makes its cash. The yr Solomon took over, Goldman earned 62 per cent of its revenues from funding banking and international markets. In 2022, analysts forecast that these two divisions will present nearly 69 per cent of revenues, dropping again all the way down to about 62 per cent in 2023.

To some extent, Goldman suffers from a humiliation of riches: the final two years have performed to its historic strengths. Rock-bottom rates of interest, market volatility and the push of pandemic dealmaking helped push Goldman’s income and share worth to file highs in 2021.

Goldman veterans who minimize their enamel when the financial institution was a partnership query whether or not its reliance on its conventional areas of energy is known as a downside. They argue that fee-based companies equivalent to asset administration could be risky in downturns, and keep that Goldman’s buying and selling operations can churn out huge income whatever the setting.

Their level was underscored final quarter when the buying and selling division overcame risky markets to supply extra revenues than Goldman’s three different items mixed. Within the second quarter, Goldman earned more cash from funding banking and reported a much bigger bounce in buying and selling revenues than any rival.

Traders disagree. Analysts notice that working a large buying and selling enterprise requires Goldman to put aside enormous quantities of capital, making it more durable for the financial institution to spice up its return on common tangible frequent fairness, a key measure of profitability. Goldman’s present Rote goal lags behind rivals Morgan Stanley and JPMorgan Chase.

It is usually the case that Goldman stockholders have needed to cope with their justifiable share of nasty surprises from its wheeling and dealing. In 2010, Goldman paid a $550mn fantastic to settle US regulators’ allegations that it misled traders in a fancy mortgage-backed safety referred to as Abacus. In 2020, it agreed a $2.9bn international settlement with regulators over its position within the 1MDB money-laundering scandal in Malaysia.

The share of income Goldman makes from funding banking is more likely to take a success as properly, as inflation and a looming international recession have created a cold setting for dealmaking. The corporate’s latest struggles to dump debt to again the £10bn takeover of grocer Wm Morrison can have been a painful reminder of a modified market.

Making a lot of its income from unpredictable actions equivalent to buying and selling in monetary markets and advising corporations on offers has not impressed traders, judging by Goldman’s price-to-book ratio.

Goldman now trades at about 1.1 occasions ebook worth, barely forward of its common a number of over the previous 5 years of 1.06. Morgan Stanley, by comparability, trades at about 1.7 occasions ebook, forward of its five-year common of 1.3.

A millstone round Solomon’s neck since he assumed command, the price-to-book ratio additionally presents a hurdle to Goldman utilizing its inventory as an acquisition foreign money to purchase any firm with a better valuation.

“The standard capital markets companies are perceived to be very cyclical when it comes to these revenues. The cyclicality of revenues tends to get a fairly wholesome low cost out there,” says Devin Ryan, banking analyst at JMP Securities.

The man from Bear

A part of Solomon’s job has additionally been to modernise Goldman’s tradition and transfer on from the financial institution’s macho “masters of the universe” fame. It has made extra various promotions to its coveted associate ranks, for instance, and launched a extra relaxed gown code.

Nonetheless, the brand new outward-facing company picture to accompany its push into shopper banking are to not everybody’s style at Goldman — and neither is Solomon’s personal flashy private type.

As soon as the quintessential behind-the-scenes agency, Goldman is now sponsoring McLaren’s System 1 group as a part of a branding effort by Fiona Carter, the financial institution’s chief advertising and marketing officer whom Solomon recruited in 2020 from AT&T. Spending cash on the partnership has displeased some on the financial institution in a yr when it has warned of potential job cuts, in accordance with financial institution insiders. “Doing the McLaren partnership is tone deaf,” says one Goldman Sachs banker.

Managing the financial institution’s expertise — a job some at Goldman liken to serving as a Hollywood producer — has proved difficult for Solomon. Though Goldman has lengthy boasted of its deep bench, it has been hit by a number of important departures — together with senior bankers Gregg Lemkau, Stephen Scherr and Eric Lane. Complaints have additionally been made to Solomon about his return-to-work insurance policies, with the corporate seeking to get lots of its bankers again to the workplace 5 days every week, in accordance with individuals aware of the complaints.

Solomon’s ostentatious type has grated on some at Goldman. His DJ profession — a ardour he developed whereas engaged on a financing deal for a Las Vegas lodge in 2008 — has attracted scrutiny from the board of administrators, in accordance with individuals aware of the matter.

Some members of Goldman’s board, which Solomon chairs, instructed him they had been uneasy about his determination in 2019 to carry out at Tomorrowland, a Belgian music competition, one of many individuals says. Board members famous an article within the New York Put up that described the occasion as being identified for its “undulating throngs of bare, sweaty, drug-fuelled revellers”.

Solomon additionally apologised to Goldman’s board after DJing at a 2020 occasion within the Hamptons resort space of New York that was criticised for flouting social distancing guidelines in the course of the Covid-19 pandemic, one other individual aware of the matter says.

However the consideration hasn’t slowed him down. This summer time, Solomon, who has promised to donate earnings from his DJ efforts to charity, hit the street to carry out at Lollapalooza, a four-day music competition in Chicago attended by lots of of hundreds of individuals. Goldman declined to touch upon whether or not Solomon took the corporate jet to Chicago.

Solomon hit the stage in Grant Park on July 29 after holding a city corridor with Goldman’s Chicago employees and assembly some shoppers. Clad in a black T-shirt, Solomon handled the group to Abba and Queen remixes and was joined by OneRepublic singer Ryan Tedder to carry out a 2021 collaboration. The monitor’s title: Be taught To Love Me.

Source link