[ad_1]

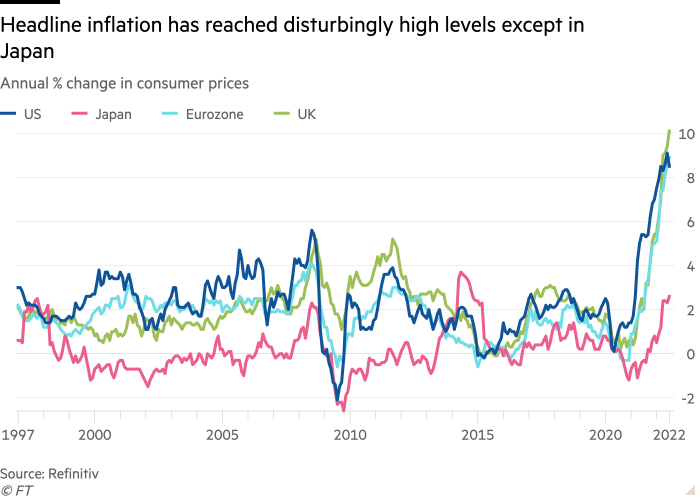

Central banks are decided to convey inflation again beneath management. This was the message from Jay Powell, chair of the Federal Reserve, and Isabel Schnabel, an influential member of the board of the European Central Financial institution on the Jackson Hole symposium final week. So, why have been the central banks so insistent on this message? Are they proper? Above all, what may it suggest for future coverage and the financial system?

“Lowering inflation is prone to require a sustained interval of below-trend development . . . Whereas increased rates of interest, slower development, and softer labour market situations will convey down inflation, they can even convey some ache to households and companies. These are the unlucky prices of decreasing inflation. However a failure to revive value stability would imply far higher ache.” These have been the words of Powell. Once more, Schnabel argued that central banks should act decisively, since expectations threat being de-anchored, inflation has been persistently too excessive, and the prices of bringing it beneath management will rise the longer motion is delayed. There are dangers of doing an excessive amount of and of doing too little. But “dedication” to behave is a more sensible choice than “warning”.

It isn’t obscure why central bankers say what they’re saying. They’ve a transparent mandate to regulate inflation on which they’ve didn’t ship. Not simply headline inflation, however core inflation (excluding vitality and meals) has been above goal for a protracted interval. In fact, this sad final result has a lot to do with a collection of surprising provide shocks, within the context of the post-pandemic shift in direction of consumption of products, the constraints on vitality provide and now the conflict in Ukraine. However the scissors have two blades: demand, in addition to provide. Central banks, notably the Fed, continued with the pandemic’s ultra-loose policies for too lengthy, although US fiscal policy was also too expansionary.

In an vital evaluation, Ricardo Reis of the London College of Economics factors to 4 explanation why this occurred. First, central banks repeatedly interpreted provide shocks as momentary interruptions, not quasi-permanent hits to potential output. Second, they misinterpret short-term expectations, focusing an excessive amount of on the imply somewhat than the shift in direction of increased expectations on the higher edges of the distribution. Third, they tended to view credibility as an infinitely deep nicely, as a substitute of a shallow one which must be refilled promptly. Thus, they failed to notice that the distributions of long-term inflation expectations have been additionally shifting towards them. Lastly, their perception in a low impartial price of curiosity led them to fret an excessive amount of about deflation and too little in regards to the return of inflation. A central level is that these have been mental errors. So, for my part, has been the lack of attention paid to monetary data.

In essence, central banks are enjoying catch-up as a result of they worry that they threat dropping credibility and, in the event that they did, the prices of regaining it could be far increased than of appearing now. This worry is bolstered by the dangers to wage inflation from the mixture of excessive value inflation with sturdy labour markets. The truth that increased vitality costs elevate the costs of primarily every part makes this threat larger. This might then begin a second-round wage-price spiral.

They’re proper to take this judgment. A shift right into a Nineteen Seventies-style period of excessive and unstable inflation can be a calamity. But there may be certainly a threat that the slowdown in economies brought on by a mix of falling actual incomes, and tightening monetary situations will trigger an unnecessarily deep slowdown. One a part of the issue is that calibrating financial tightening is especially tough as we speak, as a result of it includes elevating short-term charges and shrinking stability sheets on the similar time. A much bigger one is that policymakers haven’t confronted something like this for 4 a long time.

Within the US, there’s a notably optimistic view of “immaculate disinflation”, promulgated by the Federal Reserve. This debate focuses on whether or not it’s potential to cut back labour market stress by reducing vacancies with out elevating unemployment. An vital paper by Olivier Blanchard, Alex Domash and Lawrence Summers argues that this is able to be unprecedented. The Fed has responded by saying that every part now’s unprecedented, so why not this, too? In reply, the authors of the unique paper insist that there isn’t a good motive to imagine issues are that unprecedented. Give it some thought: how can one anticipate a basic financial tightening solely to hit companies with vacancies? It’s certain to hit companies that might then have to put off employees, as nicely.

If the deliberate tightening of financial coverage is prone to generate a recession within the US, what may occur in Europe? The reply is that the recessions there are prone to be deep, provided that the vitality value shock is so giant. Right here too, the stability between the influence on provide and demand is unclear. If the influence of upper vitality costs on the previous is bigger than on the latter, demand will have to be curbed, too.

Financial coverage will play an element within the European story. However the core of its present disaster is the vitality shock. Central banks can not do something immediately about such actual financial disturbances. They have to keep on with their mandate of value stability. However an enormous effort have to be made to protect probably the most weak from the disaster. Furthermore, these most weak will embrace not simply folks, however international locations. A excessive degree of fiscal co-operation shall be wanted within the eurozone. A political understanding of the necessity for solidarity inside international locations and amongst them is a precondition.

A storm has come from Europe’s east. It have to be weathered. How finest to take action would be the topic of future columns.

[ad_2]

Source link