[ad_1]

After coping with booming demand and international shortages because the begin of the pandemic, the semiconductor business is going through a sudden downturn.

However even for an business accustomed to frequent cyclical slumps, this one has defied simple evaluation and left researchers struggling to foretell how the setback will play out.

The sudden glut in reminiscence chips, PC processors and another semiconductors has come at a time when producers in lots of automotive and industrial markets nonetheless lack a dependable provide of chips.

It has additionally pressured a number of the largest US chipmakers to slash billions of {dollars} off deliberate capital spending, on the very second that Washington has handed a long-awaited law to subsidise a large enhance in home chip manufacturing capability.

The velocity of the flip, and the conflicting forces at work, have been unprecedented, mentioned Dan Hutcheson, the veteran chief government of VLSI Analysis who has analysed chip cycles because the Nineteen Eighties.

“I’ve by no means seen a time after we had extreme stock and we had shortages,” he mentioned.

The quick trigger has been a fast build-up in stock within the chip provide chain since early this 12 months. In contrast with February, when there have been sufficient chips available to help round 1.2 months of manufacturing, international stock ranges jumped to 1.4 months in June after which 1.7 months in July, in accordance with VLSI Analysis.

Tumbling PC gross sales and weaker smartphone demand have been the principle causes, as customers retrench. However with fears rising of an financial slowdown, producers of a variety of kit, which had been constructing stock to make themselves extra resilient to provide pressures, have reversed course. In the meantime, it’s unclear how a lot weakening chip gross sales mirror provide chain issues, fairly than any fall-off in demand.

The suddenness of the flip has ricocheted by the sector since late July, when Intel stunned Wall Street with the information that income in its newest quarter had fallen $2.6bn, or 15 per cent, wanting expectations. Chief government Pat Gelsinger blamed it on the type of stock adjustment that solely hits as soon as in a decade, though Intel additionally admitted to errors of its personal.

Nvidia, the most important maker of graphics processing models, or GPUs, utilized in video graphics and machine studying techniques, final week pre-announced an excellent larger income miss, as gross sales of its gaming chips fell 44 per cent from the previous quarter. And Micron, one of many largest makers of reminiscence chips, mentioned its free money movement was prone to flip destructive within the subsequent three months, after averaging $1bn in current quarters.

The stresses have additionally been felt by Asia. Late final week, the chief government of Chinese language chipmaker Semiconductor Manufacturing Worldwide Company mentioned demand had slowed from smartphone and different client electronics markers, with some stopping orders altogether. A month earlier than, Taiwan Semiconductor Manufacturing Firm mentioned it was anticipating a list correction that will final till late subsequent 12 months.

The abrupt slide has left chipmakers within the US attempting to handle a decline on the very second that they have been laying the bottom for a large enhance in manufacturing due to the $52bn in authorities help supplied by this month’s Chips Act.

On the identical day that Congress handed the regulation, Intel, which is anticipated to be the most important beneficiary of presidency grants, sliced $4bn from its capital spending plans for the remainder of this 12 months, though it mentioned that it was nonetheless dedicated to a “robust and rising dividend” for its shareholders.

In the meantime, Micron, which celebrated President Joe Biden’s signing of the laws final week with the announcement that it deliberate to take a position $40bn within the US by the top of the last decade, was pressured only a day later to say it could minimize its capital spending “meaningfully” subsequent 12 months due to the downturn.

For now, most chip provide chain specialists predict a comparatively shallow downturn, supplied that the worldwide financial system is heading for a smooth touchdown. However the velocity with which issues have turned has left them scrambling to know the advanced dynamics at work.

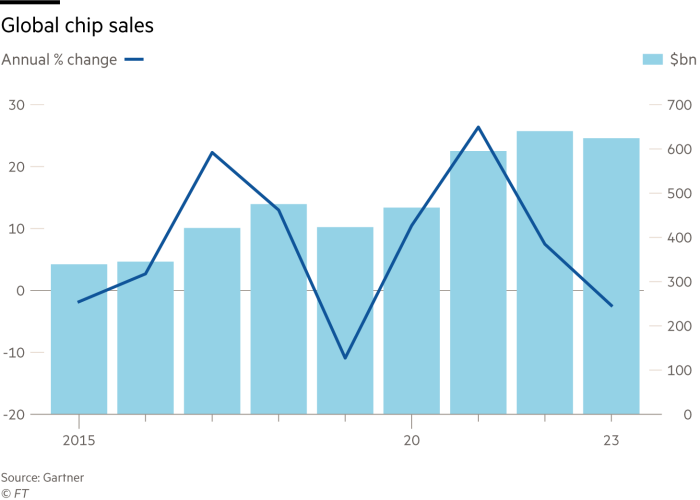

Gartner, which had been anticipating the expansion in international chip gross sales this 12 months to halve from 2021’s 26 per cent, took its forecast down additional to 7 per cent, and is now predicting a 2.5 per cent contraction in 2023 to $623bn.

For now, Wall Avenue has taken the information in its stride. The Philadelphia semiconductor index, which contains the 30 largest US firms concerned within the design, manufacture and sale of semiconductors, fell again practically 40 per cent because the inventory market corrected this 12 months after rising three-fold following the early pandemic inventory market hunch. However since early July, regardless of mounting proof of the chip slowdown, the index has rebounded 24 per cent.

On Monday, Nvidia’s shares climbed again above the extent they have been buying and selling at earlier than its earnings disappointment, although it disclosed a savage 17 per cent shortfall in income in comparison with earlier expectations.

However after the extreme stock and provide chain stresses of the previous two years, few analysts are assured that they will choose how an financial slowdown will feed by the business. Hopes that the slide could be largely restricted to the PC and smartphone markets have already been dashed.

Whereas a collapse in demand within the gaming market was the principle trigger for Nvidia’s earnings disappointment, the US chipmaker additionally mentioned its gross sales of knowledge centre chips had solely risen 1 per cent from the previous three months, in comparison with Wall Avenue expectations of nearer to 10 per cent. It blamed provide shortages fairly than falling demand, though different indications, together with a fall-off at Intel, have fed the suspicion that the booming cloud computing market has cooled quickly.

In current days, the indicators of retrenchment have broadened. Micron finance chief Mark Murphy mentioned final week that industrial and automotive clients have been the most recent to chop their chip purchases.

“It’s a really current improvement,” he added, making it too early to inform whether or not these clients are merely making an adjustment after a fast stock build-up, or whether or not they’re responding to falling demand from their very own clients.

Both means, in accordance with Murphy, the consequence has been the identical: “We’re seeing clear indicators of weak point in these markets.”

Source link